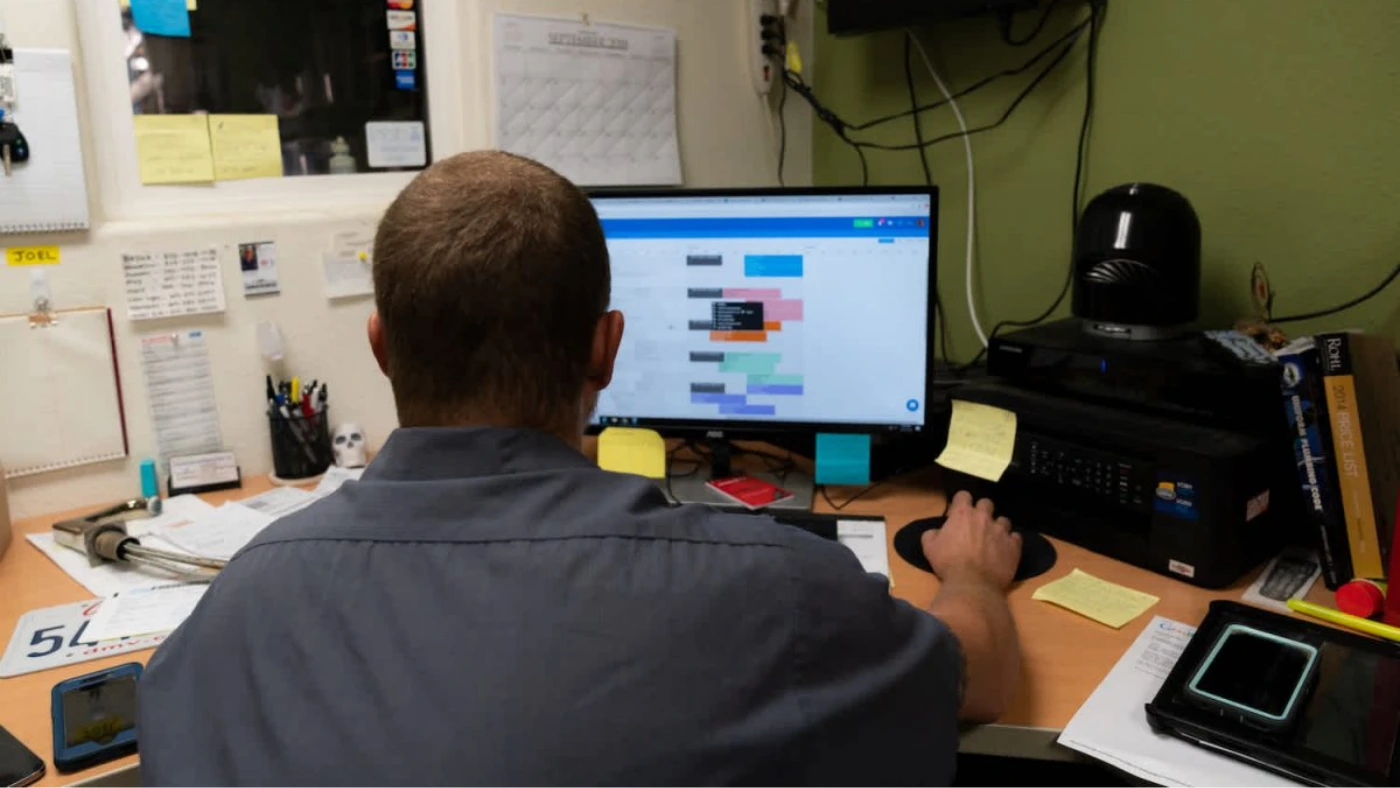

Spending too much time on admin work?

Automate your daily tasks and save time with our home service software.

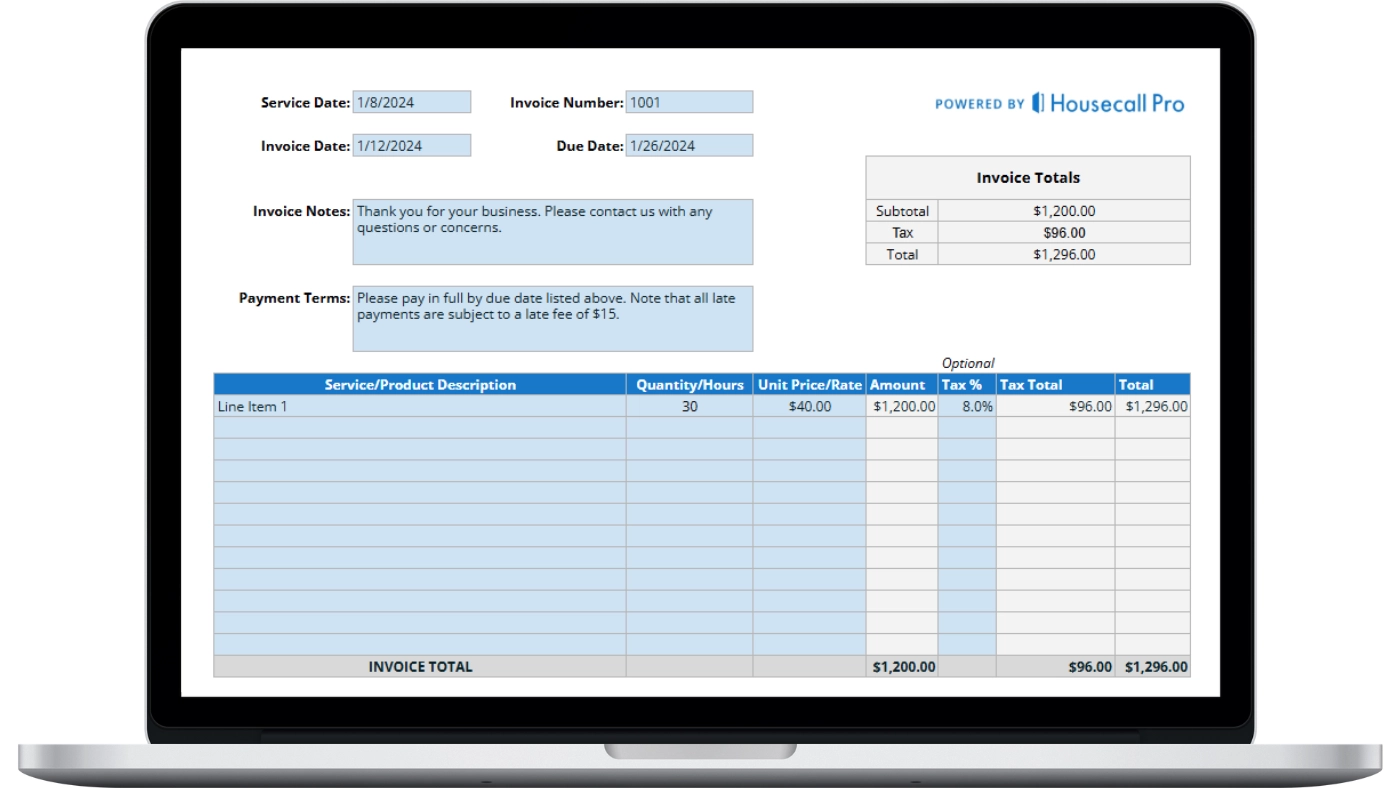

Want to win more jobs with less effort?

Grow your business and send quick quotes with our home service software.

What home service businesses need to know about the new relief package

On April 16, the Small Business Administration (SBA) ran out of money for the Paycheck Protection Program (PPP). The SBA also stopped taking new applications for Economic Injury Disaster Loans (EIDL).

This week, Congress is working to pass another relief bill that will give the SBA another $310 billion to fund the PPP and $60 billion for EIDL.

Banking industry professionals are warning that this amount isn’t nearly enough with hundreds of thousands of applications already pending that come closer to nearly $1 trillion. The additional funding is expected to run out very quickly.

According to the SBA, Economic Injury loans that have already been submitted will continue to be processed on a first-come, first-serve basis. You just can’t submit a new application.

If you’ve already applied for a PPP loan through a lending institution, it’s still possible to hear something positive back. Some lenders are still processing agreements for finances through the SBA using funds from the first relief package.

Many lenders are still taking new PPP applications in preparation for the new funding. Business consultant Jill James told the Los Angeles Times, “If you don’t have an SBA guarantor number, you’re probably going to have to reapply … The queues we had are out the window.” If you applied through a larger national bank such as Wells Fargo or Bank of America, she recommends trying again with a regional bank or online lender like Kabbage.

The government and private entities are working to create financial solutions for small businesses impacted by COVID-19.

We will continue updating this blog post as we find more resources for home service businesses.

Here are the programs we covered with links to articles with more detailed information.

Economic Injury Disaster Loans (EIDLs)

The U.S. Small Business Administration is offering low-interest loan assistance of up to $2 million for businesses of any size impacted by the Coronavirus.

Per the CARES Act, small businesses that apply for an EIDL will receive an advance of $10,000 within three days that they do not need to pay back even if they are not approved for the loan.

Read a more detailed article on what is the EIDL and how to apply and receive your $10,000.

Paycheck Protection Program

Part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Paycheck Protection Program or PPP, makes federally guaranteed loans available to businesses that commit to retaining employees during the crisis.

Read a more detailed article on what is the PPP and how to it may impact your business.

Families First Coronavirus Response Act

The Families First Response Act will require small businesses to pay for up to two weeks of sick leave and ten weeks of family and medical leave for full-time and part-time employees for situations related to COVID-19. Businesses with under 50 employees will be able to apply for exemptions to this requirement.

Unemployment Insurance Provisions

Read a more detailed article on your unemployment options as a home services employer.

Refundable Payroll Tax Credit

Learn who qualifies for the Refundable Payroll Tax Credit and how to apply

Small Business Debt Relief Program

Read a full article and download a Small Business Debt Relief Program facts sheet

Recovery Rebates

Learn more about the Recovery Rebates in a full article

Additional Options

Local Assistance Many cities and states are creating their own local relief programs.

Private Aid Big corporations such as Facebook, Verizon, and Amazon are creating relief funds and grants for small businesses. Check out a list of resources available from many private companies.

Alternative Lending Solutions

As banks are overwhelmed with an influx of new credit and loan applications, peer-to-peer (P2P) loan providers and fintech platforms can offer much needed alternative avenues for obtaining capital.

P2P platforms act as a middleman between the borrow and investors who fund the loan. Look into P2P providers like Funding Circle, LendingClub and StreetShares who work with small businesses.

Payment processors like Square, PayPal and Stripe also offer credit solutions for small businesses. If you’re already a customer, they will have your transaction history to pull from when making credit decisions.

Both P2P providers and fintech platforms offer fast credit decisions and access to funds, often a much faster turnaround than traditional business loans.

Short-Term Cash Flow

For short-term cash flow assistance, check out Fundbox. Small loans can be available as quickly as the next day. Note that current Housecall Pro users can apply for business credit via Fundbox through their account. Learn more.

This article is for informational purposes only and to foster thoughtful communication and discussion regarding the COVID-19 pandemic. Readers should obtain independent advice relating to their businesses and their particular circumstances.