POWERED BY WISETACK

Win more jobs with integrated consumer financing

7,000+ Pros use Housecall Pro to offer consumer financing to their customers

Consumer financing built for Pros

More sales, bigger wins, happier customers

With integrated consumer financing through Wisetack, you can help your customers say ‘yes’ to premium services by breaking up the project cost into affordable monthly payments. Financing will be automatically added to invoices and estimates between $500 and $25,000.

-

Let customers prequalify beforehand so they can borrow with confidence

-

Our mobile app means you can manage your dispatching from anywhere

-

Offer loans as high as $25,000 for terms up to 60 months, backed by best-in-class approval rates

-

Get paid in full as soon as the job is finished, while your customer pays over time

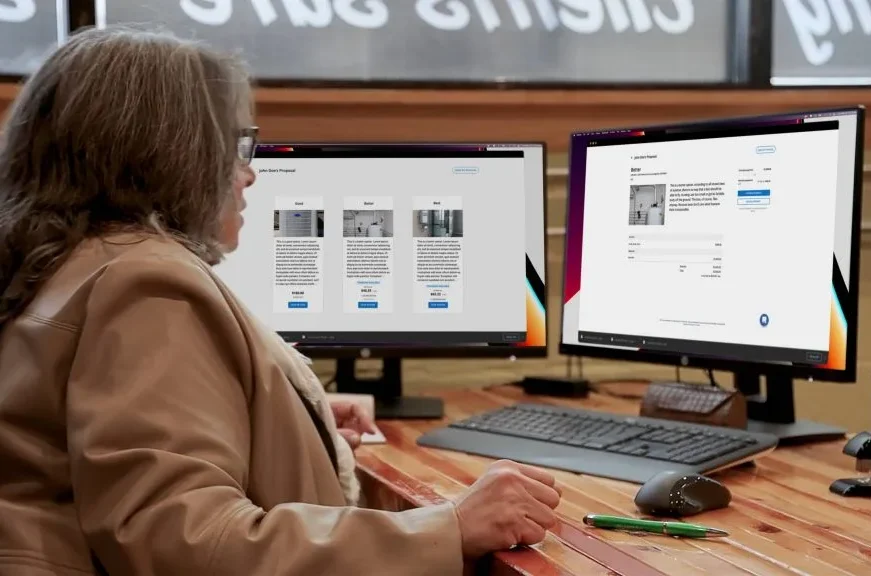

Quick and seamless application

No more extra paperwork and long waits – applying for Wisetack only requires a quick online application. That means you don’t need to ask for any more SSNs, yearly incomes, or other kinds of sensitive information!

-

Your customers can apply securely from their mobile device and get an approval decision in minutes

-

Applying has zero impact on their credit score

-

Keep track of the entire consumer financing process within your Housecall Pro account

Transparent terms and pricing

Don’t underestimate the power of word-of-mouth marketing. Win customers over and bring in new business with simple and transparent pricing.

-

Give your customers multiple options, with interest rates as low as 0% APR for up to 24 months

-

Your customers pay no origination, prepayment, or late fees, with no compounding interest

-

You pay only a flat fee of 3.9% per transaction (excluding 0% APR add-ons)

What our Pros say about consumer financing

Simple and easy

Our customers tell us how simple and easy it is to apply and get approved. It has saved us from loosing many jobs we love Wisetack!

Mitchell T., Admin

Comfort Pro Heating and Cooling

Fresno CA

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by 35% after their first year.

See plan options and feature breakdown on our pricing page.

- Drive Sales

- Review Management Software

- Pipeline

- Recurring Home Service Agreement

- Online booking

- Sales proposal tool

- Receive and manage money

- Invoicing software

- Payment

- Expense Cards

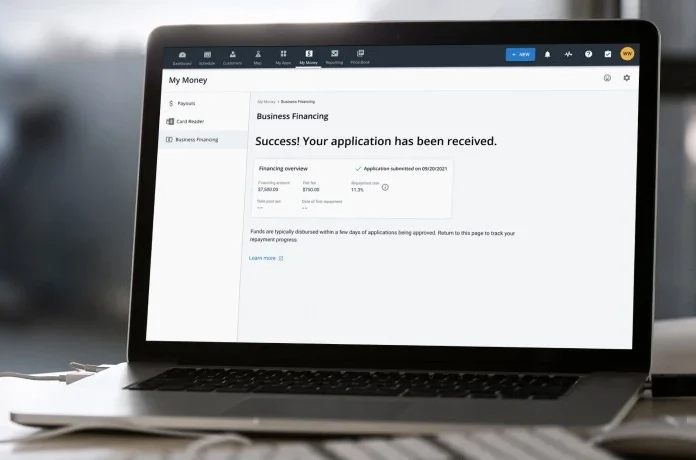

- Business Financing

- Consumer Financing

- Know your business

- Enhanced Reporting

- Quickbooks

- Time Tracking

- Job costing and profitability

- Customer management

- business solutions

- Voice solution

- Conquer coaching

- Open API integrations

- Pro Community

- Call answering service

- explore more solutions

- Franchises

- See all solutions

Consumer Financing FAQs

- How much does integrated consumer financing cost?

-

The only cost to you is a 3.9% fee per transaction. There are no subscription or credit card processing fees on top of that.

- Will my customer’s credit score be affected?

-

Not when checking options – Wisetack and its lending partners perform a soft credit pull, which means that your customer’s credit score will not be affected by checking their financing options. However, accepting a financing offer can affect credit, and repayment behavior will also affect credit.

- Do I need to ask my customer for SSN or their yearly income?

-

No – you can skip the whole process of asking your customers for sensitive information. Customers can apply for financing from the privacy and comfort of their own device.

- Can my customers know how much they qualify for before the job is agreed to?

-

Yes – your customers can see which options they prequalify for on an estimate.

- Are there 0% APR options available through integrated consumer financing?

-

Yes, qualified customers will see rates as low as 0% APR.

- How will I know if I got paid?

-

Your payment will show up as a ‘pending transaction’ when your customer accepts terms and conditions. When the job is completed, there will be a payout as if the transaction were made with a credit card.

- What is consumer financing?

-

Great question! Consumer financing lets your customer break the cost of a job into smaller monthly payments. You can learn more about what it is, how it works, and how to promote it in this blog on the topic of “What is consumer financing“.