Want to win more jobs with less effort?

Grow your business and send quick quotes with our home service software.

Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Understanding what your HVAC business is worth gives you more than a number—it gives you a clear picture of its financial health and future potential. A valuation shows how your company performs, how buyers and lenders judge your operations, and where your biggest opportunities are to increase long-term value. Even if you’re not planning to sell right now, knowing your worth can help you make smarter decisions about growth, staffing, pricing, and investments.

HVAC companies tend to have high valuations because demand is steady, there’s recurring revenue, and customer relationships often last for years. But the actual value of your business depends on more than annual revenue. Buyers look closely at your profitability, how many maintenance plans you have, the stability of your technicians, the condition of your fleet, and whether the business can run smoothly without you.

In this guide, we’ll break down how HVAC businesses are valued, what factors raise or lower your multiple, and the exact steps to estimate your company’s worth.

→ Get an instant estimate of your company’s value using real industry formulas and valuation multiples with Housecall Pro’s HVAC business valuation calculator.

Key takeaways

Here’s a quick overview of what influences HVAC business valuation.

SDE and EBITDA matter: Most HVAC companies are valued using earnings multiples.

Recurring revenue wins: Maintenance agreements raise your valuation significantly.

Clean books help: Organized financials make valuations stronger and more accurate.

Predictability pays: Consistent, repeatable revenue increases your multiple.

Start with a calculator: Use our HVAC Business Valuation Calculator for fast estimates.

Want more trade business insights like this? Sign up for our TradeWire newsletter to get the latest trends, tools, and trade talk straight to your inbox.

Jump ahead

What determines the value of an HVAC business

Revenue isn’t the only thing that affects your HVAC business’s value. Buyers want companies with predictable income, documented processes, a stable workforce, and a customer base they can count on long after the owner exits. When brokers or valuation specialists assess an HVAC company, they look for signs that the business can continue generating cash flow without dramatic operational changes.

Industry reports from IBISWorld and the Air Conditioning Contractors of America (ACCA) highlight that recurring revenue, technician stability, and operational maturity are the strongest long-term value drivers in the HVAC sector.

Here’s a look at how HVAC buyers distinguish high-value strengths from potential risks. We’ll go into more detail about each factor below.

| High-Value Factors (Increase Valuation) | Low-Value Factors (Decrease Valuation) |

| Consistent year-round revenue and stable margins | Large seasonal swings or unpredictable income |

| Strong base of recurring maintenance agreements | Few or no maintenance plans or memberships |

| Balanced service mix (install + service + maintenance) | Install-heavy revenue with big seasonal peaks |

| Loyal, diversified customer base | Overreliance on a handful of big clients |

| 4–5 star reviews and strong local reputation | Poor reviews or unstable reputation |

| Long-tenured, licensed technicians | High turnover or staffing shortages |

| Clean, well-maintained fleet and updated tools | Aging vans and outdated diagnostic equipment |

| Organized financials, clean P&Ls, documented addbacks | Messy books, unclear expenses, or missing financials |

| Systematized operations (scheduling, dispatching, invoicing) | Heavy owner dependency for daily tasks |

| Strong presence in a growing, high-demand market | Highly competitive or stagnant regional market |

What this means for you

If you want to increase the value of your HVAC business, focus less on chasing big installation jobs and more on creating a business that runs smoothly every single day. Buyers pay the highest multiples for companies that generate predictable revenue, keep clean books, retain skilled techs, and don’t rely on the owner to make every decision. Even small improvements in recurring memberships, documentation, or fleet condition can shift your valuation range upward faster than most owners expect.

Revenue and profit consistency

Buyers want an HVAC business that performs predictably year after year. Companies that rely on one-off installations see major peaks and valleys, which makes forecasting harder. High valuations go to businesses that show steady performance and resilient margins.

According to ACCA’s financial guidelines, HVAC companies with consistent margins perform significantly better during the sale process.

Buyers look for:

- Consistent service revenue that doesn’t disappear in slow seasons

- Healthy, stable profit margins

- Year-over-year growth or stability

- Minimal revenue volatility

Learn more: How to Maximize HVAC Profit Margins & Revenue

Service mix: Install vs. service vs. maintenance

Your revenue mix signals how stable your business really is. Installation work brings big revenue spikes but also big slowdowns. Buyers typically assign higher multiples to companies with a deeper base of service and maintenance work because that income is repeatable.

IBISWorld notes that installation-heavy HVAC companies show unstable revenue, while businesses with recurring maintenance show greater resilience.

How mixes affect value:

- Install-heavy: Unpredictable revenue lowers valuation confidence

- Service-heavy: Steadier income and stronger lifetime value per customer

- Maintenance-heavy: Highest stability, strongest multiples

Maintenance agreements and recurring memberships

Recurring revenue is one of the strongest indicators of a business’s long-term health. Maintenance plans reduce revenue swings, improve forecasting, and create steady technician workload. A buyer sees these memberships as “built-in future cash flow,” which is why they heavily influence the final valuation multiple. Viking Mergers & Acquisitions reports that companies with strong membership bases consistently earn higher multiples.

What raises valuation:

- A large base of active agreements

- Automatic renewals

- High retention rates

- Predictable off-season revenue

Recurring revenue almost always leads to a higher selling price.

Customer base quality

Not all revenue is equal. Buyers prefer businesses with a broad and loyal customer base that continues booking service year after year. If your customer list is diverse and shows high lifetime value, it signals durability—meaning the business won’t collapse if a few customers churn.

Value-driving indicators:

- A large pool of returning customers

- Low dependency on any single client

- Long-standing service relationships

- Minimal churn

Customer loyalty reduces acquisition risk.

Reputation and online presence

Your reputation acts as social proof for the buyer. Online reviews are a testament to your workmanship, reliability, and customer satisfaction. A strong digital presence makes the business easier to market and scale—translating into better offers.

BizBuySell’s Insight Report shows that HVAC companies with strong reviews sell faster and at higher multiples.

What buyers look for:

- Steady flow of 4–5 star reviews

- Strong Google Business Profile

- Positive sentiment in customer comments

- Few complaints or service disputes

Reputation issues almost always show up in the sale price.

Technician stability and licensing

Skilled labor is one of the hardest parts of running an HVAC business. Buyers value companies with stable, licensed technicians who know the systems, workflows, and customers. A revolving door of techs introduces significant operational risk.

What improves valuation:

- Long-tenured, reliable technicians

- Proper licensing and certifications

- Low turnover

- Efficient onboarding practices

Fleet and equipment condition

Your vehicles and tools are major assets in the sale. Buyers inspect your fleet closely because it tells them how much capital they’ll need to invest after acquiring the business. A clean, updated fleet signals professionalism and reduces upfront replacement costs.

Value-positive signs:

- Well-maintained service vans

- Modern diagnostic equipment

- Organized tools and inventory

- No looming major replacements

Old vans or outdated tools decrease valuation quickly. IBBA valuation guidelines show that updated fleets reduce post-sale investment needs and improve offer quality.

Financial organization and documentation

Buyers want transparency. Clean books show that your numbers can be trusted and that the business is managed professionally. In contrast, messy financials make buyers nervous and reduce offers because they introduce uncertainty.

Buyers expect:

- Up-to-date P&Ls and balance sheets

- Clear documentation of addbacks

- Accurate job costing

- Consistent bookkeeping practices

- No “surprise” expenses

A well-documented business is always worth more.

Local market conditions

Even a strong HVAC business is affected by its market. Local demand, competition, licensing requirements, and workforce availability all play into the multiple a buyer is willing to apply.

Relevant regional factors:

- Population growth and housing trends

- HVAC demand in your climate

- Competitive landscape

- Ease of finding licensed technicians

- Cost of living and overhead

Two identical HVAC companies can receive different valuations based solely on geography.

Main HVAC business valuation methods

HVAC businesses can be valued in many ways, but the two methods buyers trust most are SDE and EBITDA. These approaches highlight different aspects of financial performance and, when used together, help determine a realistic valuation range.

SDE vs. EBITDA: Side-by-side comparison

| Feature | SDE | EBITDA |

| Who uses it? | Small & midsize HVAC businesses where the owner is heavily involved | Larger HVAC companies with managers and established departments |

| What it measures | Total owner compensation, incl. salary, perks & one-time adjustments | Operating profit before financing, taxes, and non-cash expenses |

| Includes owner salary? | Added back into SDE because it won’t continue under new ownership | Not included; EBITDA assumes an owner or manager must be paid |

| Treatment of personal expenses? | Added back as “owner perks” | Not added back because EBITDA reflects ongoing business operations |

| Treatment of one-time expenses? | Added back to show normalized earnings | Not typically added back unless they impact operations |

| Best for | Owner-operated businesses w/ no managers or limited recurring rev | Larger, systematized HVAC companies with management layers |

| Typical multiple | 2–4x SDE | 3–6x EBITDA |

| Why buyers use it | Shows the true earning power of an owner-run business | Shows profitability for the company as a stand-alone operation |

| Used by PE firms? | Rarely | Yes—private equity primarily uses EBITDA |

What is SDE?

SDE means Seller’s Discretionary Earnings. It measures the total financial benefit the owner receives from the business. It shows how much money the business generates before the owner’s personal compensation and one-time expenses. Buyers use SDE to understand the true earning power of an HVAC company.

- Net profit is the business’s bottom-line income.

- Owner salary is added back because it reflects owner compensation, not ongoing business expenses.

- Owner perks include personal expenses run through the business, such as vehicles, phones, or meals.

- Addbacks are expenses that will not continue under new ownership.

- One-time expenses are unusual costs that happened once and will not repeat.

SDE = Net profit + Owner salary + Owner perks + Addbacks + One-time expenses

SDE provides a standardized number that buyers can apply a valuation multiple to. It’s the most common valuation method for small and midsize HVAC businesses.

SDE example

Here’s how a typical owner-operated HVAC business calculates SDE.

Company snapshot

- Annual revenue: $900,000

- Net profit: $110,000

- Owner salary: $95,000

- Owner perks (vehicle, phone, meals): $18,000

- One-time expenses (legal + rebrand): $7,000

- Addbacks (nonrecurring items): $5,000

Step 1: Add everything back

Net profit: $110,000

+ Owner salary: $95,000

+ Owner perks: $18,000

+ One-time expenses: $7,000

+ Addbacks: $5,000

Total SDE = $235,000

This number represents the true earning power of the business once the owner’s compensation and personal expenses are removed.

Step 2: Apply the SDE multiple

Most HVAC businesses sell for 2–4x SDE, depending on recurring revenue, team stability, and financial cleanliness.

Using a midrange 3x multiple:

$235,000 × 3 = $705,000 estimated value

Estimated SDE-based valuation range:

$650,000 – $775,000

This reflects what a buyer would realistically pay for an owner-operated HVAC business with these financials.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures how much profit the business produces from operations alone—before financing decisions, tax strategies, or non-cash accounting expenses are factored in.

Buyers use EBITDA for larger HVAC companies, especially ones with:

- Multiple managers

- Multiple revenue streams

- Documented systems

- Reduced owner involvement

EBITDA shows how profitable the business is if a new owner or investor steps in and runs it like a stand-alone company.

EBITDA example

Here’s an example based on a larger HVAC business where the owner is not involved in day-to-day operations.

Company snapshot

- Total revenue: $4,000,000

- Operating profit (EBIT): $550,000

- Depreciation: $60,000

- Amortization: $15,000

Step 1: Calculate EBITDA

Operating profit: $550,000

Depreciation: $60,000

Amortization: $15,000

EBITDA = $625,000

Step 2: Apply an HVAC EBITDA Multiple

Larger HVAC companies typically sell for 3–6x EBITDA depending on:

- Strength of management team

- Size of customer base

- Percentage of recurring revenue

- Financial documentation

- Market stability

Let’s apply a mid-range multiple: 4.5x

$625,000 × 4.5 = $2,812,500

Estimated EBITDA-based valuation:

$2.6M – $3.4M (with a midpoint valuation of ~$2.8M)

This range reflects typical market conditions for systematized HVAC companies with multiple managers and strong recurring revenue.

SDE vs. EBITDA: Which valuation method should you use?

Understanding whether to use SDE or EBITDA is key to getting an accurate HVAC business valuation. Smaller, owner-operated companies typically use SDE, while larger, systematized companies use EBITDA.

Rule of thumb:

If the business depends on you, use SDE.

If the business depends on systems, use EBITDA.

Asset-based valuation

This method calculates your company’s value by subtracting liabilities from the resale value of your assets. It’s most useful when the business is equipment-heavy or when profitability is inconsistent.

Assets often include:

- Service vans and trucks

- HVAC tools and diagnostic equipment

- Parts inventory

- Accounts receivable

- Office equipment and software licenses

This method is rarely the primary approach for profitable HVAC companies, but it’s useful for establishing a baseline value.

Market comparables (“comps”)

Comps compare your business to recently sold HVAC companies with similar revenue, service mix, technician size, and location. Buyers often look at listings on BizBuySell or through brokers to establish a realistic valuation range.

Comps can show:

- Average multiples in your region

- Buyer demand for HVAC companies of your size

- How recurring revenue affects selling price

- How market conditions shape buyer expectations

Comps don’t replace SDE or EBITDA—they help validate the number.

How these methods work together

Valuation specialists rarely rely on just one method. Instead, they use SDE, EBITDA, and comps together to create a range. Our calculator uses the same approach, giving HVAC owners a realistic valuation estimate based on standard industry logic.

How to calculate HVAC business value

You don’t need to be a financial expert to calculate what your HVAC business might be worth. Most valuations follow a straightforward process built around your earnings, your assets, and how stable your business appears to a buyer. Here’s the exact sequence most brokers use when determining your valuation range.

Step 1: Gather your financial statements

Before you calculate your valuation, you need a complete picture of your recent financial performance.

Start with the last two to three years of:

- Profit and loss statements

- Tax returns

- Balance sheets

- Equipment and fleet lists

Clean financials make every step that follows more accurate.

Step 2: Normalize your earnings

Normalizing earnings means adjusting your finances to reflect the true profitability of the business, not just what shows up on the tax return.

Common adjustments include:

- Owner salary

- Benefits and perks

- One-time expenses

- Non-operational costs

- Addbacks (interest, depreciation, etc.)

These adjustments help reveal the business’s real earning power.

Step 3: Calculate SDE or EBITDA

Once your earnings are normalized, determine whether SDE or EBITDA is the right fit:

- SDE: Best for owner-operated businesses

- EBITDA: Best for larger or more systematized businesses

Your SDE or EBITDA number becomes the foundation of your valuation.

Step 4: Apply the correct valuation multiple

A valuation multiple reflects what buyers in your market are willing to pay for each dollar of earnings.

Typical ranges:

- SDE: 2–4x

- EBITDA: 3–6x

This is where strong operations translate directly into a higher selling price.

Step 5: Add the value of tangible assets

Buyers also consider the resale value of your assets.

This includes:

- Vans and trucks

- HVAC tools and diagnostic equipment

- Inventory and parts

- Office equipment

- Software licenses

- Accounts receivable

Updated vans and modern equipment can meaningfully increase your valuation.

Step 6: Subtract liabilities

Once assets are included, you also need to subtract any financial obligations the buyer would take on.

Common liabilities include:

- Outstanding loans

- Vehicle financing

- Accounts payable

- Unresolved legal or regulatory obligations

These reduce the business’s net value and are factored into any offer.

Step 7: Adjust for recurring revenue and memberships

Maintenance plan revenue increases valuation because it shows predictable future cash flow. Buyers often adjust multiples upward when a company has:

- Strong membership enrollment

- High renewal rates

- Year-round service demand

- Stable customer retention

This is one of the most influential steps in the valuation process.

Step 8: Compare your results to market comps

Check platforms like BizBuySell for HVAC businesses with similar revenue, technician count, and service areas. If your calculations are much higher or lower than local comps, adjust accordingly.

Comps help ensure your valuation matches real buyer expectations.

Step 9: Establish a valuation range, not a single number

Buyers don’t think in absolutes but in ranges. A final valuation will usually look like:

“This HVAC business is worth between $900,000 and $1.1 million.”

Your exact number depends on negotiations, market demand, and how well-documented your operations are.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

Example HVAC Business Valuation

To understand how HVAC valuations work in practice, here’s a realistic example based on typical financial data from BizBuySell listings and standard SDE methodology recommended by IBBA and NACVA. This mirrors the type of information you would enter into our free HVAC Business Valuation Calculator.

Company snapshot

- Annual revenue: $1,200,000

- Net profit: $180,000

- Owner salary: $120,000

- Owner perks/addbacks: $25,000

- One-time expenses: $10,000

- Maintenance agreements: 650 active plans

- Fleet: 5 service vans, well maintained

- Staff: 6 technicians + 1 office admin

- Service mix: 50% service, 30% install, 20% maintenance

This mix is typical for healthy mid-sized HVAC companies, according to IBISWorld and ACCA.

Step 1: Calculate SDE

Per IBBA and NACVA guidelines, SDE includes net profit, owner compensation, and any addbacks or one-time adjustments.

- Net profit: $180,000

- Owner salary: $120,000

- Addbacks: $25,000

- One-time expenses: $10,000

- Total SDE = $335,000

Step 2: Choose the appropriate SDE multiple

Based on this company’s strong fundamentals:

- 650 recurring maintenance agreements

- Updated, well-maintained fleet

- Long-tenured technicians

- Clean financial documentation

…it would reasonably earn a 3x SDE multiple.

This falls within the common 2–4x range for HVAC companies.

Step 3: Apply the multiple

$335,000 × 3.0 = $1,005,000 estimated business value

Step 4: Establish the valuation range

Valuations are typically presented as a range rather than a single number.

A realistic spread around the $1,005,000 estimate is:

$950,000 – $1.15 million

This accounts for buyer type, negotiation, seasonal factors, and recurring revenue strength.

Step 5: Validate with market comparables (“comps”)

Reviewing actual HVAC businesses of similar size listed on BizBuySell:

- Revenue commonly falls between $1M–$2M

- SDE multiples typically cluster between 2.5x–3.5x

- Companies with 300+ memberships often command higher multiples

This example fits comfortably within those comps, confirming the valuation is realistic.

Step 6: Add asset value separately (optional)

Some buyers value assets separately when they’re newer or in excellent condition.

Example asset values:

- Fleet (5 vans): ~$110,000

- Tools & diagnostic equipment: ~$25,000

- Inventory/stock: ~$10,000

- Total asset value: $145,000

Add this to the SDE-based valuation:

$1,005,000 + $145,000 = $1,150,000

This aligns with the top end of the valuation range.

What increases the value of an HVAC business

Not all HVAC businesses with similar revenue earn the same valuation. Buyers focus on specific indicators of stability, predictability, and operational maturity.

Here are the factors that have the biggest impact on valuation:

- Strong maintenance agreements: Recurring revenue raises valuation multiples because buyers value predictable, year-round income. Businesses with large membership bases typically command higher SDE multiples.

- Balanced service mix: A stable mix of service, maintenance, and installs keeps revenue consistent throughout the year. Buyers prefer companies that aren’t overly dependent on unpredictable installation spikes.

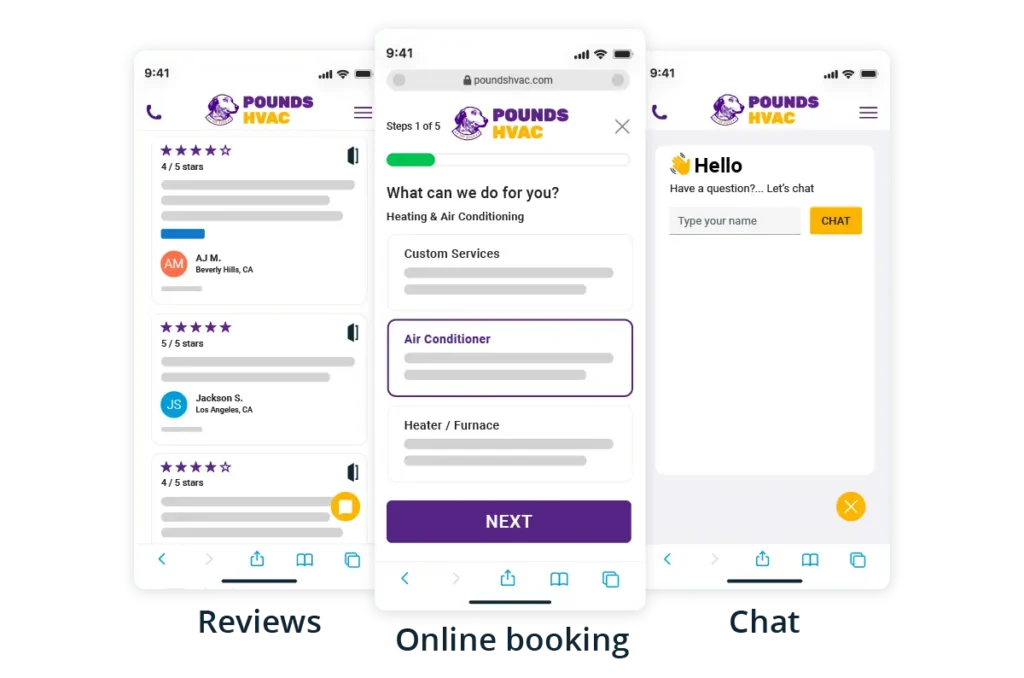

- High online reputation: Consistent 4–5 star Google reviews increase trust and lead flow, which helps businesses sell faster and closer to asking price. Strong public sentiment signals operational quality.

- Long-tenured, licensed technicians: A stable, well-qualified team reduces operational risk and boosts buyer confidence. Technician retention is one of the strongest predictors of valuation.

- Updated fleet and modern tools: Newer vans and diagnostic equipment reduce the buyer’s upfront investment and reflect strong operational discipline. Well-maintained assets often raise overall valuation.

- Clean, organized financials: Transparent financials justify higher multiples and reduce deal friction. Buyers reward companies with clean P&Ls, documented addbacks, and clear tax records.

- Documented systems and SOPs: Companies with strong systems earn more because they’re easier to run after the sale. Clear workflows reduce owner dependency and improve operational stability.

- Strong local demand or market growth: Businesses in high-demand regions consistently receive more competitive offers. Location factors like population growth, hot climates, and active construction can move valuations by 10%–20%.

What lowers the value of an HVAC business

If you want to avoid losing value, watch for the factors buyers flag as high-risk. Many issues stem from the opposite of what increases valuation—like inconsistent revenue, weak systems, or operational instability—but the most harmful red flags tend to be deeper structural risks.

Here are the factors that most commonly lead to discounted offers, slower sales, and lower valuation multiples:

- Heavy dependence on installs: Install-driven companies have unpredictable revenue tied to weather and one-off jobs, which buyers view as high risk. Large revenue swings and slow off-season workload pull valuations down.

- High owner dependency: When the owner handles sales, dispatch, estimates, or customer relationships, buyers see the business as difficult to transition. High dependency lowers multiples because the buyer must replace multiple roles immediately.

- Technician turnover or staffing gaps: Replacing HVAC techs is expensive and slow, so buyers heavily discount companies with chronic turnover or unlicensed staff. High churn signals operational instability.

- Customer concentration: If more than 20% of revenue comes from a single client, buyers fear losing that account after purchase. Even strong businesses get discounted when too much revenue depends on too few relationships.

- Shrinking or stagnant markets: Companies in declining or oversaturated markets attract fewer buyers and lower multiples. Population decline, weak construction activity, or heavy competition all reduce valuation.

How Housecall Pro helps you build a more valuable HVAC business

A strong valuation isn’t just about revenue—it’s about running a business that performs predictably, operates efficiently, and produces clean, reliable financial data. Housecall Pro gives HVAC companies the tools to strengthen the exact factors buyers care about most: recurring revenue, documented operations, technician productivity, and customer satisfaction.

Here’s how Housecall Pro’s HVAC software supports long-term business value:

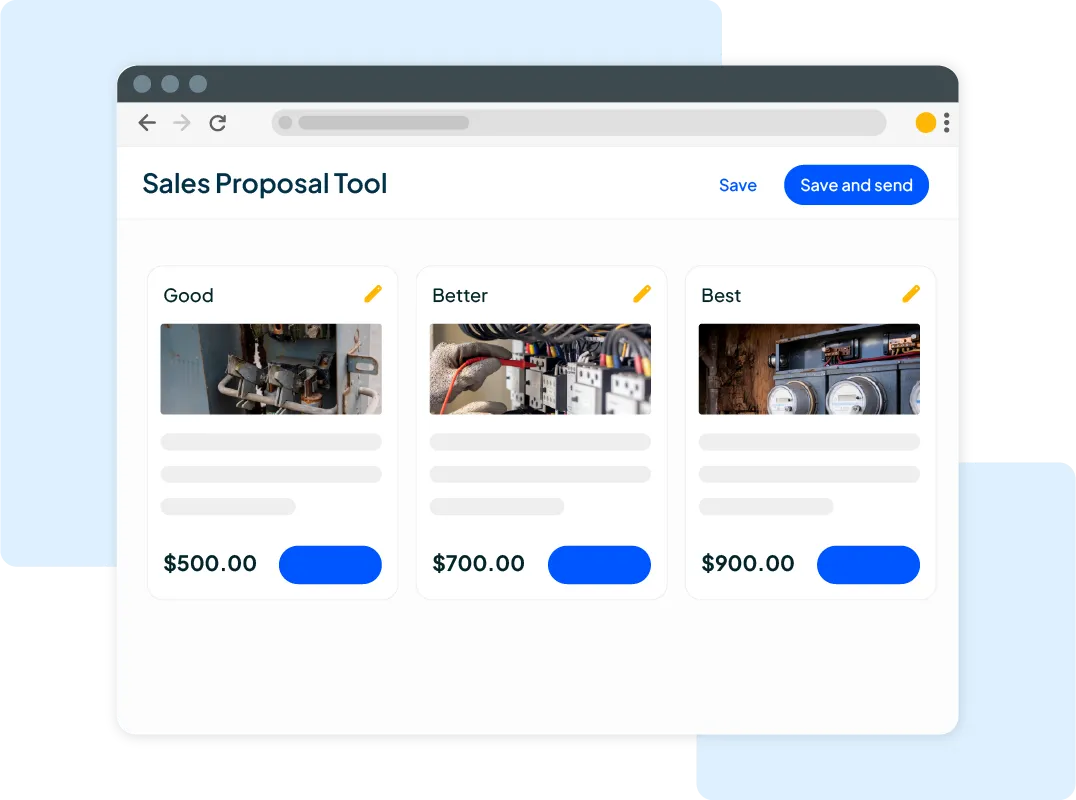

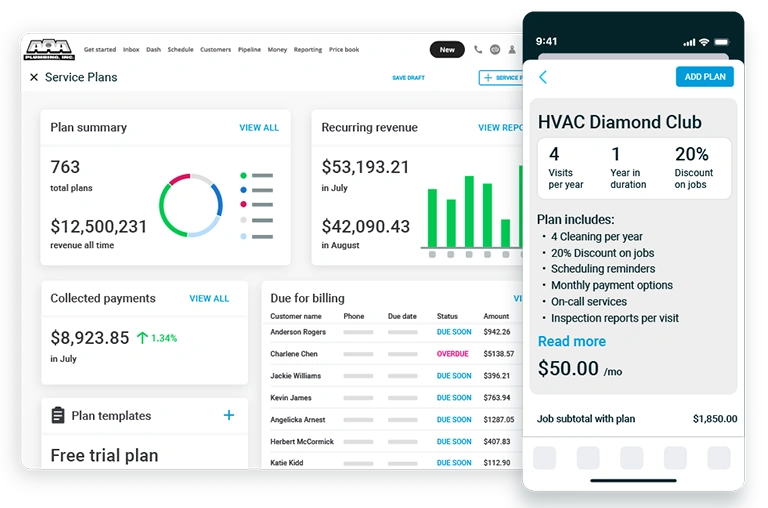

- Recurring revenue tools: Create, manage, and automate maintenance agreements with scheduled renewals, predictable billing, and year-round service reminders—one of the biggest drivers of higher valuation multiples.

- Cleaner financials and real-time reporting: Track job costing, profit margins, revenue categories, and technician performance in a centralized dashboard, giving you clear, trustworthy numbers that make valuations more accurate.

- Pricebook organization: Standardize your pricing, item descriptions, and service workflows so buyers see a systematized, easy-to-scale operation—not an owner-dependent one.

- Scheduling, dispatching, and workflow automation: Streamline the day-to-day operations that buyers evaluate closely. Automated scheduling, digital estimates, and online payments show operational maturity and reduce owner dependency.

- Review generation and reputation tools: Automatically request reviews after every job and monitor your ratings from one place. Strong online reputation consistently correlates with higher business value and faster sale timelines.

- Technician management and job tracking: Track technician productivity, licensing, and performance. A stable, documented team is one of the strongest positive signals to buyers.

Start your free 14-day trial of Housecall Pro and build the operational foundation that makes HVAC businesses more valuable, more efficient, and easier to sell.

FAQ

-

How do I calculate the value of my HVAC business?

-

To calculate the value of your HVAC business, you typically use either SDE (seller’s discretionary earnings) for small/owner-operated companies or EBITDA for larger companies. You then apply a valuation multiple based on factors like recurring revenue, technician stability, service mix, and financial documentation.

-

What multiple do HVAC companies usually sell for?

-

HVAC companies usually sell for 2–4x SDE or 3–6x EBITDA, depending on size and operational maturity. Businesses with strong maintenance agreements and clean financials may have higher multiples.

-

What documents do I need for an HVAC business valuation?

-

You need 2–3 years of financial records including P&Ls, tax returns, balance sheets, equipment lists, technician summaries, and documentation of addbacks.

-

Do maintenance agreements increase HVAC business value?

-

Yes. Maintenance agreements increase HVAC business value because they create recurring, predictable revenue.

-

How accurate is an HVAC business valuation calculator?

-

An HVAC valuation calculator is accurate as a starting estimate. These calculators use the same formulas and multiple ranges used by brokers (SDE/EBITDA + market comps), but final valuations can vary based on buyer type, competition, and local demand. For precise offers, buyers may request deeper financial documentation.

-

What lowers the valuation of an HVAC company?

-

The valuation of an HVAC company decreases when revenue is unstable, maintenance agreements are low, technicians are difficult to retain, financials are unorganized, or the owner is heavily involved in daily operations.

-

How long does it take to sell an HVAC business?

-

Selling an HVAC business typically takes 3–9 months, depending on financial documentation, market demand, and whether the business has recurring revenue.

-

Can I increase my valuation before selling?

-

Yes. You can increase your valuation by building recurring revenue, cleaning up your finances, updating fleet and equipment, systematizing operations, and reducing owner dependency.