Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Running a home service business is busy enough. When payroll day hits, you don’t want to scramble through time sheets, double-check tax rates, or worry that you missed something important. Setting up payroll is the first step. Processing payroll is the repeatable task you complete every pay period—reviewing hours, calculating wages, applying deductions, filing taxes, and paying your team accurately and on time.

In this guide, you’ll learn exactly how to process payroll each pay period, what to review before releasing payments, and the most common payroll mistakes small home service businesses should avoid.

Key takeaways

Here’s what matters most when you’re processing payroll for your small business:

Accuracy builds trust: Paying employees the correct amount every time boosts morale and reduces turnover.

Compliance protects you: Following federal, state, and local payroll rules helps you avoid fines and legal trouble.

Automation saves time: As you grow, tools like Housecall Pro Payroll can automate calculations, filings, & reports so you spend less time on admin and more time running jobs.

Table of contents

What does payroll processing involve?

Payroll processing is the step-by-step work you complete each pay period to calculate employee wages, withhold taxes, apply deductions, file required reports, and issue accurate payments.

The process isn’t overly complex, but it does demand attention to detail. Paying wages is only one part. You’re also responsible for tracking time, calculating overtime, withholding federal and state taxes, submitting payroll tax payments, filing reports, and maintaining accurate records.

Paying employees accurately and on time

In a Hi Bob survey of 2,000 workers, 53% said they would consider leaving their jobs if they experienced persistent payroll problems. Late or incorrect paychecks don’t just create frustration—they can cost you good techs.

Start with a predictable wage release schedule.

A wage is the total amount employees earn for their work. Your pay schedule determines when they receive it. Depending on the role and how consistent the hours are, you’ll typically choose one of these structures:

- Hourly: Track the total time spent on each job and pay your workers per hour. This works well for field techs with variable schedules and changing job scopes.

- Salaried: Pay a fixed amount each pay period. This structure makes sense for office staff or managers with predictable responsibilities and hours.

Run payroll on the same day each cycle. That consistency helps you stay organized and gives your team clear expectations.

Withholding and submitting payroll taxes

Federal income tax, Social Security, and Medicare taxes are known as “trust fund taxes.” These funds don’t belong to your business—they’re collected on behalf of the government.

You’re required to:

- Withhold the correct amount from employee wages

- Submit those funds on the proper schedule

- File the required payroll reports

If you fail to submit payroll taxes, the penalties are serious, including fines up to $10,000 or even prison time in extreme cases. This isn’t an area where you want to guess.

Staying compliant with labor laws

Payroll is where labor laws show up in your day-to-day operations. You’re responsible for:

- Paying at least minimum wage

- Calculating overtime correctly

- Following your state’s approved pay periods

- Maintaining accurate records

Under the Fair Labor Standards Act you must keep payroll records for at least three years. Clean records protect you if an employee raises a wage question or your business gets audited.

What you need to set up payroll

Before you run payroll for the first time, gather the right information and registrations.

Employer registrations and tax IDs

To legally pay employees, you must:

- Obtain an Employer Identification Number (EIN) from the IRS

- Register with your state for income tax withholding

- Register for state unemployment insurance

Without these registrations, you can’t file or submit payroll taxes correctly—even if your calculations are accurate.

Employee information and documentation

Collect this information before your first payroll run:

- Full legal name

- Address

- Social Security Number

- Pay rate and role

- Direct deposit details (if paying electronically)

Each employee must also complete:

- Form W-4 (Employee’s Withholding Certificate)

- Form I-9 (Employment Eligibility Verification)

The W-4 determines how much federal income tax to withhold. The I-9 verifies they’re legally authorized to work in the United States.

Pro tip: Store employee records securely inside your Housecall Pro account so everything stays organized and protected.

Pay schedules and policies

Decide how often you’ll pay your team: weekly, bi-weekly, semi-monthly, or monthly. Your choice depends on cash flow, state laws, and what’s standard in your trade.

Many U.S. states have laws that regulate payment schedules. For example, in New York, manual workers must be paid weekly, but clerical workers are paid at least twice per month. Washington requires its employers to pay employees at least once a month.

Once you choose a schedule, create a written payroll policy that outlines:

- Exact payday

- How time is tracked

- Overtime eligibility and calculation

- Payment processing timelines

- How errors are resolved

- When final paychecks are issued

Check your state’s labor and wage laws to see which payroll requirements apply to your small home service business.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

How to process payroll each period (step by step)

Processing payroll is easier when you follow the same structured sequence each pay period.

Step 1: Track employee hours and wages

Start by tracking:

- Regular hours

- Overtime

- Paid time off

- Unpaid leave

Double-check entries for missed time-ins, duplicate hours, or numbers that don’t line up with scheduled shifts. Catching errors early is far easier than correcting payroll after payments are released.

Pro tip: Track employee hours with time tracking inside Housecall Pro, so hours flow directly into payroll without manual entry. That reduces errors and saves you time.

Step 2: Calculate gross pay

Gross pay is the amount of money an employee earns before any deductions, such as taxes and insurance. You’ll need to calculate gross pay differently for hourly versus salaried employees.

- Hourly employees: (Regular hours × Hourly rate) + (Overtime hours × Overtime rate)

- Salaried employees: Annual salary ÷ number of pay periods

Double-check calculations. Even small errors can create bigger problems later.

Step 3: Apply deductions and taxes

Payroll deductions typically fall into three categories:

- Pre-tax deductions: Health insurance, retirement contributions, commuter benefits

- Post-tax deductions: Garnishments, Roth IRA contributions

- Payroll taxes: Federal, state, and local taxes based on W-4 information

Accurate deductions ensure your team gets paid correctly and your filings stay compliant.

Step 4: Pay employees

Pay employees on the agreed-upon date. Common payment methods include:

- Direct deposit: Funds are sent straight to the employee’s bank account.

- Checks: You issue paper or electronic checks to your employees, and they deposit them at their banks.

Direct deposits are the fastest and simplest method.

Step 5: File payroll taxes and reports

Submit withheld taxes and employer contributions according to required schedules. Some payments are due monthly, while others are quarterly, depending on the size of your business and tax liability.

You’ll also file periodic payroll reports summarizing wages and taxes paid. Even if your payment is correct, missing a deadline can still result in penalties.

Common payroll mistakes to avoid

Small details cause big problems in payroll. Watch out for:

- Misclassifying employees: Treating a worker as an independent contractor when they’re legally an employee can trigger back taxes, fines, and legal claims.

- Poor recordkeeping: Federal law requires employers to keep detailed payroll records for set timeframes. Well-kept records give you proof if disputes or audits arise.

- Missing tax deadlines: If you miss a deadline, file immediately to avoid additional penalties.

Pro tip: Sync Housecall Pro with QuickBooks to automatically push payroll, invoices, and payment data to your accounting system. That means fewer manual uploads, cleaner records, and less back-and-forth during tax season.

Check out our webinar on misclassifying workers to learn how to avoid issues.

Choosing the right payroll solution for your small business

You can run payroll manually or use software. The decision depends on how much time you have, how confident you feel handling compliance, and how quickly your business is growing.

Running payroll manually vs. using payroll software

The table below highlights the differences between manual payroll processing and using payroll software.

| Factor | Manual payroll processing | Payroll software |

| Time | Requires manual work | Most steps run automatically |

| Error risk | High chance of data entry errors | Minimal errors with built-in checks |

| Scalability | The workload increases with business growth. | Built to scale |

| Compliance | You track rules and deadlines | The system applies rules for you |

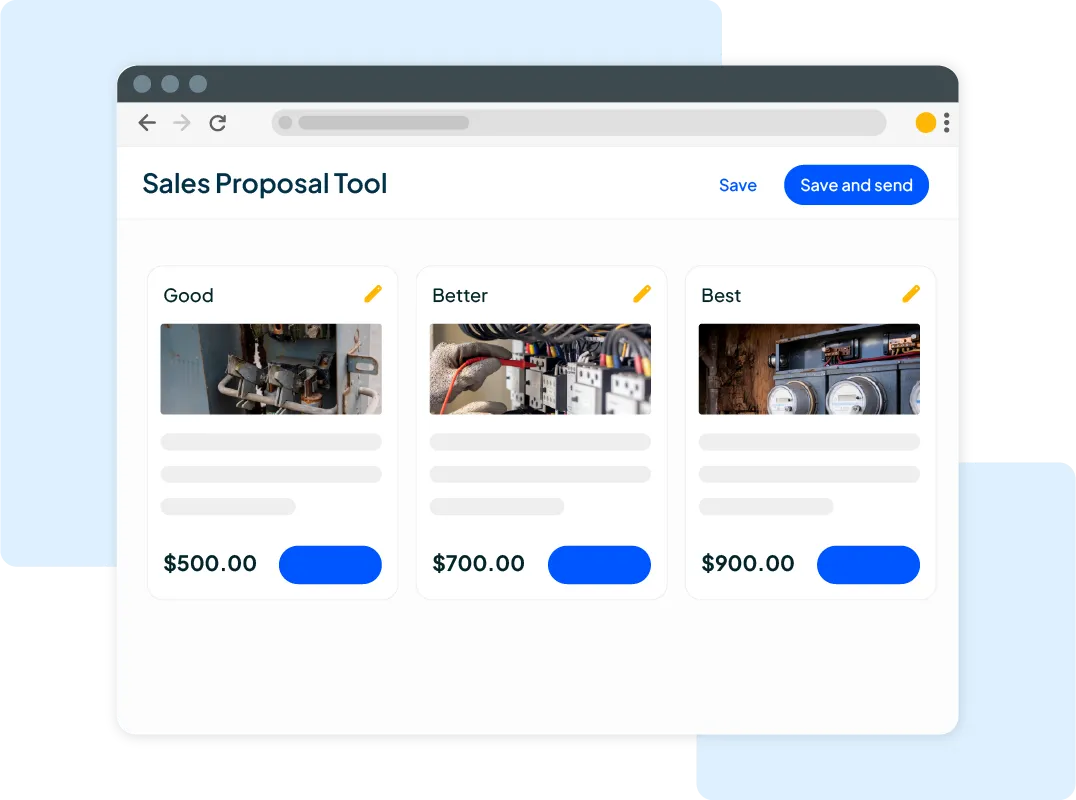

How Housecall Pro helps simplify payroll

Payroll takes time, and mistakes are expensive. That’s why many pros use Housecall Pro Payroll to handle the heavy lifting.

With Housecall Pro Payroll, you can:

- Run unlimited payrolls: Pay multiple employees with one click.

- Handle tax filings automatically: Federal, state, and local payroll taxes are calculated and filed for you.

- Pay accurately from tracked hours: Connect payroll directly to employee time tracking.

- Reduce compliance risk: Built-in calculations help prevent erroneous withholding and late filings.

“We had been paying an astronomical [amount] for payroll support services that just didn’t meet our needs,” says Amber DeLong, the owner of DeLong and Sons HVAC. “After finding out about HCP Payroll, we immediately made the switch. I got the same exact support at a way better price.”

Ready to simplify payroll for your small business? Try Housecall Pro free for 14 days and take the stress out of paying your employees.