The pandemic hit the US hard in 2020, with 30 million Americans filing for unemployment benefits by March and April reports, which will be published this Friday, will likely show the highest unemployment rate since the report began in the 1940s.

According to internal reports published by Gusto, a payroll and HR management platform, home service trades did not appear in the list of top ten industries laying off either salaried or hourly employees. This is likely thanks to many trades being considered “essential services” across the country.

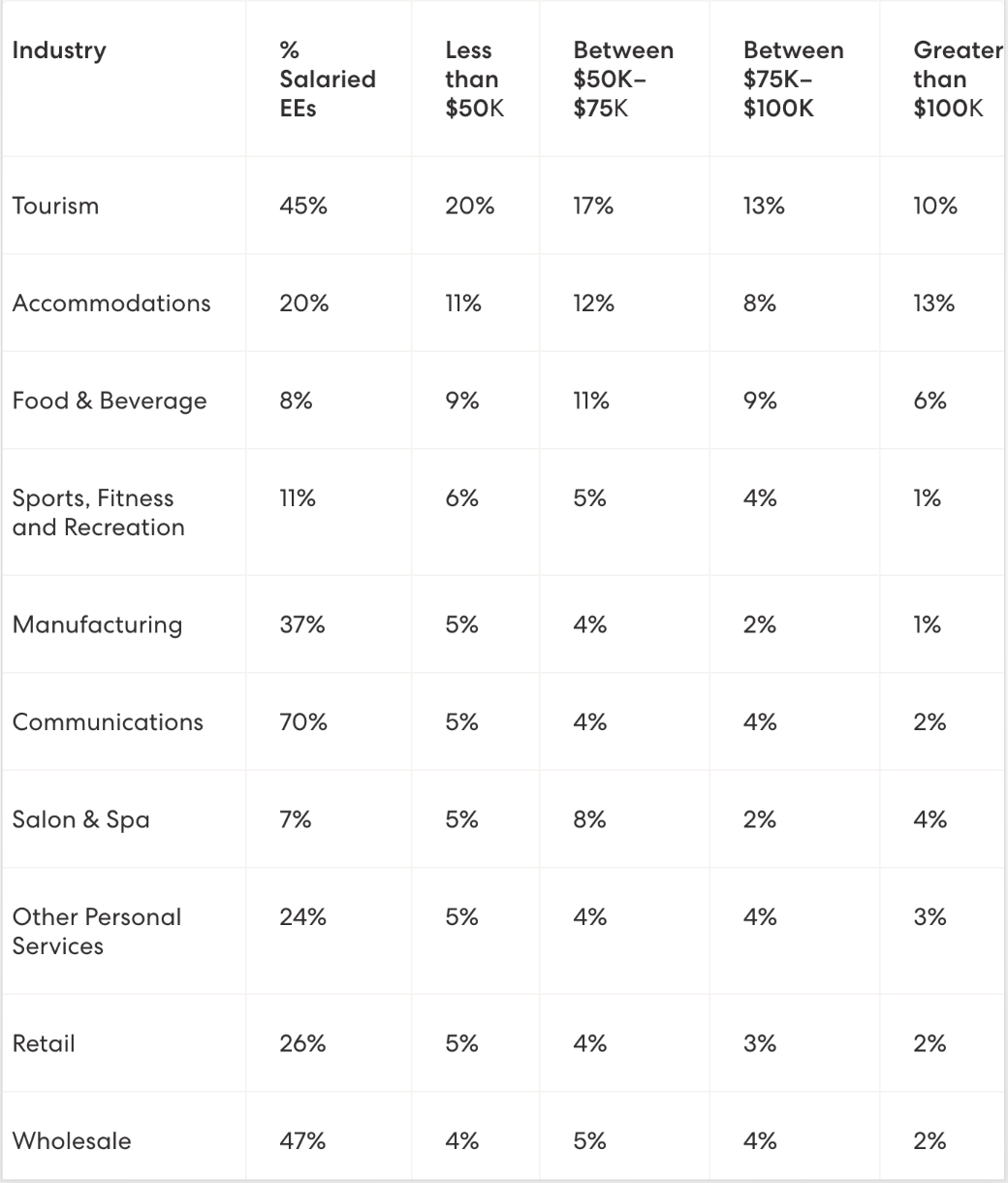

Top 10 highest industries in terms of layoffs of salaried positions, % of workers laid off by income group (data from Gusto):

The U.S. Department of Labor has given states the opportunity to extend unemployment insurance benefits for individuals impacted by the epidemic while the Coronavirus Aid, Relief, and Economic Security (CARES) Act adds an additional $600 per week to state unemployment benefits, among other provisions.

Changes to unemployment impact your employees, friends and family affected by layoffs or reduction in hours due to the COVID-19 pandemic.

We’ll go through the changes to unemployment encouraged by the Department of Labor and the CARES Act, and address home service companies’ frequently asked questions.

Qualifying for Unemployment Benefits

Part of the rise in unemployment claims is that the rules to get unemployment benefits have changed. Per this new mandate, an employee can receive benefits if:

- An employer temporarily ceases operations during the outbreak

- If an individual is quarantined through illness or risk of exposure

- If an individual is taking care of a sick family member

It is up to the state on how they are responding to these new guidelines. However, we’re finding that most states are providing partial benefits to individuals whose work hours have been reduced due to COVID-19. The employee does not need to quit their job to receive benefits.

In addition, many states are also covering employees that have lost their full-time job and are replacing it with one or more part-time jobs, as well as individuals who were not full-time to begin with.

The CARES Act

The CARES Act adds a weekly benefit of $600 to unemployment benefits otherwise paid by the state (and requires states not to reduce their benefits as a condition of the extra $600). This extra federally funded unemployment benefit will last for a period of up to four months through July 31. Additionally, the CARES Act extends the normal state benefits by an additional 13 weeks. Since those benefits typically last 26 weeks, the total length of unemployment compensation will typically be extended to 39 weeks.

Depending on the decision of the state, you might receive two separate payments or one big payment, but both should be delivered on the same day.

The benefit applies to reductions in hours as well as layoffs, even if the effect of the extra payment is for the employee to make more after the reduction in hours, with the extra payment, than they did while working full time.

The legislation encourages states to waive their initial waiting week so you can get access to unemployment assistance as soon as possible. It also provides a temporary pandemic unemployment assistance program for those not traditionally covered by unemployment, such as self-employed individuals and independent contractors, in an amount equal to the state benefit plus $600.

Who is eligible to receive unemployment benefits?

This will be available to individuals who are unemployed or partially unemployed because their work can’t operate due to COVID-19; they are quarantined with the expectation of returning to work after the quarantine is over; or leave employment due to a risk of exposure or infection or to care for a family member.

If you are partially unemployed, you will still be eligible for the additional benefits even if it’s more than you would typically make working full time.

It also provides unemployment assistance to those who wouldn’t normally be eligible – like those who are self-employed or independent contractors.

How do you apply for unemployment benefits?

Every state is different, but typically you have to apply for benefits through the labor department or unemployment agency in the state where you worked, not where you live.

Visit careeronestop.org and go to “Find Local Help,” then “Unemployment Benefits.” Be prepared to provide basic information, such as the address of your employer and the dates you worked there.

As an employer, you can create an unemployment insurance claim on behalf of your employees which can speed up the approval process. In fact, certain states, such as Georgia, are requiring employers to file claims if they are reducing hours for their team.

Tips for rehiring employees

In a webinar, Will Lopez, the Head of the Accountant Community at Gusto, explained that he expects to see many businesses start to rebuild their teams using contract labor as opposed to salaried employees.

Melina Fairleigh, Housecall Pro’s SVP of People, advises that a common error she sees small businesses make is misclassifying independent contractors that should be regular employees. “The general rule is that an individual is an independent contractor if you as the payer has the right to control or direct only the result of the work, not what will be done and how it will be done.”

Listen to the full webinar for information about how to use the PPP funding correctly, how to hire while social distancing and more.

FAQ

What’s the difference between a layoff and a furlough? Laid-off employees are officially separated from employment, furloughed workers remain on your books as current employees. Furloughed workers stop working for a shorter, fixed-period of time.

When will I get my first check? It typically takes 2-3 weeks to receive your first check. Currently the unemployment offices are overloaded and are backed up so it may take a little longer.

If it takes 6 weeks for the check to get here and I’m back to work, will I still be compensated? What If I’m just partially unemployed? Depending on your state, you will qualify for partial unemployment benefits in addition to the $600.

How do I find out what my state’s unemployment policies are? The AARP has linked all of the state’s unemployment websites and office phone numbers here.

My employees are asking if people that are working but less hours, will they get compensated? Depending on your state, they can qualify for partial unemployment benefits in addition to the $600.

Several of my employees are on sick leave. Can they still apply for unemployment? According to the US Department of Labor, unemployment benefits are only applicable if an individual is not receiving paid sick leave.

We offer our employees the option not to go to work but said they choose to work because they need money. What is the best course of action here? You can let them know they have the option to apply for unemployment benefits if they are unemployed or partially unemployed because their work can’t operate due to COVID-19; they are quarantined with the expectation of returning to work after the quarantine is over; or leaves employment due to a risk of exposure or infection or to care for a family member.

As an LLC with no employees, what is my ability to receive unemployment and what do I need when I apply? You can apply for unemployment benefits if you report self-employed LLC income.

What if you have independent contractors and not employees? Independent contractors and self-employed individuals will now generally be eligible to apply for unemployment assistance (plus the $600 addition).

Can you apply for unemployment if you’re the business owner? If you are reporting self-employed LLC income you can apply for unemployment.

What is the best way to apply for assistance? The best way to apply is to go through your state’s unemployment office. The AARP has linked all of the state’s unemployment websites and office phone numbers here.

Our employees filed unemployment effective 03/20/2020 however since we need to finish what we have started we require them to come in for a few hours in three days. Will their unemployment check be less since they are still working at the time they filed unemployment? If your employees are still working partial hours they will still be eligible for partial unemployment benefits in states that allow that as well as the $600.

Trump passed a stimulus for sole proprietors/Independent contractors to get unemployment. Is this something we have to apply for or do we automatically get it? You will still need to apply for unemployment with the state where you work to qualify for the additional $600.