Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Running a home service business can come with its fair share of financial challenges. Well, actually, more than its fair share. Seasonal slowdowns. Unexpected equipment repairs. Hiring and training costs. Yet, one of the most useful tools for handling these ups and downs is something many business owners hesitate to talk about: working capital.

It’s time to normalize smart business funding

The business lifeline no one talks about

For some, the idea of taking out a line of credit or securing additional funds feels like admitting defeat. But here’s the reality. Smart financing can be a key part of maintaining a healthy business. The most successful companies, from small operations to large enterprises, use financing strategically. It’s not about simply trying to stay afloat. It’s about growing.

Why do business owners avoid this conversation?

There’s a stigma around borrowing money for business expenses. Some fear taking on debt, while others believe they should only rely on cash flow. The truth is, even the most efficient businesses experience cash crunches from time to time, whether they’re due to delayed payments from customers, unexpected growth opportunities, or essential upgrades. Having funds available when needed can mean the difference between staying stuck and making serious progress.

A line of credit or working capital isn’t just for emergencies, like vehicle trouble or the need for new equipment. It can help smooth out cash flow, allowing you to take on larger jobs, invest in marketing, or buy materials in bulk at better prices. Used wisely, financing isn’t a crutch. It’s a tool.

Here’s how smart financing helps

- Bridge the gaps. Cash flow isn’t always predictable. Financing ensures you can cover payroll, pay vendors on time, and keep operations running smoothly even when payments are delayed.

- Seize opportunities. Say a new contract comes in that requires upfront investment in materials or labor. Having access to capital means you can take on bigger jobs without hesitation.

- Invest in growth. Having funds available means you can make strategic moves when the time is right. Financing can help you upgrade your fleet or tools, hire additional help, or expand into a new service area.

- Keep personal and business finances separate. Many business owners dip into personal savings or credit to cover work expenses. A dedicated business line of credit keeps things organized and protects personal finances.

Making the right choice

Not all financing is created equal. It’s important to choose options that fit your business needs. A line of credit offers flexibility, allowing you to borrow and repay as needed. Short-term loans can help cover immediate needs, like seasonal expenses and quick growth opportunities, but they come without the commitments of long-term debt. The key is to use financing as part of your overall business strategy, not as a last resort.

It’s time to flip the narrative

Successful businesses don’t just react to financial challenges. They plan for them. Accessing capital should be seen as a strategic decision, not a desperate one. By normalizing the conversation around financing, more business owners can make informed choices that set them up for long-term success.

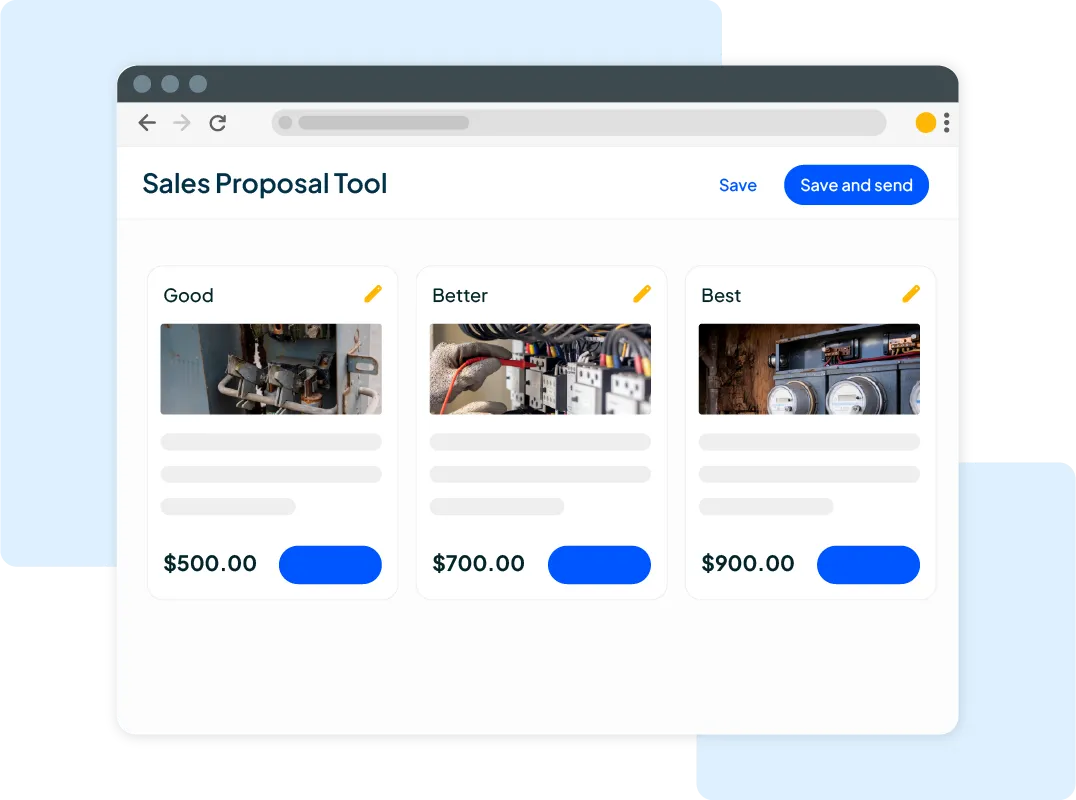

Apply for and access funding right in Housecall Pro

Getting the funds you need couldn’t be easier. Unlike traditional lenders, our partners make sure you don’t need to spend hours finding the right documents, filling out endless paperwork, or waiting for a credit check. With a few clicks, you can apply for a line of credit. It’s that simple.

Pro tip: To access business financing through Housecall Pro, you must be an existing user of Payments through HCP Money. Don’t worry—it’s free to sign up! Already one of our Pros? Log in to your account now.