Want to win more jobs with less effort?

Grow your business and send quick quotes with our home service software.

Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

For businesses in the U.S., “net 30” terms of payment means that the invoice must be paid within 30 days. Net 30-day terms are common in B2B industries and are essentially a 30-day interest-free line of credit for the buyer. The 30-day payment period includes weekends and holidays, giving the business one month to pay the full amount.

As a business owner, you may be frequently asked, “What does net 30 mean in terms of a deadline?” This is a valid question; some suppliers require payment within 30 days of the invoice date, while others may have more generous terms, allowing customers to pay the invoice within 30 days of receipt of the invoice.

If you are struggling with delinquent payments and need to “firm up” your payment deadlines, or if you’re just launching your home service-based business and are creating your invoice templates and payment terms and conditions, establishing a general “Net 30” deadline payment can make your life easier. And, if you use our user-friendly field service invoicing software from Housecall Pro, adding “net 30” terms to your invoices is as simple as a click of your mouse.

Let’s look closer at the benefits and drawbacks of these payment terms.

Key Takeaways

- Net 30 refers to the terms of payment for an invoice

- Net 30-day payment terms means payment is due 30 days from the invoice date

- Businesses may opt to combine Net 30 terms with early payment discounts

- Listing net 30 terms of payment clarifies your terms of payment

- Adding a net 30 due date and payment link is a snap with Housecall Pro’s invoicing software

Net 30 Meaning

Net 30 on an invoice means that payment is due within 30 days of the date on the invoice. It’s a standard term of payment frequently used by business-to-business companies. Note that “net 30” means 30 calendar days, not business days. And, the 30 days typically includes holidays, too.

For example, an invoice dated September 1 would be due on September 30; the weekends and Labor Day are included in the 30-day grace period. It’s important to clarify the specifics when negotiating a new contract.

What Does Net 30 Mean on an Invoice?

Net 30 is one of the most common payment types for business-to-business (B2B) suppliers. When you offer these terms instead of payment on receipt or COD, you help your customers better manage their cash flow, which, in turn, builds stronger relationships and improves customer loyalty. Good relations with your current customers can help attract more clients, especially in smaller markets, where word of mouth and reputation are crucial.

Net 30 states the payment deadline for the invoice. It doesn’t refer to the methods of payment. Each business owner sets their own accepted forms of payment (cash, credit cards, bank transfer, company checks, etc.), which may be specified in the initial contract, listed on the invoice, or both. Some business owners offer an incentive for early payment, like “2/10 net 30,” which translates to a 2% discount if the invoice is paid within 10 days.

Many business owners use “net 30” to mean payment 30 days from the invoice date, but it may also mean payment due by the 30th of the month. If you are a vendor who only invoices monthly and sends out your invoices on the first of the month, then your net 30 terms would mean the 30th is your customer’s deadline.

If you choose to use net 30 terms for payment, be sure to clarify when you request payment whether you mean the payment is due on the 30th day of the month or payment is due 30 days from the date of the invoice.

Whether these terms are suitable for your business model and cash flow may depend on your business’s fiscal situation, the commonly accepted billing practices in your market, and general industry standards. You may find that offering net 30 terms across the board isn’t workable for all your customers, and instead, set specific parameters for offering this extended payment timeframe.

Where to Put Net 30 on an Invoice?

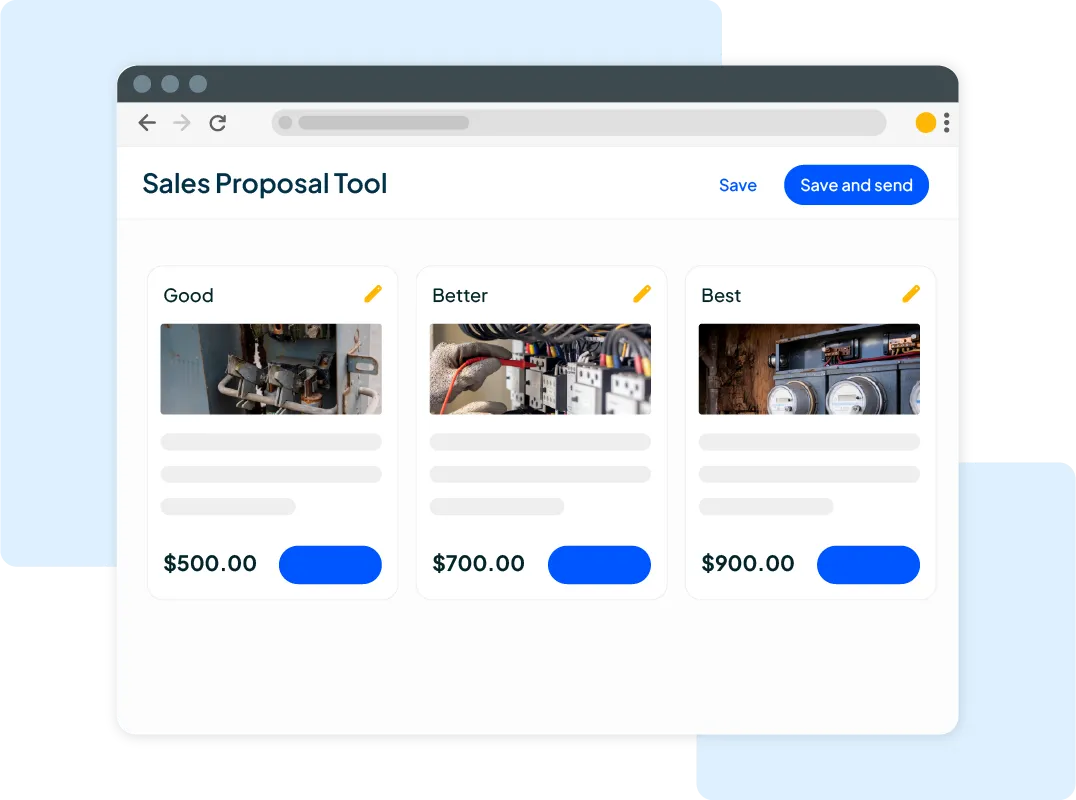

When you set up your business invoices using the Housecall Pro interface, you have numerous options to fully customize the layout, including the due date for payment (you can also use our free small business invoice template as a reference). You can also list the “net 30” alongside the specific date, so there is no confusion for your customer about when payment is expected.

We recommend putting “net 30” under the payment terms, by the invoice number, or beside the due date. Or, depending on how your invoice is set up, you may add “net 30” at the top, beside the due date, and at the bottom, with the rest of your payment terms (which should include the accepted tenders).

Why Timely Payments Are Important

Holding your customers accountable for on-time payments is just good business. Without on-time payments, your business may start suffering from a cash flow. Small businesses are especially vulnerable to this problem. When your customers pay on time, you can pay your bills on time, keeping your business liquid.

Adding specific payment terms and holding your customers to them can help avoid common problems that seem to plague small-to-medium-sized home service-based businesses, such as consistently delinquent customers or those who delay payments, only submit partial payments, or worse, dodge your calls and emails.

Net 30 Terms and Discounts

The easier it is for customers to see your required payment terms and due date, the easier it is for them to pay you. When setting up your invoice, be sure to include your net 30 terms (e.g., 30 days from the invoice date or on the 30th day of the month) in clear, easy-to-understand language.

It’s common in B2B enterprises to offer an early payment discount. Even if your business is primarily B2C (business-to-consumer), consider offering an early payment discount to large-volume customers or those with a solid history of on-time or early payments.

For example, “2/10 net 30” is a common early payment discount offered by many of your competitors. Customers who pay their invoice (in its entirety) within 10 days of receipt may receive a 2% discount. The terms of payment are still 30 days from the invoice date, but the discount may incentivize customers to pay earlier, ensuring your cash flow remains steady.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

Pros and Cons of Net 30

Just like anything else, there are benefits and drawbacks to net 30 payment terms for both buyers and sellers. Is this the term of payment you’re comfortable with offering? Will it make sense for your business model? Let’s break down the pros and cons of net 30 payment terms.

Pros of Net 30

Customers and businesses both benefit from net 30 terms. In fact, many of the benefits for your business are also benefits for your customers.

- You meet customer expectations. Net 30 is a standard payment term for B2B entities and many home service-based businesses as well. Including these terms on your invoices ensures you remain competitive.

- You build goodwill and imply a sense of trust in your client. Net 30 payment terms are essentially an interest-free 30-day loan to your customer. Instead of payment on receipt of goods or completion of service, your customer has 30 days to pay you, which demonstrates to them that you believe in the strength of your business relationship.

- Your cash flow is standardized. Consistently setting net 30 terms means that you should see consistent revenue coming in. If you bill monthly, then you can predict the money you’ll have at the end of the month (Day 30). Instead of wondering when you’ll be paid, you can predict when you’ll receive certain sums and budget accordingly.

- You’ll attract more customers. New customers appreciate an extension of net 30 benefits, so they may be more likely to go with your company than one requiring COD.

- You may see a reduction in bad debt. Most customers can pay within 30 days, so with these payment terms, your books typically look better, as most of your accounts will be current. If you’re in a growth phase or seeking capital to expand, having your accounts receivable current is especially crucial.

- You’ll find it easier to work with large companies. Larger companies typically have multiple levels of payment processing; your invoice may go through several hands before a check is cut, which takes time. Offering 30 days of grace for this process earns you goodwill from large corporations that typically operate on longer payment cycles.

Cons of Net 30

There’s a lot to like about net 30 terms of payment! But, there are a few drawbacks you should consider before implementing this payment condition across the board:

- Extending net 30 terms further out (to 60 or 90-day due dates) can strain the cash flow of smaller businesses.

- Net-30 terms are unlikely to help businesses already financially struggling. If you’re having trouble paying your own bills, you may not be in a position to extend credit for 30 days.

- Will offering a 2% discount end up biting you? If a large portion of your customers are receiving this discount, and your margins are small already, then you may be leaving money on the table.

- Start-ups may not have sufficient cash on hand to initially offer net 30 payments, especially if they must purchase a large amount of materials upfront.

- You may extend credit to the wrong customer. Some customers are just bad customers and may not be credit-worthy or could be facing cash flow problems themselves.

Net 30 Alternatives

So net 30 isn’t for you. Or, maybe net 30 payment terms are a good idea for some customers but not others. What are other fair payment terms you can offer your customers?

Maybe a net 20 term of payment makes more sense for your business. If you’re not dealing with large corporations that generally have a longer invoice approval and payment cycle, then there is no reason to extend credit out that far.

Alternatively, you may use net 30 terms as an incentive for new customers, including a clause in your contract that states consistent payment within one week will earn the customer consideration for net 30 payment terms for future business.

Should I Use Net 30 for My Business?

To determine if your business can benefit from extending net 30 payment terms to your customers, ask yourself these questions:

- Would these favorable terms improve your business’s cash flow?

- What are standard payment terms for your industry, AND

- What is your market like? That is, can you leverage offering net 30 payment terms to gain a competitive edge?

- Can you negotiate different terms with different customers so you maximize the financial benefits for your business?

If your business is new and has limited cash reserves, extending credit from the outset may not be viable. However, if net 30 is the market standard where you live, then you may not be able to avoid offering these payment terms; otherwise, you may not be competitive. Potential customers may view net 30 as the default term for businesses like yours.

Streamlining Field Service Invoicing With Housecall Pro

Is net 30 right for you? It may help boost your cash flow. Adding net 30 terms to your invoices and managing the payments are simple with Housecall Pro. You can track outstanding invoices, see which customers are paying early enough to receive a discount, and process payments all from one user-intuitive platform. You can even use your full Housecall Pro interface via our field service mobile app on the road from a phone or tablet.

Come discover what your competitors already know: Housecall Pro is the industry’s leading, all-in-one field service management software program. Sign up for a 14-day free trial of Housecall Pro today.