Salt Lake City’s Beehive Plumbing is growing fast. From 2019 to 2020, the team doubled from 24 to 50 employees. And one of the things driving this growth is consumer financing.

“We have really big jobs that we do in plumbing emergencies,” office manager Patty Wright explained. “They never happen at a good time. They’re always a surprise and can be expensive, and you don’t usually have it budgeted for.”

Offering financing options allows customers to sign on for necessary work they otherwise couldn’t afford. It also means that Beehive Plumbing can take more jobs.

Two years ago, Beehive Plumbing started using a company that provides consumer financing for home improvement projects. They were able to offer their customers the options they needed, but the process itself was cumbersome. It took multiple steps to get a new project approved.

Five months ago, they switched to Housecall Pro’s consumer financing solution. Since then, they’ve closed on $50,000 in sales through financing.

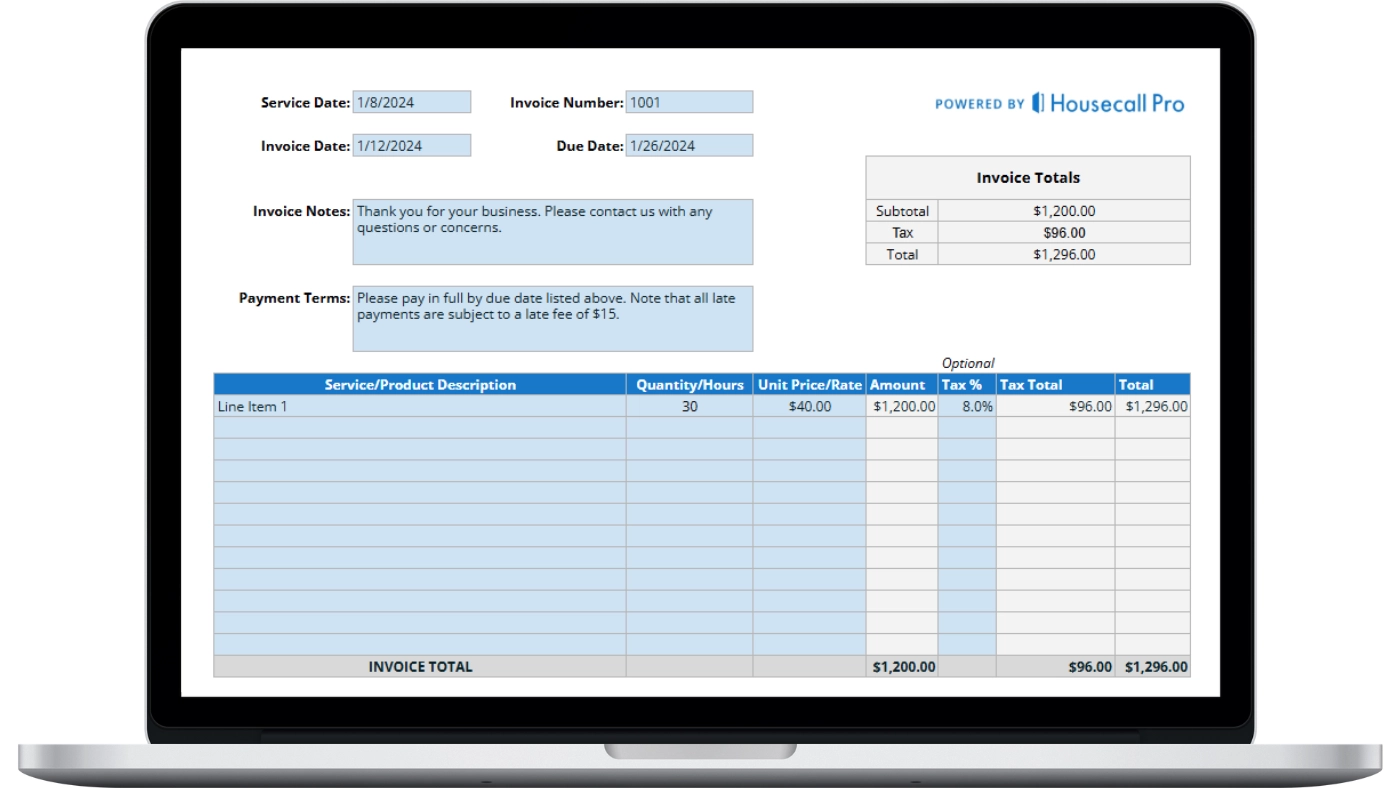

Housecall Pro has partnered with Wisetack to offer financing directly within the platform. Housecall Pro users can attach a link to the financing application on any job estimate or invoice. While you’re still in the field, a customer can pull up the estimate on their phone, apply for financing, and receive an immediate decision. The integration also includes a “Pay by Financing” option to all invoices created through Housecall Pro.

“The process was much more streamlined than the other kind of financing that we were using,” she explained. “The amount of information is put in over an app through the phone, so it’s not like filling out a bunch of long forms. And the response, whether it be it’s accepted or declined is so much quicker.”

Giving customers direct access to the application through a job estimate or invoice also keeps their information more confidential. “Customers take care of it themselves. They don’t have to give us their social security number or any of their personal information,” Patty explained.

With this new system in place, customer service has improved exponentially. Recently, the bottom of one family’s ancient water heater fell apart and water began leaking everywhere. “There was just no way they could afford to have us put in a new water heater, but everybody needs hot water. It’s essential.” But because the family was able to apply for financing, Beehive Plumbing was able to install a brand new water heater that same day.

Tips for Implementing Customer Financing

Here are some tips on how Beehive Plumbing has successfully promoted its financing options.

1. Talk About it Everywhere

“The tech mentions it. We put it on their invoice. And if they don’t make a decision right away about an estimate, we follow up with them and say, ‘Hey, is there anything you need help with this estimate? Do you need help financing or do you have any questions?’ So we bring it up several times,” Patty explained.

Beehive also has financing mentioned several times on their website, so even before a prospective customer contacts them, they know that financing is an option.

2. Repeat Yourself Without Being Pushy

Patty explained that her team mentions financing several times without being pushy about it. If a customer declines, then you know they’re not interested. But sometimes it takes several mentions for a customer to really consider whether financing is for them.

“I think bringing it up more than once, because you never know whether someone needs help.”

3. Make it Easy on Your Techs

Especially if your techs are the ones closing jobs in the field, choose a system that doesn’t require much of them.

Since switching to Wisetack, Patty explained, “Our sales are better and we do more work. It’s easy for the guys to offer financing because they don’t have to worry about doing paperwork.”

Consumer Financing Is a Business Strategy During This Public Crisis

With changes in the economy and many household’s livelihoods, offering financing can be another way to be there for your customers and help them feel secure.

Beehive Plumbing has stayed busy throughout the COVID-19 epidemic. “Plumbing is an essential business,” Patty said. “Everyone needs hot water. They need their sewer working. You need to have clean water coming into their home. So it’s very important.”

Consider consumer financing as a sound strategy that helps keep your customers safe while growing your business.