Take charge of business expenses

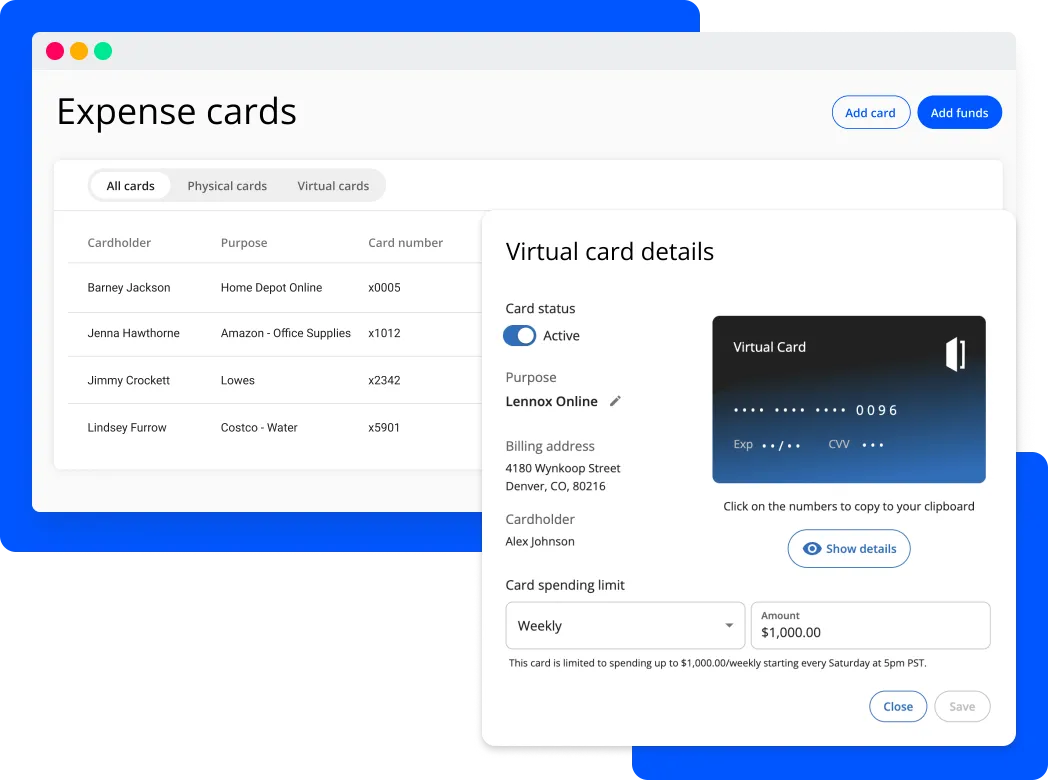

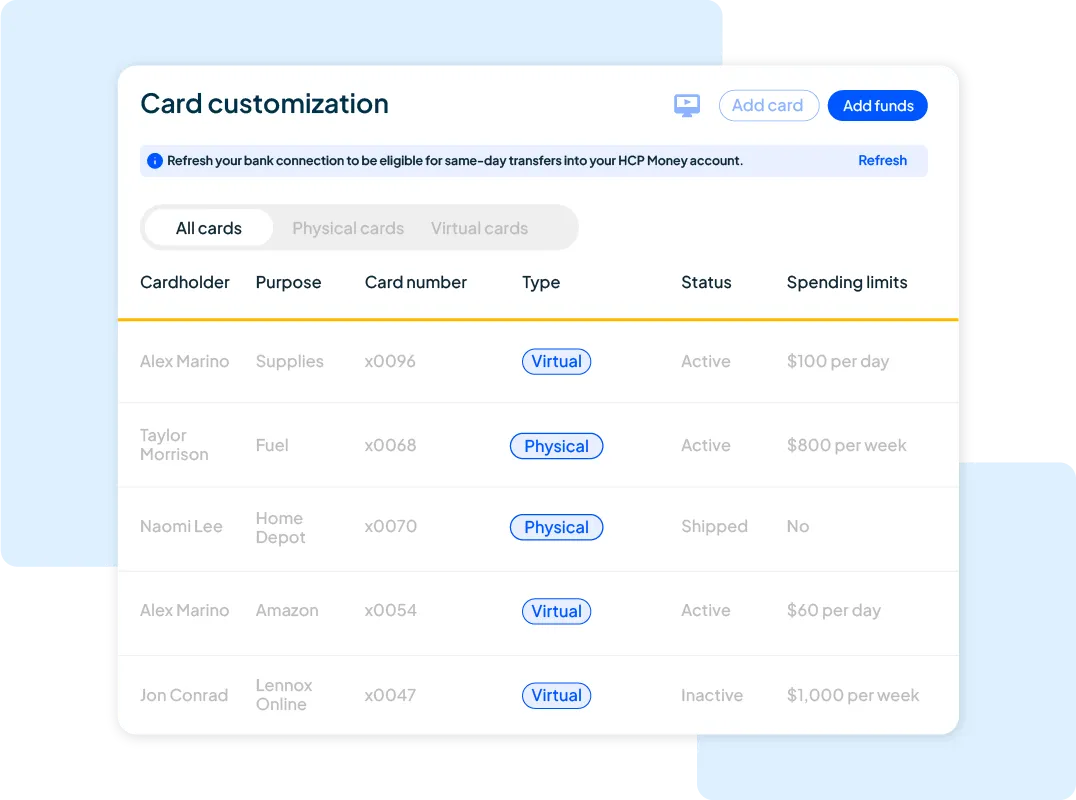

Give each employee a card with customized spending limits—plus restrictions for fuel and other purchases.

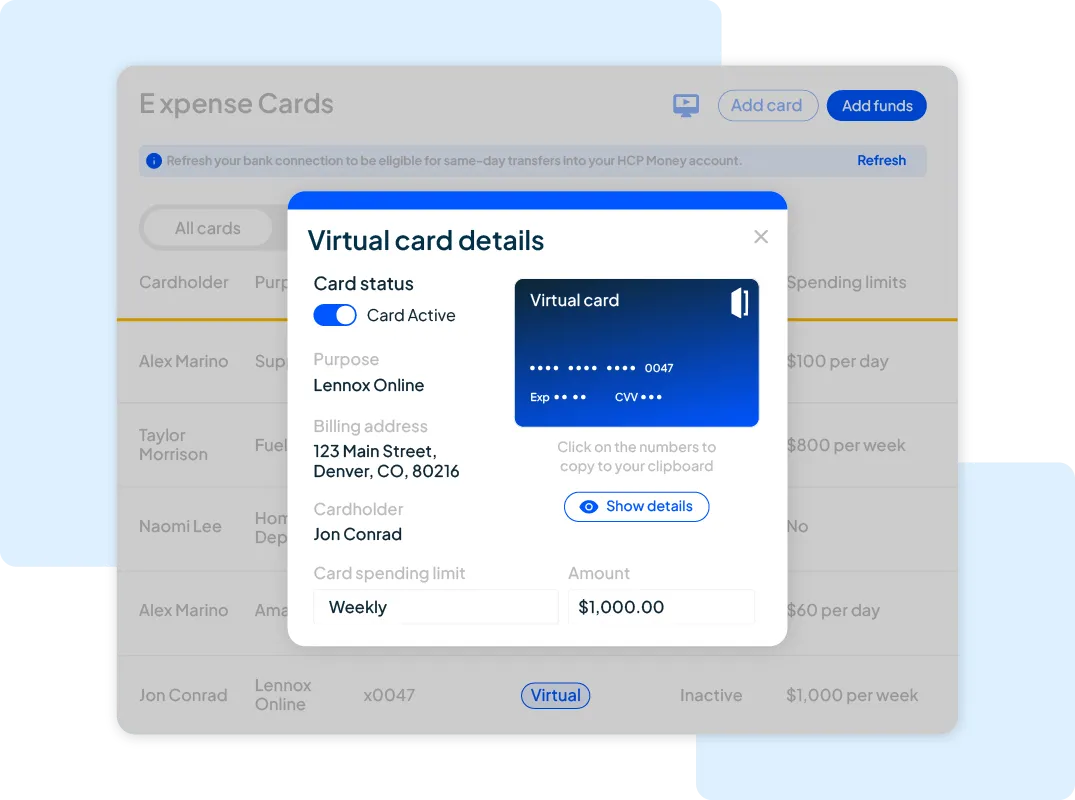

Instantly generate virtual cards for online purchases with built-in limits and security controls.

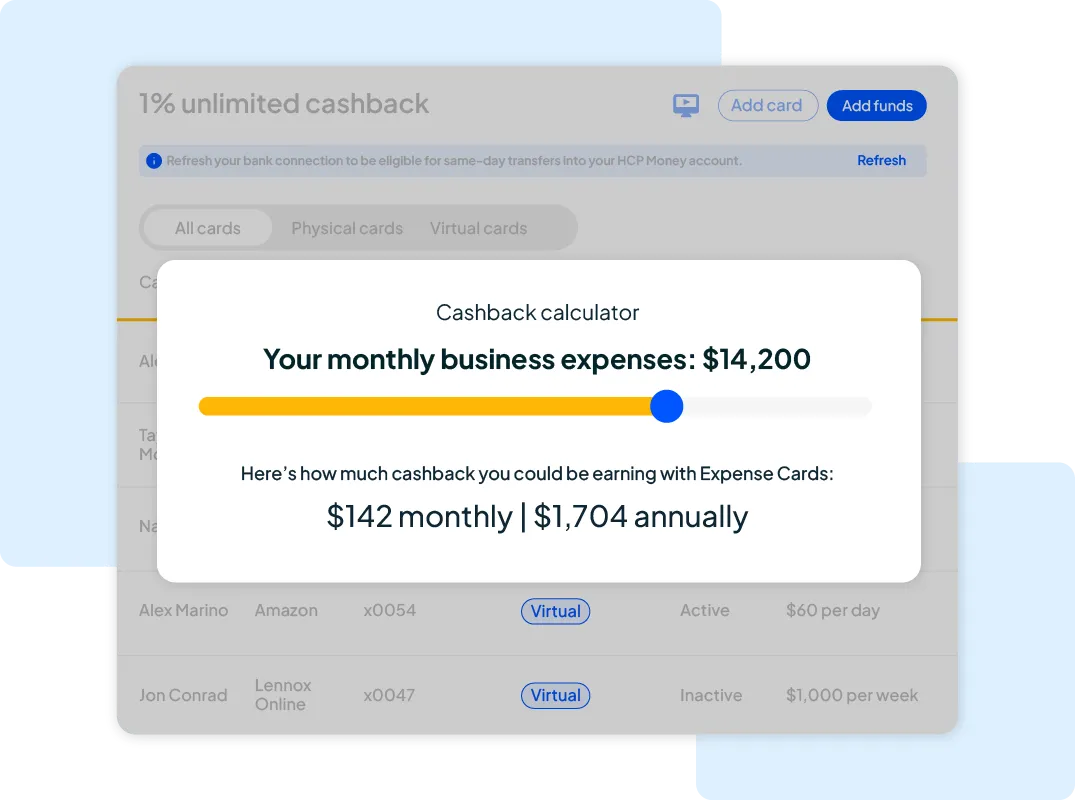

Create unlimited cards for your techs at no extra cost, so they always have what they need to get the job done.

Adjust card restrictions anytime with a single click, keeping you in control as your business needs change.