Free 14-Day Trial

Look professional and save money

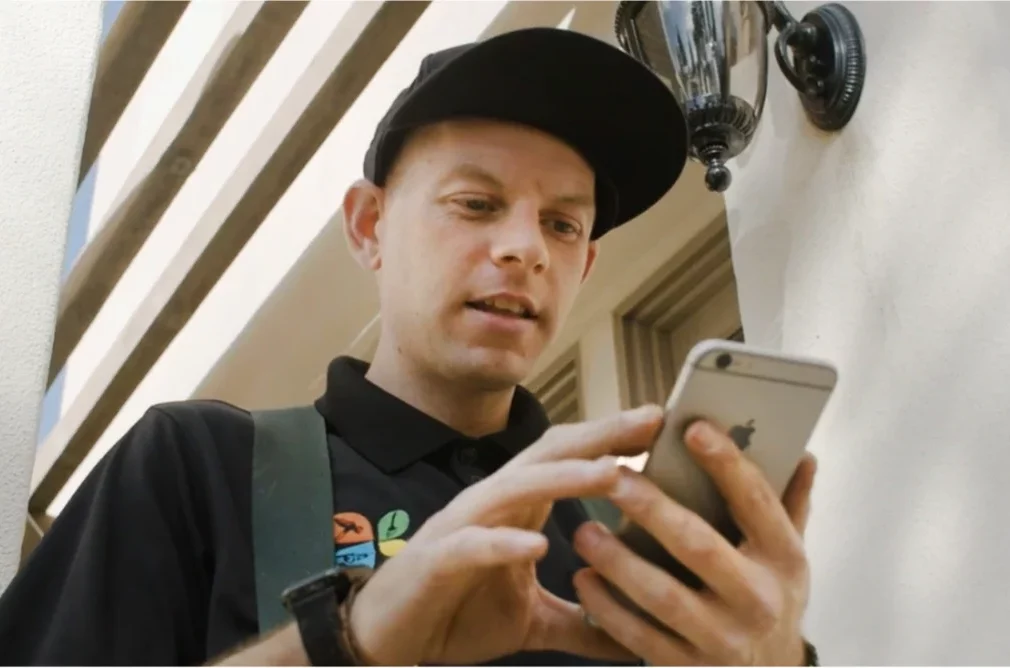

Whether it’s a chip, tap, or swipe, mobile card readers gives your customers the most professional experience.

Manage money with hcp my money tools

Now you can accept any card, any way

Make it easier for customers to pay

Once the transaction has been authorized, the funds are moved from the credit card company to the acquiring bank. After the transaction has been authorized and captured, the funds from the credit card sale are settled through your credit card company’s systems and deposited in your account.

-

Card reader integrates with Housecall Pro’s mobile app

-

Take card payments via swipe, tap, or chip

-

A low processing rate of 2.59%

Modern payment options

Options like contactless payments and chip readers make it easy for customers to submit payments. Get paid faster and provide your customers with a more convenient way to pay.

-

Accept credit card payments anywhere with card reader

-

Works with FC payments like Apple, Samsung, and Google Pay

-

Accept contactless chip cards

Track payments easily

Use recurring billing options and take payments that are processed via the Housecall Pro app. Turn around in-field payments faster with Instapay.

-

Visibility into your payments and deposits directly in Housecall Pro

-

Payments integrate and reconcile in QuickBooks to eliminate double entry

-

Easily see which invoices are paid and which need follow up

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by 42% after their first year.

See plan options and feature breakdown on our pricing page.

- Drive Sales

- Review Management Software

- Pipeline

- Recurring Home Service Agreement

- Online booking

- Sales proposal tool

- Receive and manage money

- Invoicing software

- Payment

- Expense Cards

- Business Financing

- Consumer Financing

- Know your business

- Enhanced Reporting

- Quickbooks

- Time Tracking

- Job costing and profitability

- Customer management

- business solutions

- Voice solution

- Conquer coaching

- Open API integrations

- Pro Community

- Call answering service

- explore more solutions

- Franchises

- See all solutions