Spending too much time on admin work?

Automate your daily tasks and save time with our home service software.

Want to win more jobs with less effort?

Grow your business and send quick quotes with our home service software.

As a small to mid-sized business owner, you might not have the cash flow to manage through multiple clients with outstanding invoices or even worse, those who are late on their payments. And while failure to pay invoices is not typically intentional, the fact is that running a business is hard. It can be easy to let payments fall to the wayside and become deprioritized when trying to balance everything else that needs to get done during the day.

Worrying about the receipt of payments shouldn’t be something you have to worry about, either. As professionals in the business of using software and automation to help businesses be more effective and efficient—especially with invoicing and accounts receivable—we’ve learned a few things throughout the years. Read on to learn more about asking for—and getting—payments when they are due.

Table of contents

How to ask a client for a job payment professionally

No matter your business type, delivering a high-quality product or service is first and foremost. Your business will fail if your sell isn’t good or doesn’t meet your target audience’s needs. Next up on the list is customer service. No matter how good what you sell is, if you offer your customers a poor experience, the chances are that they won’t want to come back for a subsequent purchase.

But there’s another way to alienate your customers totally, and it’s not what you might think. It’s all related to asking for job payments. Yes, it’s a given that if you have delivered the product or service to the order’s specifications, you are due payment on time (especially if you have a contract in place). However, an unprofessional approach to billing and accounts receivable can quickly burn bridges.

Approach clients cordially

In business, professionalism is the name of the game. It means mutual respect on both sides of the table—you as the business owner and your customer—you’re both responsible for managing a respectful relationship. And though we’ll get into the concept of being cordial here in a moment, we want to back up and talk about one of the things you need to have in place—your service agreement.

Now, if you sell a product, the customer is likely to pay before receiving the product. So, this might not apply to you. But in the service industry, it’s more often the case that the work is provided and payment is made upon completion. That’s why a service agreement—aka a contract—is so important. It doesn’t have to be super long. Your service agreement simply needs to outline the expectations of your working agreement and one of those items in there needs to be your payment terms and conditions. Having a signed document from your customer that shows their agreement to these payment terms and conditions can be super helpful down the road.

This all said, let’s discuss the concept of being cordial. When you present an invoice for services rendered, be polite—always. Greet the customer respectfully, use your please and thank yous, and don’t forget to flash your winning smile (especially when presenting an invoice in person).

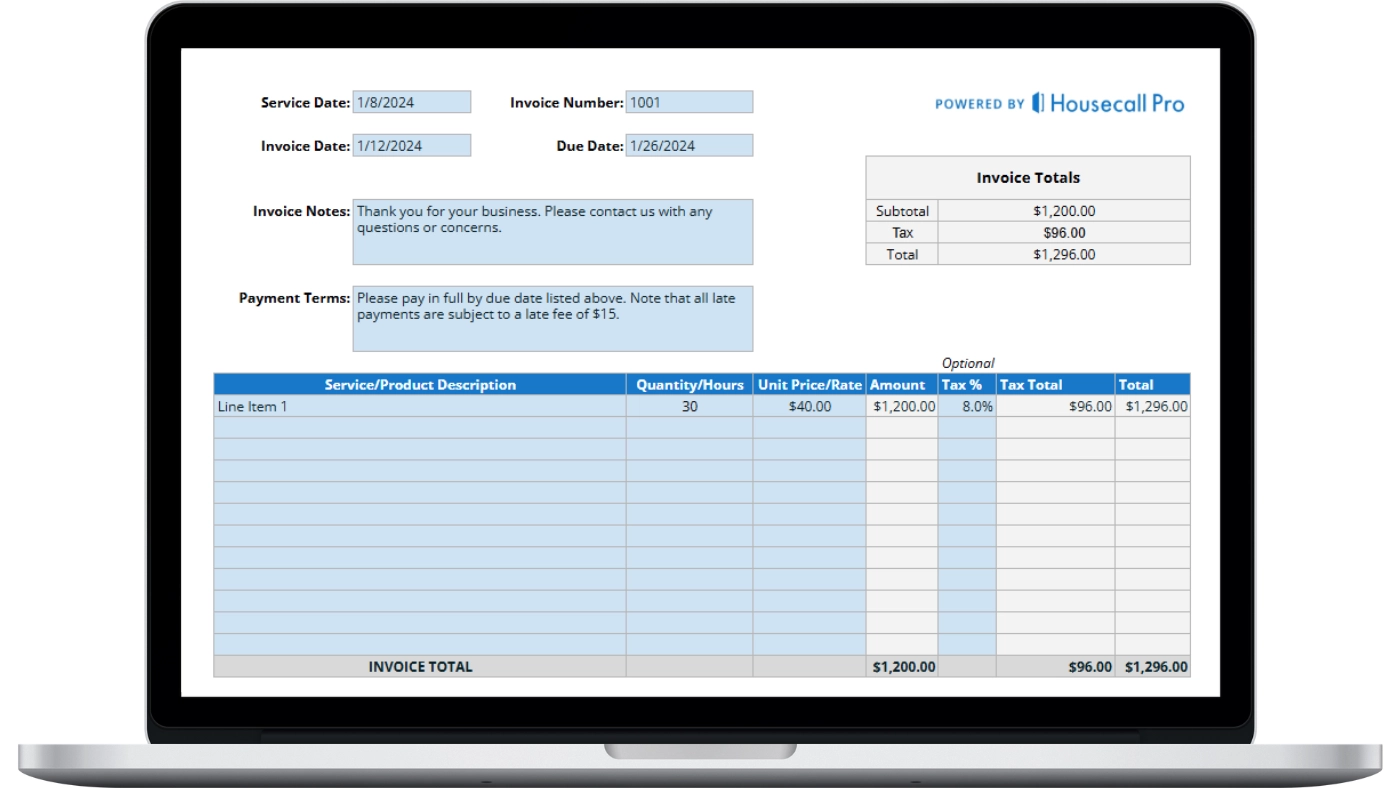

Emphasize payment terms

When preparing an invoice, start by using a consistent format or template. Make sure your logo, business, and contact information, date of the invoice, and description of products and services delivered or rendered are clear and easy to locate on the invoice. When you are inconsistent with the look and feel, it can confuse your customer. So, again, consistency matters.

Also, make sure your payment terms are clear on your invoice. If you have a service agreement in place, these should match exactly. Examples of payment terms include:

- Net 30: This means the full payment for the invoice is due 30 days after the invoice date. It’s a standard way to give clients time to gather funds without waiting too long for your payment.

- Due Upon Receipt: This term indicates that payment is expected as soon as the client receives the invoice. It’s a way to communicate that you’d like to be paid immediately for the services or products provided.

- Partial Payment (e.g., 50% upfront, 50% upon completion): This term is used when you require a portion of the payment before beginning the work and the remainder after the job is complete. It’s useful for projects that take time and resources upfront.

- Late Payment Fee: Mentioning a fee will apply if the payment is late (e.g., “A 2% late fee will be added to invoices not paid within 30 days”) can encourage timely payments. It informs the client there are extra costs for delaying payment.

- Early Payment Discount (e.g., 2% off if paid within 10 days): This incentivizes clients to pay their invoice earlier than the due date. It benefits both parties: clients save money, and you receive payments faster.

Communicate expectations and deadlines

As shared above, its super important that you are clear on your expectations for payment. Just as with the payment terms, you need to make your deadlines crystal clear. One way to do this is to include the payment terms in your service contract and on the invoice, and then articulate the specifics when you deliver the invoice.

For example, if you are in the residential cleaning business and send an invoice on May 1 with Net 30 payment terms, this implies the invoice is due in 30 days, which would be on May 31. While your invoice needs to have the payment terms, you can get more specific in the email that your invoice is attached to, in your text message, during your phone call, or in the letter that accompanies your invoice.

The next section will provide some examples. This step is important because it creates a visual or audible association with the payment is exact date. Though you are really only responsible for providing the terms and letting the customer do the math, providing that specific detail in your delivery mechanism can help a client get the date stuck in their head.

How to ask for payment in an email or text message

With our easy access—and heavy reliance—to technology, many businesses use email to deliver invoices. And sending via email has a host of benefits, including:

- Immediate Delivery: Email allows you to send an invoice to your customer within seconds. This is especially effective right after you’ve finished a job or discussed it with them.

- Paper Trail: Emailing invoices provides a clear digital paper trail. This makes tracking sent and received documents easier and is useful for reference during follow-ups or disputes.

- Cost-Effective: Emailing invoices reduces printing, paper, and postage costs. It’s a free method that saves money while still efficiently reaching clients.

- Environmentally Friendly: By sending invoices via email, you reduce the need for paper, which is good for the environment. This approach aligns with green business practices and can be a positive talking point with your customers.

- Easy to Organize: Digital invoices are simple to store and organize on your computer or cloud storage. Using billing software makes this process even easier. This makes retrieving past invoices for any purpose, like audits or customer queries, quick and hassle-free.

But, what do you say to a customer? How long should the communication be? See below for some simple templates that you can use when sending an invoice or asking for payment.

Email message template

As we shared above, email communications are often the easiest and least time-consuming option. But, you don’t just want to send an email as an attachment with no context. Be sure to be polite and cordial, and be very clear about what your email is about. Here is a brief template that you can customize based on your payment terms and invoicing process.

Email Subject: Invoice #12345 Due on [Due Date] for [Service/Product Provided]

Email Body:

Dear [Customer’s Name],

I hope this message finds you well. Attached to this email is Invoice #12345 for the recent [service provided/product delivered] on [date of service/product delivery]. As per our terms, the [invoice amount] is due by [due date].

Please review the invoice as soon as possible. If you have any questions or require further details, feel free to contact me directly via email or at [your phone number]. We appreciate your prompt attention to this matter and look forward to your continued business.

Thank you for your cooperation and trust in us. We value your partnership.

Best regards,

[Your Name]

[Your Position]

[Your Contact Information]

[Your Company Name]

As you can see from the above example, this template effectively did the following:

- Informed the customer of what the email was about

- Made it clear when the payment was due

- Provided clear contact information for the customer to use with any questions

- Was polite and cordial

Text message template

According to SMS Corporation’s website, 97% of U.S. adults own a mobile phone, 85% of which are smartphones. Thus, most people these days are familiar with the concept of texting and know how to do it. And if your customer falls in the Millennials and GenZ categories, you can bet they’ll prefer a text message over other forms of communication.

This said, texting is another highly effective way of sending invoices. However, you should do a few things before sending your first text communication requesting payment.

- Customer Opt-In: Always get explicit consent, referred to as an opt-in, from your customers to receive text messages from your business. You can ask for this permission during the initial service setup or through a follow-up communication. Make sure to record and manage these opt-ins in your Customer Relationship Management (CRM) system to stay organized and compliant.

- Use a Reputable Link Shortener: When sending invoices via text, you’ll likely need to include a link to the invoice or payment portal. Use a trusted link-shortening service like Rebrandly to make links more manageable and assure customers they are secure and legitimate.

- Personalize Your Messages: To make your text communications more effective, personalize them with the customer’s name and specific details about the service or product.

- Be Clear and Concise: Text messages should be clear and get right to the point. State that the message concerns an invoice and includes the due date and amount. Avoid any unnecessary information that could confuse the message. This particular text should not be treated as a marketing opportunity.

- Provide a Contact Option: Always include a way for customers to reach out if they have questions or concerns about the invoice. This could be a phone number or an email address.

So, what should your text message look like? As mentioned above, the goal here is to get right to the point and be polite in doing so. Don’t try to use this as an opportunity to market your business, as extra messaging can get confusing. And remember that texts needs to be short—160 characters or less—to ensure you don’t run into delivery issues.

Here is a brief template that you can customize for your payment and invoicing text communications.

Hi [Name], your invoice [#1234] for [Service/Product] is due on [DueDate].

Total: [Amount]. Pay here: [Link] Questions? [Your Contact].

Remember to check your character count before finalizing your exact version.

Phone call script template

Calling your customer is another way to reach out and ask for a payment. However, it is important to remember that most customers will want a tangible copy of their invoice. This means that the phone call serves as a courtesy to inform the customer of how their invoice will be received.

Some of the best companies to use a phone call to communicate a payment request are those in the landscaping, driveway seal-coating, irrigation, and other service industries where they come out to a customer’s home. These businesses often leave a hard copy of the invoice tucked into the door, peeking out from under the rug on the front step, or in another obvious place. But because the invoice is being left outside, the weather can sometimes cause it to blow away or get damaged.

Here is a phone script you can use with customers to inform them of how and where they will receive their invoice, and when payment is due. This template is best used when you need to leave a voicemail.

Hello [Customer’s Name], this is [Your Name] from [Your Company Name]. I hope you’re doing well. I’m calling to let you know that we’ve completed the [specific service] at your property today. Thank you for choosing us for your [service need].

We’ve left a hard copy of your invoice [specify the location, e.g., tucked into your front door, under the rug on your front step]. The total due is [amount], with payment due by [due date].

Due to the unpredictable weather, we recommend checking the specified location as soon as possible to secure your invoice. For your convenience, we can also email you a digital copy if you prefer. Please give us a call back at [Your Phone Number] to confirm or if you have any questions. We appreciate your prompt attention to this matter and look forward to serving you again in the future.

Thank you, and have a great day.

Formal letter template

Have you ever received an invoice in the mail from a service provider, with no accompanying letter or context? Sure, you probably know what the invoice is for, but without a letter to accompany the invoice, it can be a bit offputting. That said, you don’t need to write a book. A simple letter tucked in with the invoice is all it takes.

Check out this template that you can modify based on your business requirements.

[Your Company Letterhead]

[Date]

[Customer’s Name]

[Customer’s Address]

[City, State, Zip Code]

Dear [Customer’s Name],

As part of our commitment to providing transparent and efficient service, please find the invoice for the recent [service provided/product delivered] dated [Invoice Date] enclosed.

The invoice number is [#Invoice Number], details the services rendered and/or products delivered, along with the total amount due of [Amount Due]. Per our agreement, we kindly request that payment be made by [Due Date].

We understand that questions may arise, and we encourage you to contact us directly at [Your Contact Information] should you need any clarification regarding this invoice or any other aspect of our services. Our team is always here to assist you.

Thank you for your prompt attention to this matter and for your continued trust in [Your Company Name]. We look forward to continuing our partnership.

Warm regards,

[Your Signature (if sending a hard copy)]

[Your Name]

[Your Title]

[Your Company Name]

[Contact Information]

Now, one thing to call out here is that the world is your oyster when it comes to sending a letter to your customer. When sending an invoice by mail, you have an opportunity to enclose any additional information about the services provided. For example, if you are in the lawn aeration business, you can include a blurb about how to best care for their lawn in the days following the aeration.

If you are in the home cleaning business and offer a rotation service, you can advise the customer as to when the next service will be and what will be included (and excluded).

And of course, when sending a letter to an invoice, ensure your company name is on the outside envelope with the return address. This can help ensure your letter isn’t promptly tossed in the trash and misconstrued for an unsolicited advertising piece.

Get In Touch: 858-842-5746

Let us earn your trust

Avoid late payments and get paid faster with Instapay from Housecall Pro. On average, Pros increase monthly revenue generated through Housecall Pro by 35% after their first year.

See plan options and feature breakdown on our pricing page.

How to deal with late payments

No matter the size of your business, the chances are that you will have to deal with a late payment from time to time. It just happens. However, if you have done your diligence with the previous steps, this process doesn’t have to be overly challenging.

Here are some templates and scripts you can use to make the process a bit easier.

Send a polite payment reminder via email

You can approach reminder emails in two ways. First, you can send a reminder a few days before the invoice is due. Second, you can send a reminder after the payment date has passed.

Here is a template you can use if you want to remind customers of an upcoming payment deadline:

Email Subject: Friendly Reminder: Invoice #12345 Due on [Due Date]

Email Body:

Dear [Customer’s Name],

As a friendly reminder, we wanted to let you know that the payment for Invoice #12345, concerning the [service provided/product delivered] completed on [date of service/product delivery], is approaching its due date of [Due Date].

The total outstanding amount is [invoice amount]. If you have already processed this payment, please disregard this reminder. We sincerely thank you for your promptness. If you have any questions or need further details about your invoice or payment options, please contact me directly via email or at [your phone number].

We appreciate your attention to this matter and thank you for your continued partnership with [Your Company Name].

Warm regards,

[Your Name]

[Your Position]

[Your Contact Information]

[Your Company Name]

Here is a template you can use for an overdue payment. Be sure to refer to the terms and conditions of any service agreement to ensure consistency.

Email Subject: Important: Overdue Payment for Invoice #12345

Email Body:

Dear [Customer’s Name],

We are reminding you that payment for Invoice #12345, for [service provided/product delivered] on [date of service/product delivery], is now overdue. According to our records, the payment was due on [Due Date], and we have not received it as of today.

We understand that sometimes things slip through the cracks. However, timely payments are a must for the continuity of our business relationship. The total amount due is [invoice amount]. To avoid any potential late fees as outlined in our agreement ([specify late fee policy if applicable]), we kindly ask that you process this payment as soon as possible.

If any circumstances prevent the payment or if you have any questions, please let us know. We are here to work with you to find a solution. You can make a payment directly through [payment method/link] or contact us for more assistance at [your phone number or email].

Thank you for your immediate attention to this matter and your ongoing business. We value our relationship and look forward to resolving this promptly.

Best regards,

[Your Name]

[Your Position]

[Your Contact Information]

[Your Company Name]

Give them a call

Give the customer a call to let them know of an overdue payment is a courtesy that many customers will understand. You never know if a customer misplaced an invoice, forgot about it, or are facing some extenuating circumstance. Here is a template that you can use if you call and receive the customer’s voicemail.

Hello [Customer’s Name], this is [Your Name] from [Your Company Name]. I hope you’re doing well. I’m calling regarding the invoice numbered [#12345] for [service provided/product delivered] on [date of service/product delivery], which was due on [Due Date]. We noticed it hasn’t been settled yet and wanted to ensure everything is okay on your end.

We understand that things can sometimes get overlooked, or other circumstances might arise. If you’ve already taken care of this, please disregard this message. If not, and you need any assistance or wish to discuss payment options, we’re here to help. You can reach me directly at [Your Phone Number] or via email at [Your Email Address].

Thank you very much for your prompt attention to this matter. We truly value your business and are here to support you however we can. Looking forward to hearing from you soon.

Take care, [Customer’s Name].

Create a payment agreement plan

If you have a service agreement in place, then great job, you’ve already taken care of this. However, if you don’t want to deal with attorneys and create a comprehensive service agreement, developing your own payment agreement plan is a great option.

A payment agreement plan outlines the terms and conditions under which payments will be made between two parties, ensuring there’s a mutual understanding and helping to avoid any potential misunderstandings in the future. Here’s what to know and consider about payment agreement plans:

- Clarity is Key: The terms of payment, including amounts, deadlines, and methods of payment, should be clearly outlined to prevent any confusion.

- Flexibility: Consider offering payment plans that are realistic and flexible, accommodating the financial situations of your clients while ensuring you receive payments in a timely manner.

- Legal Protection: While a payment agreement plan does not need the complexity of a contract drawn up by lawyers, it should still provide legal protection by outlining agreed-upon terms and conditions.

- Record Keeping: Both parties should keep a signed copy of the payment agreement for their records. This document can serve as proof of agreement in case of disputes.

Here is a template you can use to create your own payment agreement plan.

This Payment Agreement Plan is made on [Date] between [Your Company Name], herein referred to as “Provider,” and [Client’s Name], herein referred to as “Client.”

Payment Terms:

The total amount due for services rendered/products delivered is [Total Amount].

Payments will be made according to the following schedule: [Payment Schedule, e.g., $XXX due on the first of each month for X months].

Methods of Payment:

Payments will be made via [Accepted Payment Methods, e.g., bank transfer, online payment portal].

Late Payment Policy:

In the event of a late payment, [describe any late fees, interest rates, or grace periods].

Modifications:

Any modifications to this agreement must be made in writing and signed by both parties.

Agreement to Terms:

Both parties agree to the terms outlined in this Payment Agreement Plan. This agreement is binding and enforceable by law.

Signatures:

Provider: ___________________________ Date: ___________

Client: _____________________________ Date: ___________

Send a formal demand letter

Hopefully, by sending a reminder email or text or by placing that brief reminder phone call, that’s all it takes to get your customer back on track. But, sometimes that isn’t the case. If a reasonable time period has passed and you still haven’t received payment despite your diligence to collect, a formal demand letter may be in order.

Here is a template you can modify for your business:

[Your Company Letterhead]

[Date]

[Customer’s Name]

[Customer’s Address]

[City, State, Zip Code]

Subject: Final Notice of Outstanding Payment for Invoice #12345

Dear [Customer’s Name],

Greetings. Despite our previous communications regarding the outstanding balance for Invoice #12345, dated [Invoice Date], for [Description of Products/Services], we have yet to receive payment. As of today, the amount of [Amount Due] remains unpaid, and this balance is now [Number of Days Late] days overdue.

This letter serves as a final demand for payment. We value our relationship with our clients and understand that unforeseen circumstances can sometimes delay payment. However, we must insist on the settlement of this account to avoid any further action.

Please find the payment details below to settle this account:

Amount Due: [Amount Due]

Due Date: [Original Due Date]

Payment Methods: [List of Accepted Payment Methods]

We kindly request that this balance be paid in full by [Final Deadline Date] to avoid potential further actions, including but not limited to legal proceedings or the involvement of a collection agency. Such actions may affect your credit rating or result in additional costs.

Should there be any reason you dispute the amount due or if you are experiencing financial difficulties and wish to discuss a payment plan, please contact us immediately at [Your Contact Information]. We are more than willing to work with you to find a mutually acceptable solution.

Thank you for your prompt attention to this matter. We hope to resolve this issue amicably and continue our business relationship.

Sincerely,

[Your Name]

[Your Position]

[Your Contact Information]

[Your Company Name]

Helpful hint: We recommend sending this letter via certified mail to ensure you have proof of delivery and receipt.

Next steps if your client doesn’t pay

Let’s face it—when a client doesn’t pay you for your work, it can be super frustrating. Not only that, lack of payment can have serious consequences on your business. You may have been counting on those funds to pay for new equipment, to pay employees, etc. Thus, when you have a client who isn’t paying, you may have to make some tough decisions.

Consider stopping further work

While the decision is up to you, it may be in your best interests to stop work until payments have been caught up. This ensures you are not spending valuable time against a project that might go further into arrears.

Consult a legal advisor

No one wants to have to consult with (or pay) an attorney or legal advisor to chase payment. But, if you are out a lot of money, this might be your only recourse. If you have a service agreement in place, be sure to reference that for what was agreed to. You may need to go to arbitration to seek payment.

And, if you decide to talk to a legal advisor, be sure you have your records in order for that meeting. Have the following on hand and readily available (many attorneys will charge you for follow-ups, so having your ducks in a row up front will save you money).

- Copy of any service agreement

- Copies of applicable invoice(s)

- Copies or document to show when invoice was sent and what follow-ups were made

Evaluate collection agencies

If going to collections is the next step, a great place to start is with your bank. Let your business banker know what has happened, and see if they can provide you with a recommendation on who to work with. It is important that you select a collections agency that will support your company values.

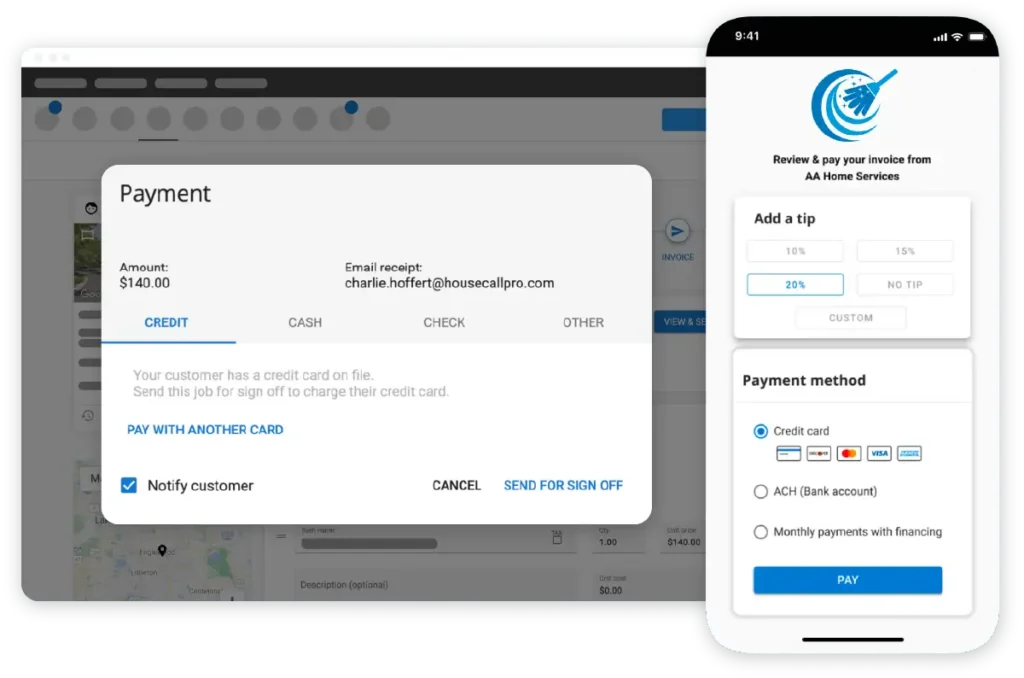

Avoid late payments and keep track of all your invoices with Housecall Pro

If you’re in business, you’re in business to make money. So if you aren’t getting paid, that can be a serious setback to your organization’s growth and future plans. One of the best ways to avoid late payments and keep your invoices organized is with invoicing and payment software like Housecall Pro.

We automate your invoice process, taking most of that work off your plans. We document the entire process, too, so you don’t need to worry about what follow-ups have been made and when. Want to learn more? Try Housecall Pro for free today and never worry about payments again.