HANDYMAN LICENSING

How to Get a Handyman License in California (2025 Guide)

What You’ll Learn

- When a California handyman license is required

- The difference between “unlicensed handyman” and licensed contractor work

- Step-by-step licensing process

- What insurance, forms, and costs to expect

- How to grow your business faster once you’re licensed

Do You Need a Handyman License in California?

In California, you can take on small repair or improvement jobs under $500 in combined labor and materials without a contractor license.

Anything above $500 requires a C-61/D-XX or General B Contractor License issued by the California State Licensing Board (CSLB).

If you:

- Work on plumbing, electrical, or structural jobs, or

- Split one large job into smaller contracts to avoid the $500 rule — You must hold a contractor license.

💡 Pro Tip: Many Pros start as unlicensed handymen for minor work, then upgrade to a contractor license to book bigger, more profitable jobs.

Step-by-Step: How to Get Licensed

1. Choose the right license type

Most handymen apply for a Class B (General Building Contractor) or a specialty trade license (C-10 electrical, C-36 plumbing, etc.).

2. Meet the experience requirement

You need at least four years of journeyman-level experience in the trade you’re applying for.

3. Complete your application

Submit your Application for Original Contractor License (Form 13A-1) to the CSLB. Be prepared to

provide:

- Proof of work experience

- Background check authorization

- Fingerprints (Live Scan)

4. Pass the state exams

- Law & Business exam

- Trade-specific exam

5. File your paperwork and insurance

You’ll need:

- $25,000 contractor’s bond

- Worker’s compensation insurance (if you have employees)

- Proof of liability insurance

6. Pay your fees

- Application fee: $450

- License fee: $200 for two years

Renewing and Maintaining Your License

California contractor licenses must be renewed every two years.

Keep your bond, insurance, and business information current to avoid penalties or suspension.

Avoid Common Mistakes Pros Make

- Underbidding jobs to stay under $500 — this can still violate CSLB rules

- Forgetting to register your business name (DBA)

- Ignoring permit requirements from local cities or counties

- Not carrying insurance — homeowners often ask for proof before hiring

How to Grow Once You’re Licensed

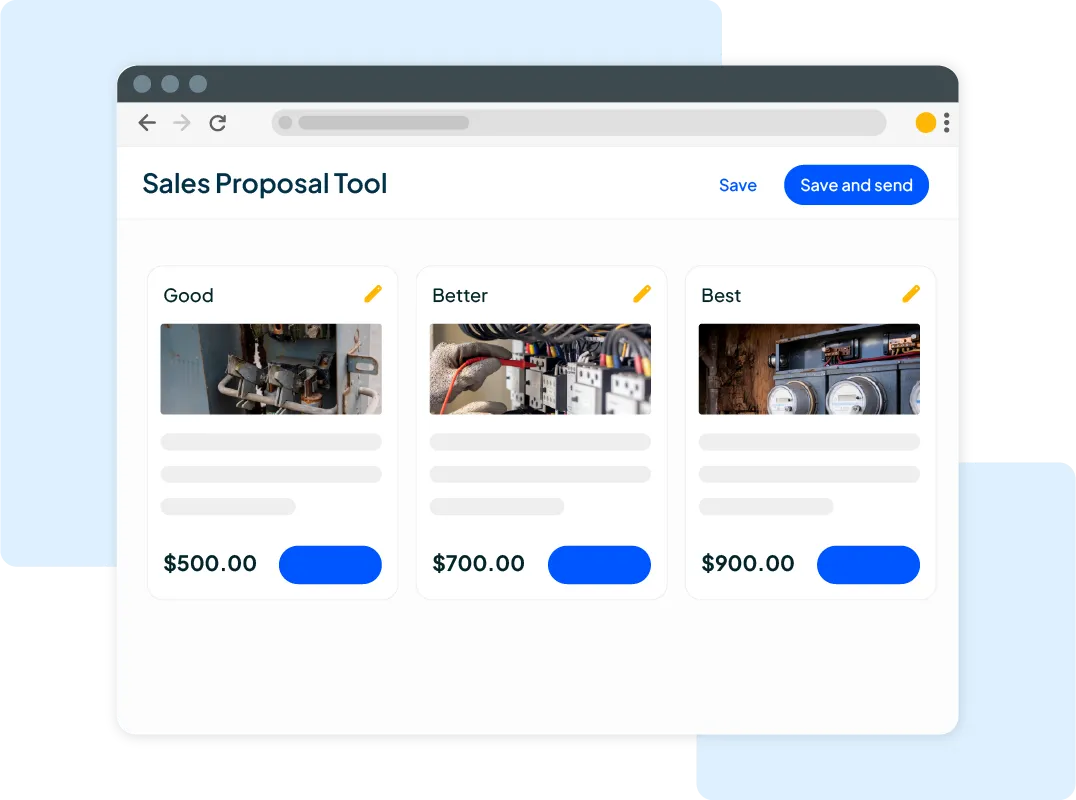

Once you’re licensed, the next step is scaling your business.

Housecall Pro helps licensed handymen and contractors:

- Schedule jobs and send estimates from your phone

- Collect payments on-site or online

- Automate reminders and follow-ups

- Track reviews and win repeat work

Start strong: Try Housecall Pro free for 14 days and get everything to run and grow your handyman business in one place.

Quick Facts: California Handyman License 2025

| Requirement | Details |

| Governing agency | California State Licensing Board (CSLB) |

| License threshold | $500 total per job (labor + materials) |

| Application fee | $450 |

| Experience | 4 years minimum |

| Renewal | Every 2 years |

| Insurance required | Yes – bond + worker’s comp |

| Exams | Law & Business + trade exam |

Resources

Other industry licenses

Other industry licenses

LEARN FROM THE PROS

Helpful content for the trades

Explore our collection of helpful articles written by top experts in their field to seasoned pros in the field. Strengthen your field service knowledge and stay current on the latest industry topics and trends.