Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Running a business means keeping a close eye on your bottom line, which is why many home service pros choose to handle payroll in-house. But as your team grows, managing pay dates and tax withholdings in a spreadsheet can quickly turn into a compliance headache.

To make sure your people are paid on time, every time, you need a repeatable system that covers everything from initial setup to tax filings and recordkeeping. This guide breaks down exactly how to do payroll yourself, step by step, so you can stay focused on the job—not buried in paperwork.

Key takeaways

Payroll works best when it follows a clear, consistent flow:

Know what payroll includes: Every payroll run includes pay, taxes, deductions, and filings.

Set a schedule and stick to it: Consistent pay dates build trust with your team and help you avoid missed tax deadlines.

Get the setup right early: Proper registration, worker classification, and paperwork prevent expensive penalties later.

Monitor tax timelines: Payroll taxes must be withheld, filed, and paid on strict government timelines.

Use the right tools: You can do it all by hand, but payroll software reduces manual work.

Table of contents

- What is payroll, and how does it work?

- What you need before you run payroll

- How does payroll change as your team grows?

- How to process payroll in 5 steps

- Should you do payroll or use payroll software?

- How to do payroll taxes (step-by-step for small businesses)

- How long should you keep payroll records?

- Payroll tips for small service businesses

What is payroll, and how does it work?

Payroll is more than just “cutting checks.” It’s a system that tracks hours, calculates pay, withholds taxes, files required reports, and keeps detailed records.

When done right, payroll runs quietly in the background. When done wrong, it creates stress for you and your team—and can trigger penalties.

Understanding these moving parts helps you take full responsibility for calculating pay correctly and withholding the right amounts every time.

What payroll includes

Payroll covers every financial detail tied to paying your team. To run it accurately, you’ll need to account for:

- Wages: Hourly pay, salaries, overtime, and tips.

- Taxes: Some taxes are withheld from employee paychecks; others are a direct expense paid by your business.

- Deductions: Health insurance, retirement plan contributions, or legally required wage garnishments.

- Payment delivery: The method used to send money, typically paper checks or direct deposit.

How payroll runs on a schedule

Payroll follows a set rhythm. You choose:

- A pay period (the time employees worked)

- A pay date (the day wages are issued)

These two dates aren’t always the same.

Common pay periods for home service businesses include:

- Weekly: Employees are paid once a week.

- Biweekly: Employees are paid every two weeks.

- Semi-monthly: Employees are paid twice per month.

- Monthly: Employees are paid once per month.

Consistency matters. Employees plan their bills around paydays, and late or changing pay dates will quickly erode trust. Your payroll schedule also dictates your tax deadlines, as many payroll taxes are tied to when wages are paid rather than when the work was performed.

What laws and rules apply to payroll?

Payroll is governed by multiple sets of regulations that you must follow regardless of your company’s size. Missing a requirement can lead to audits, back pay, or significant fines, which is why learning these basics early is a smart way to protect your business. You’ll need to balance federal mandates with the specific rules of where your business and employees are located.

Federal requirements

At the national level, payroll rules cover:

- Minimum wage: You must meet federal requirements for basic pay.

- Overtime: You must pay hourly employees correctly for hours worked beyond the standard work week.

- Payroll taxes: You’re responsible for Social Security and Medicare contributions.

- Reporting: You must meet strict deadlines for employer tax reporting and payments.

State and local regulations

States may layer on additional requirements like:

- State income tax withholding

- Higher minimum wages

- Disability or paid leave programs

- Final paycheck rules when an employee leaves

Because payroll laws vary by location, always verify the rules where your business operates.

What you need before you run payroll

Before you process payroll for the first time, you need to do some admin work. This is the part many owners rush, but getting it right up front makes payroll a much easier, repeatable task.

Getting business registration and tax IDs

To legally run payroll, your business must register with the proper agencies:

- Federal: You’ll need a free Employer Identification Number (EIN) to report wages and submit taxes.

- State and local IDs: Most states require registration for income tax withholding and unemployment insurance.

- Multi-state operations: If your team works across state lines, payroll requirements become more complex. Consulting a professional early can prevent filing errors later.

Classifying workers correctly

Before anyone starts work, you must determine if they’re an employee or an independent contractor. Misclassification is a serious error that can trigger back taxes and penalties.

Every person on your payroll must have completed paperwork on file, including:

Check out our webinar on misclassifying workers to learn how to avoid issues.

Choosing a pay schedule

There’s no single payroll schedule that works for every business. The right choice depends on your cash flow, billing cycle, and t.rade.

Many service businesses choose weekly or biweekly pay to align with how jobs are completed and invoiced. For example, 65.4% of the construction industry pays weekly.

The key is consistency. Once you choose a schedule, stick to it.

How does payroll change as your team grows?

Running payroll for yourself is relatively simple. Adding even one employee introduces new legal, tax, and recordkeeping responsibilities.

As you grow, you’ll spend more time:

- Tracking hours

- Managing overtime

- Answering pay questions

- Filing additional tax reports

Key differences: Payroll for one employee vs. team

Recognizing how payroll changes as you scale can help you decide when spreadsheets won’t be efficient—and when automation can save you time.

| Feature | Solo payroll (owner only) | Team payroll (multiple employees) |

| Setup and workload | Minimal setup; once in the system, it’s consistent | Requires ongoing updates for new hires, approvals, and reviews |

| Tax filings | Fewer filings and lower form volume | Increased reporting frequency and higher form volume |

| Time tracking | Often unnecessary for the owner | Requires structured tracking, overtime monitoring, and approvals |

| Scheduling | Simple and predictable for one person | Complex, often involving different roles, pay rates, and shifts |

| When to use tools | Spreadsheets usually suffice | Software becomes useful as soon as manual filing takes too much time |

How to process payroll in 5 steps

A payroll mistake can cost you money—and credibility. Building a repeatable process reduces the risk of errors.

Step 1: Track hours and pay rates

Accurate payroll starts with clean time and pay data.

- Hourly employees are paid based on hours worked, including any overtime.

- Salaried employees earn a fixed amount each pay period, regardless of hours.

Whether you’re tracking manually or digitally, always review time entries before processing payroll. Small mistakes lead to larger corrections later.

Step 2: Calculate gross pay

Gross pay is the total amount an employee earns before any taxes or deductions are removed. For hourly workers, this includes regular hours, overtime, and any bonuses or commissions. For salaried workers, it’s their set pay for the period.

If gross pay is wrong, everything that follows will be wrong.

Step 3: Withhold taxes and deductions

Once you’ve calculated gross pay, subtract:

- Federal income tax

- Social Security and Medicare

- State or local taxes

- Optional deductions like health insurance or retirement contributions

Accuracy here is critical.

Step 4: Pay employees

Issue payments via paper check or direct deposit (93% of employees in the U.S. use the latter).

Regardless of the method, pay your team on time to maintain trust.

Step 5: File payroll taxes and forms

Payroll doesn’t end after paychecks go out. You must:

- Deposit withheld taxes on schedule

- File required quarterly reports

- Issue year-end forms

Missing deadlines can result in penalties and interest charges.

Should you do payroll or use payroll software?

Most small business owners either manage payroll manually or use software to automate parts of the process.

DIY payroll keeps costs low and gives you full control. But it also means you handle every calculation, filing, and deadline yourself.

As your business grows, payroll software reduces risk and saves time.

When payroll software can help

Even with software, payroll is still managed in-house. You retain control over pay decisions and approvals, while the system handles the heavy lifting of calculations and filings.

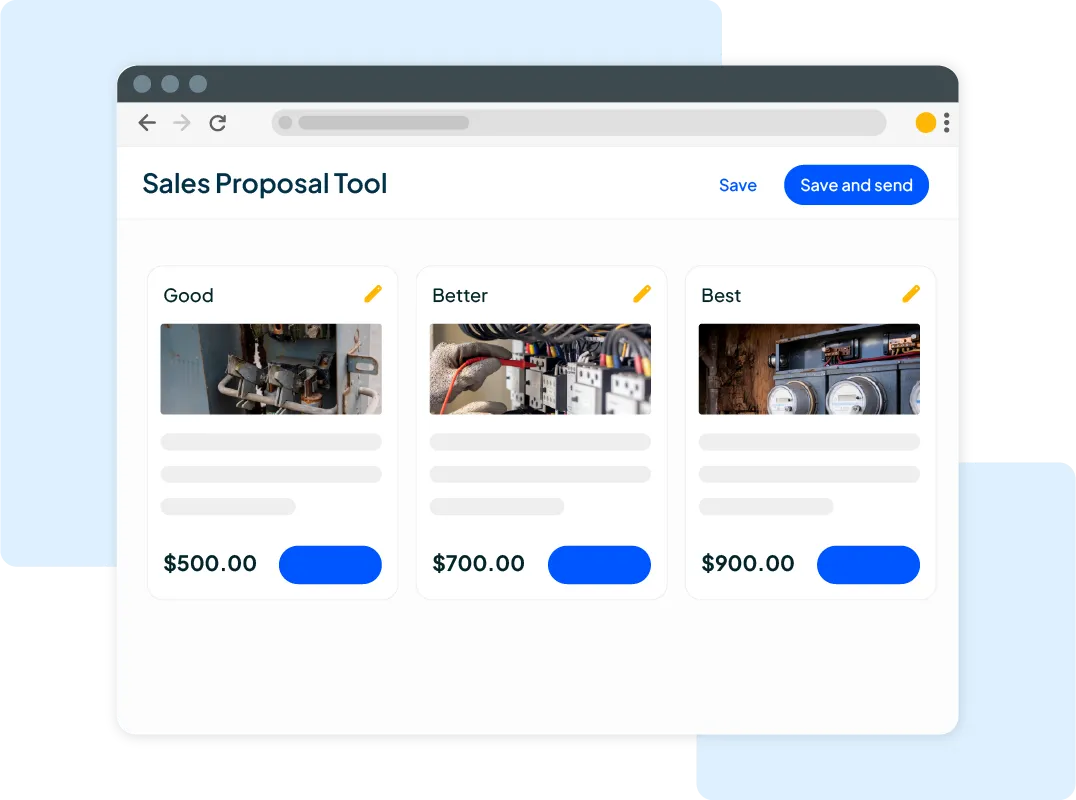

A tool like Housecall Pro Payroll helps by offering:

- Automatic tax calculations and filings

- Direct deposit and pay history tracking

- Integrated time tracking

- Employee self-service access

Because payroll lives alongside scheduling, time tracking, and job management inside Housecall Pro, you’re not juggling disconnected systems. That means fewer manual entries and fewer mistakes.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

How to do payroll taxes (step-by-step for small businesses)

Payroll taxes aren’t separate from payroll; they’re built into every pay run. If you’ve already followed the five payroll steps above, you’ve completed the calculation portion (see Step 3: Withhold taxes and deductions).

Now, here’s how to handle payroll taxes correctly from a compliance standpoint:

Step 1: Calculate employee and employer taxes

During payroll processing (Step 3 above), you must calculate:

Employee withholdings:

- Federal income tax (based on Form W-4)

- Social Security tax (6.2%)

- Medicare tax (1.45%)

- State and local income taxes, if required

Employer-paid taxes:

- Matching Social Security (6.2%)

- Matching Medicare (1.45%)

- Federal unemployment tax (FUTA)

- State unemployment tax (SUTA), if applicable

If these amounts are miscalculated, every filing and deposit that follows will be incorrect.

Step 2: Separate withheld taxes immediately

Once payroll is processed, transfer withheld taxes into a separate account.

These funds do not belong to your business. You’re holding them temporarily before sending them to federal and state agencies. Mixing payroll taxes with operating cash is one of the most common compliance mistakes small businesses make.

Step 3: Deposit payroll taxes on the correct schedule

Payroll tax deposits follow strict government timelines.

- Most small businesses deposit federal payroll taxes monthly.

- Larger payrolls may require semiweekly deposits.

- State agencies set their own deposit schedules.

Important: Deposit timelines are based on when wages are paid—not when work was performed.

Missing a deposit deadline can trigger automatic IRS penalties.

Step 4: File required payroll tax forms

In addition to depositing taxes, you must file reports documenting what was withheld and paid.

Common federal payroll tax forms include:

- Form 941: Quarterly federal payroll tax return

- Form 940: Annual federal unemployment tax return

- Form W-2: Annual wage statement for employees

- Form W-3: Summary transmittal of W-2 forms

States require separate quarterly and annual filings as well.

Deposits and reporting are two different responsibilities. Doing one without the other can still result in penalties.

Common payroll tax mistakes

Even when payroll calculations are correct, errors happen during deposits and filings. Watch for:

- Missing deadlines: Failing to meet filing or payment dates is one of the most frequent causes of IRS penalties.

- Incorrect withholdings: Withholding the wrong amounts from employee checks creates accounting errors that are difficult to fix later.

- Underpaying employer obligations: You must ensure the business’s share of taxes is calculated accurately and paid in full.

- Misusing payroll funds: Never use money withheld for taxes to cover other business expenses.

- Payroll fraud: According to the Association of Certified Fraud Examiners, organizations lose roughly 5% of their annual revenue to fraud, with payroll schemes and asset misuse among the most common issues.

How long should you keep payroll records?

Payroll records are your primary defense if a dispute or audit arises.

The U.S. Department of Labor requires employers to keep payroll records for at least three years.

Your records should be stored securely and include:

- Employee information: Pay rates and hours worked.

- Tax documents: All tax filings and records of payments sent to agencies.

- Deductions: Records of all optional or required withholdings.

- Agreements: Collective bargaining agreements and sales or purchase records

Digital storage makes retrieval faster if you ever need it.

Payroll tips for small service businesses

Running payroll is part of running a service business. Jobs change, schedules shift, and cash flow can fluctuate week to week. The goal is consistency even when jobs vary.

These small habits make a big difference over time:

- Automate payroll tasks where possible to reduce manual entry and calculation errors.

- Keep time tracking accurate and consistent so pay matches hours worked.

- Review payroll reports each pay period to catch issues early.

- Set payroll funds aside so pay and taxes are covered even during slow weeks.

- Track tax deadlines carefully to avoid late fees and added interest.

Housecall Pro Payroll helps service businesses manage payroll alongside scheduling, time tracking, and jobs, making it easier to stay organized as your business grows.

Try Housecall Pro free for 14 days and see how much smoother payroll can feel when it’s connected to the rest of your business.

FAQ

-

Is it possible to do payroll yourself?

-

Yes. Many small businesses run payroll in-house, especially with small teams. It requires accurate tracking, tax calculations, and strict deadline management

-

Is it hard to learn how to do payroll?

-

It isn’t hard to learn payroll, but it does take focus. Most owners learn the payroll basics quickly and then use checklists or tools to stay consistent.

-

How much does it cost to do payroll?

-

DIY payroll costs mostly your time. Outsourcing can run $50–$250 per employee per month. Payroll software adds a fee but can reduce errors and save hours each pay cycle.

-

What are the steps to process payroll?

-

Track hours, calculate gross pay, withhold taxes and deductions, issue payments, and file required reports. Housecall Pro Payroll guides you through each step automatically.

-

How long does it take to run payroll?

-

For small teams, payroll can take under an hour once systems are in place. Manual processes take longer. Automation reduces processing time significantly.