Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

There are a lot of responsibilities to juggle as a business owner, especially when you work in the trades. From taking care of clients, managing your personnel, and dealing with all of the back office work, it’s a lot to take on. But aside from offering outstanding customer service, there is just one thing you can’t afford to get wrong: invoice management. Forget to invoice a customer, and that’s money walking out the door. And forgetting to track invoices and payments? That can have some pretty big tax implications (and legal ones, at that).

In this article, our team at Housecall Pro will share some tips to help you stay organized, get paid faster, and reduce stress come tax time. If you’re still digging through email chains, spreadsheets, or scribbled notes to track down payments, it’s time to rethink your system.

- What Is Invoice Management?

- Accounts Payable vs. Accounts Receivable

- 1. Use Software to Consolidate Invoice Tracking Under One System

- 2. Send Invoices Right After the Job (While You're Still Top of Mind)

- 3. Organize Invoices by Status

- 4. Automate Overdue Invoice Reminders

- 5. Make Payment Options Easy

- 6. Track Labor, Materials, and Extras in One Place

- 7. Run Monthly Invoice Reports to Spot Trends

- How to Keep Track of Paid and Unpaid Invoices?

- Stop the Guesswork—Start Tracking Invoices Like a Pro

What Is Invoice Management?

Invoice management is the process of creating, sending, tracking, and following up on invoices for the work you complete. It may sound simple, but when things get disorganized, like losing track of which clients have paid and which haven’t, it quickly leads to cash flow problems, missed payments, and uncomfortable conversations.

In fact, 55% of all invoices issued in the U.S. are paid late, and nearly a quarter of business owners don’t think that trend is going away anytime soon. On average, small to mid-sized businesses spend 14 hours per week just chasing down late payments. That’s time you could be spending on jobs, marketing, or training your team.

Accounts Payable vs. Accounts Receivable

Before we get into our invoice management tips, let’s go over some accounting lingo.

- Accounts payable refers to the bills and expenses your business owes to others, like vendors, suppliers, subcontractors, or utility providers. These are the payments you need to make to keep your business running.

- Accounts receivable, on the other hand, is the money owed to your business by customers or clients. These are the invoices you’ve sent out for completed work or services that you’re waiting to get paid for.

Mixing up the two can lead to messy accounting records, missed payments, and cash flow gaps that make it harder to run your business smoothly. Knowing the difference and managing both sides well positions your business for a more predictable and less stressful financial routine.

And with that, let’s get into our list of invoice management tips.

1. Use Software to Consolidate Invoice Tracking Under One System

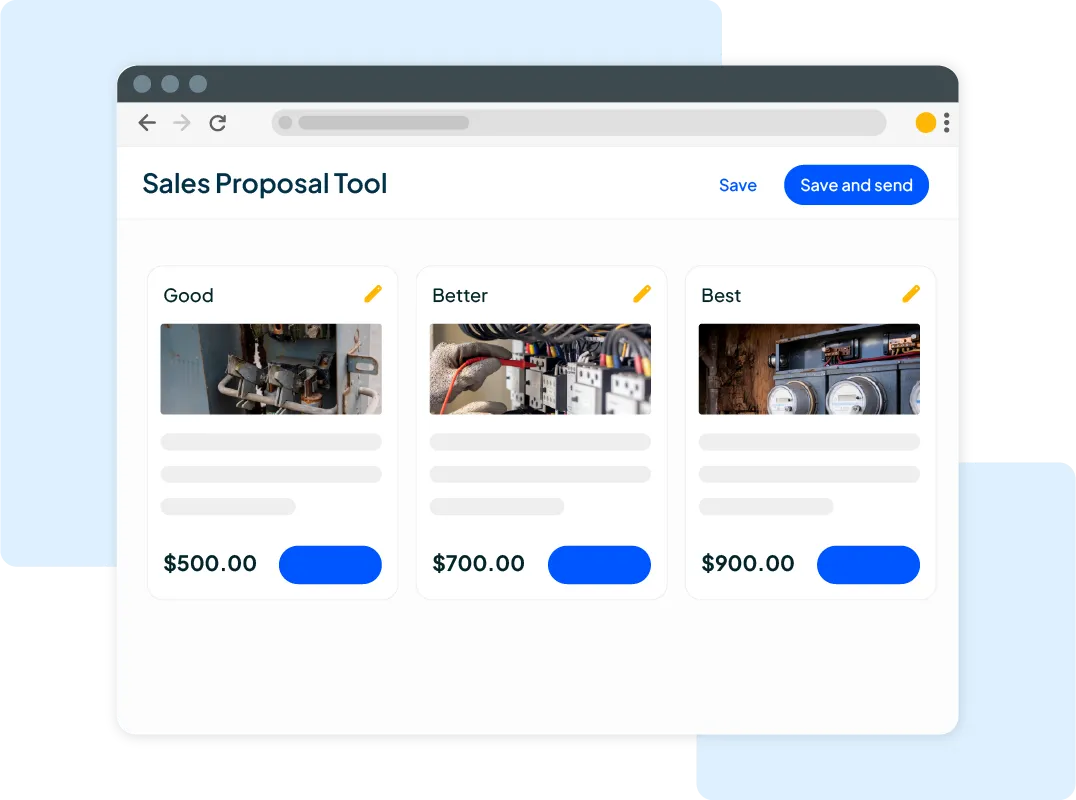

Trying to track invoices across sticky notes, text threads, Google Docs, and multiple apps is a recipe for missed payments and confusion. Instead, consolidate everything into one invoice management system built for service businesses.

Field service invoicing software, like Housecall Pro, lets you organize client contact info, job history, invoices, and payments all in one place. This helps you keep track of what’s been billed, what’s been paid, and what’s overdue, without jumping between tools.

Even better, when your accounts receivable and accounts payable are synced in one dashboard, you can see your cash flow in real time. That kind of visibility helps you make smarter financial decisions, like when to invest in equipment or bring on extra help. A single system also cuts down on double-entry errors and gives you a cleaner, more accurate view of your business’s financial health.

2. Send Invoices Right After the Job (While You’re Still Top of Mind)

When it comes to getting paid quickly, timing matters. The best time to send an invoice is right after the job is done, ideally before you even leave the driveway. This keeps your business fresh in the client’s mind and shows that you’re organized and professional.

Better yet, automated invoicing can take care of this step for you. If you offer recurring services, like weekly lawn care or monthly maintenance, set up invoices to go out on a schedule. This eliminates repetitive work and helps prevent forgetfulness.

Always include clear payment terms and due dates so your customer knows exactly what’s expected. With Housecall Pro, you can create invoice templates, send, and track invoices from your phone or desktop, so you never miss a beat, whether you’re in the office or out in the field.

3. Organize Invoices by Status

Keeping your invoices sorted by status helps you stay on top of what’s been sent, what’s been paid, and what’s still outstanding. A simple system with three categories, Sent, Paid, and Overdue, can make things much easier.

Use software that lets you filter by customer, due date, or service type so you can quickly find what you’re looking for. This approach makes accounts receivable management more manageable and helps you spot patterns, like which clients tend to pay late. Set alerts to flag invoices that haven’t been paid after a certain number of days so nothing slips through the cracks.

Staying organized reduces the risk of missed revenue and makes it easier to follow up on unpaid invoices without flipping through old records or guessing who owes what.

4. Automate Overdue Invoice Reminders

Chasing late payments can eat up your time and energy. By automating payment reminders, you can take a more structured approach without having to manually follow up each time. Many invoicing tools allow you to send email or text nudges at regular intervals, like three days or five days past the due date.

You can set the timing based on what works best for your business. Automated reminders help keep your payment process consistent and professional, while giving your clients a gentle nudge.

Some platforms even let you charge cards on file for regular customers, which makes collecting payments even easier for recurring jobs. Instead of wondering when or if to follow up, automated reminders do the work for you, keeping your income on track without constant oversight.

5. Make Payment Options Easy

The easier you make it for clients to pay, the faster you get paid. Offer several payment methods such as credit or debit card, ACH, bank transfer, or financing options if available. This gives your customers flexibility and reduces delays. Include a clickable payment link directly inside the invoice so they can pay right away without needing to ask how. It also helps avoid back-and-forth emails or missed payments due to confusion.

At the bottom of each invoice, clearly list your payment instructions. Be specific about accepted methods, due dates, and who to contact with questions. Taking this extra step makes things easier on both sides and shows that your business is organized and ready to get paid on time.

6. Track Labor, Materials, and Extras in One Place

When job details are scattered across notes or texts, mistakes are more likely to happen. Use an invoicing system that ties each invoice to the actual work performed. This allows you to track everything in one place, from labor hours and materials to trip charges and emergency fees.

You can even set standard pricing templates to speed up the process and avoid making pricing decisions on the fly. This keeps your invoicing accurate and transparent. Clients are more likely to pay without question when every charge is clearly listed. Keeping all of your service details and pricing connected to the invoice saves time, reduces errors, and helps you bill consistently from one job to the next.

7. Run Monthly Invoice Reports to Spot Trends

Running monthly invoice reports helps you understand where your money is coming from and where delays are happening. You can sort by customer, service type, or payment status to get a clear picture of your billing activity. These reports make it easier to spot patterns, like which clients consistently pay late or which services are most profitable.

You can then adjust payment terms or follow up more proactively with accounts that are slow to pay. This kind of visibility is also helpful when collecting on unpaid invoices, preparing for tax season, or setting realistic income goals. Regular reporting turns guesswork into strategy and gives you more control over your finances month to month.

How to Keep Track of Paid and Unpaid Invoices?

As we shared earlier, unpaid invoices can be a big problem, cutting into your cash flow. One of the easiest ways to stay organized is to start by assigning a unique invoice number to every job. This helps you quickly reference past work, match payments to jobs, and avoid duplicate records.

Keeping your customer database clean and current is just as important. Use a client portal or invoicing software where you can view:

- Contact information

- Job history

- Payment status

From there, set up filters to flag overdue invoices so you know where to follow up. Many tools allow for color-coded views or tags, which help you sort invoices by age or status at a glance. These small steps help prevent payments from falling through the cracks and give you a clearer view of your income.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

Stop the Guesswork—Start Tracking Invoices Like a Pro

When you can keep track of invoices and payments without stress, everything else runs smoother, from scheduling jobs to staying on top of cash flow. If you’re still patching together spreadsheets, scribbled notes, and text reminders, it may be time to switch to an invoice management system that does the heavy lifting.

With Housecall Pro, you can simplify everything from writing an invoice to setting up automated reminders. You’ll be able to accept online payments, flag overdue accounts, and run reports without needing a finance degree. If you already use QuickBooks, the integration makes syncing your financial data super easy. For businesses offering recurring service plans, invoicing can be scheduled in advance, reducing the chance of missed billing.

Start spending less time chasing payments and more time growing your business. Housecall Pro gives you the tools to track every dollar, clearly, simply, and all in one place.

Sign up for your free trial today.