For any of your business needs

Working capital made simple

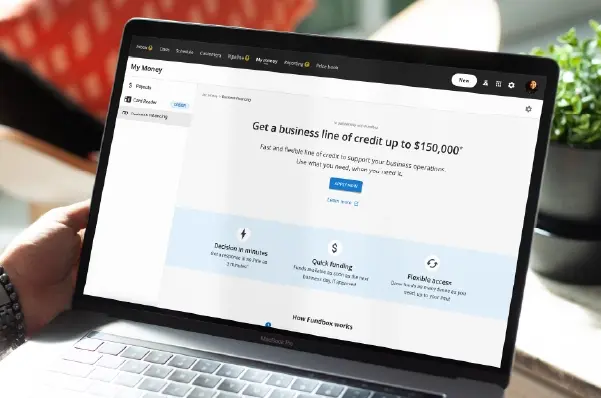

A line of credit to fund your business

We’ve teamed up with Fundbox to make financing accessible directly within your Housecall Pro account. Apply today to access an easy-to-use revolving line of credit, designed with Pros like you in mind. A Fundbox Line of Credit can help you:

-

Cover payroll

-

Buy inventory

-

Purchase materials

Convenient funding at your fingertips

Spend less time trying to access your funds so you can invest in your business. Applying for a Fundbox Line of Credit is fast and simple.

-

Quick Application

Apply and can get a credit decision in as little as 3 minutes**

-

Fast access to funds

If approved, funds can be available as soon as the next business day.

Flexible funding

Choose your repayment plan each time you draw funds. Draw funds as many times as you need, up to your limit, and pay for only what you use. There are no prepayment penalties.

-

Select between a 12-week or 24-week repayment plan

-

Get a clear breakdown of how much principal and interest you’re paying per week

-

Make fixed repayments each week

What the Pros say

As soon as I found out about the option to secure a short-term loan through Housecall Pro, I applied. Within 30 minutes, we had approval. This was pretty incredible when it took days to even get an email back from the bank.

Joel N

AirAce Heating & Cooling

Fundbox FAQ

- What is Fundbox’s approval process?

-

Applying for a Fundbox Line of Credit is quick and easy. Share some basic business information and connect your business bank accounts and accounting software, and you can get a credit decision in as little as 3 minutes.

- How much does Fundbox cost?

-

Line of credit fees differ for 12-week terms and 24 week terms. Fees may vary for each line of credit drawn. You’ll always see a clear breakdown of your repayment total before you draw funds.

- Are there any origination fees? What if I want to repay early?

-

Fundbox does not charge origination fees and there are no prepayment penalties.

- What information do I need for my application?

-

The application initially asks for some basic information about your business. You’ll also need to connect business accounts like your bank account and accounting software.

- What banks does Fundbox support?

-

Fundbox supports most banks and credit unions.

*Credit line amounts, rates, and terms are based on creditworthiness and subject to change, additional documentation may be required.

**Loans and lines of credit are made available by Fundbox and bank partner, First Electronic Bank, member FDIC.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by 35% after their first year.

See plan options and feature breakdown on our pricing page.

- Drive Sales

- Review Management Software

- Pipeline

- Recurring Home Service Agreement

- Online booking

- Sales proposal tool

- Receive and manage money

- Invoicing software

- Payment

- Expense Cards

- Business Financing

- Consumer Financing

- Know your business

- Enhanced Reporting

- Quickbooks

- Time Tracking

- Job costing and profitability

- Customer management

- business solutions

- Voice solution

- Conquer coaching

- Open API integrations

- Pro Community

- Call answering service

- explore more solutions

- Franchises

- See all solutions