Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

The last thing any small business needs is for customers to skip out on payment just because the invoice terms weren’t clear. And when 82% of businesses fail due to cash flow issues, why leave something so important up to chance? You didn’t start a service business to spend your time chasing down payments, yet here you are.

The problem often starts with unclear or missing payment terms. Vague language leads to confusion, delayed payments, and awkward follow-ups. On the other hand, a clear and concise invoice shows professionalism and encourages customers to pay on time.

In this article, we’ll explain what invoice payment terms are, how to write them, and how to make sure they support your cash flow instead of holding it back.

- What Are Invoice Payment Terms?

- Common Invoice Payment Terms for Field Service Pros

- How Payment Timing Affects Your Cash Flow

- How to Write Your Invoice Payment Terms to Avoid Cashflow Delays

- What to Do If There Are No Payment Terms on the Invoice

- Automate Your Invoicing Process to Get Paid Faster

- Set Clear Payment Terms, Get Paid Like a Pro

What Are Invoice Payment Terms?

Before we get into sharing our perspective on how to write clear invoice terms, let’s talk about what we mean by payment terms in the first place. Simply stated, payment terms and conditions for invoice documents explain when and how your customer should pay.

This includes due dates, accepted payment methods, late fees, and any discounts for early payment. Clear payment terms set expectations from the start and help avoid confusion once the job is complete and the invoice is sent.

Common Invoice Payment Terms for Field Service Pros

If you’re not sure where to start, don’t worry. Many service businesses use a handful of standard terms to keep payments clear and on schedule. Below, we’ve gathered 10 common invoice payment terms examples that field service pros can use or adapt to fit their business.

1. Payment Due Date

A clear payment due date helps avoid confusion and sets expectations from the start. It tells your customer exactly when payment is expected, reducing the chance of delays.

Here’s an example: “Payment due within 14 days of invoice date” or “Payment due by August 10.” This simple line makes a big difference in keeping cash flow steady.

2. Payment in Advance (PIA)

For larger or custom projects, asking for full or partial payment upfront protects your time and materials. Payment in advance terms let the client know work won’t begin until funds are received.

Here’s an example: “50% deposit required prior to scheduling service. Balance due upon completion.” This keeps jobs moving and prevents cancellations.

3. Net Payment Terms (Net 15, Net 30, Net 60)

“Net” terms refer to how many days a client has to pay after the invoice date. These are commonly used in business-to-business services. And, Net 30 and Net 60 tend to be the most common invoice terms.

Here’s an example: “Net 30 – Payment due within 30 days of invoice date.” Choose what fits your workflow and cash flow needs.

4. Due Upon Receipt

This term means payment is expected right away. It’s often used for quick jobs or trusted repeat customers where there’s no delay between service and billing.

Here’s an example: “Payment due upon receipt of invoice.” It encourages fast turnaround and limits accounts receivable aging.

5. Late Payment Fees

Late fees help deter overdue payments by adding a cost for delay. Clearly stating these fees in your invoice terms reinforces the importance of paying on time.

Here’s an example: “A 1.5% late fee will be added to overdue balances every 30 days.” Make sure it’s fair and within legal limits.

6. Early Payment Discount

Offering a small discount can motivate customers to pay faster. It’s a win-win—customers save a bit, and you improve your cash flow.

Here’s an example: “2% discount if paid within 10 days.” Be sure to include the discount deadline in your invoice.

7. Accepted Payment Methods

Let customers know exactly how they can pay. This avoids back-and-forth and makes the process as simple as possible. Here’s an example: “We accept credit cards, ACH transfers, and online payments via the link below.” Listing your payment options upfront improves payment speed.

8. Progress Payment Terms

Progress payments are helpful for larger projects that take time to complete. They spread out costs for the customer and protect your labor and materials along the way.

Here’s an example: “30% upfront, 40% midway, 30% upon project completion.” Set clear milestones tied to each payment.

9. Final Payment Upon Completion

This term signals that once the job is done, the remaining balance is due. It helps close the project quickly without dragging out the payment.

Here’s an example: “Remaining balance due within 24 hours of job completion.” Great for one-time jobs or project-based work.

10. Dispute Window

A dispute window gives customers a fair chance to raise any questions about the invoice, while also protecting your business from long-term challenges.

Here’s an example: “All invoice disputes must be submitted in writing within 5 business days of receipt.” It sets boundaries and keeps your process clear.

How Payment Timing Affects Your Cash Flow

Here’s the thing. If payments don’t come in on time, it can leave you in a pretty precarious position. You’ve paid for labor, materials, fuel, and time, but the money you’ve earned is still sitting in someone else’s bank account. This kind of delay can slow down your ability to take on new work, pay vendors, or cover payroll.

If you’re buying materials upfront or booking out time on your schedule, you need that money sooner, not 30 days later. In these cases, payment in advance or progress payments can make more sense. Use the final payment upon completion for standard jobs that don’t involve high upfront costs.

For first-time customers, it’s smart to require partial payment upfront to reduce risk. For repeat clients you trust, you might offer Net 15 or Net 30 terms. The trick is balancing flexibility with risk. Clear, thoughtful payment terms help protect your business and keep cash flowing.

How to Write Your Invoice Payment Terms to Avoid Cashflow Delays

Writing clear invoice payment terms is all about getting paid on time. And you deserve to be paid on time for your products and services. Vague or inconsistent terms can cause confusion, delay payments, and disrupt your cash flow. Fortunately, a few small changes to how you write your invoice and terms can make a big difference.

Here are seven tips to help you avoid delays and keep your income steady.

1. Clearly State the Invoice Due Date

Being specific avoids confusion. Writing “Due July 15” is much clearer than “Net 30,” especially for clients unfamiliar with invoice terms. Ambiguous phrases often lead to missed or delayed payments simply because customers don’t fully understand when the clock starts.

A simple example template: “Invoice Date: June 15, 2025. Payment Due: July 15, 2025.” This leaves no room for misinterpretation. For added clarity, always include both the invoice issue date and due date as separate line items. It’s a small adjustment that helps customers stay on track and helps you stay paid on time.

2. Make It Easy for Customers to Pay You

The fewer barriers your customers face, the more likely they are to pay on time. List every payment method you accept, credit card, ACH, bank transfer, or online portal, and include direct instructions or links on the invoice. Giving options gives your client control, and that often speeds things up.

Digital tools like Housecall Pro’s invoicing software make it even easier by enabling one-click payments through email or mobile. Whether you’re dealing with residential or commercial clients, offering multiple, convenient ways to pay reduces friction and helps you get paid faster.

3. Add Late Payment Terms Without Sounding Aggressive

Nobody likes surprises, especially when it comes to money. If you plan to charge late payment penalties, be upfront about it in your invoice and contracts. Use clear, professional language like: “A 1.5% monthly late fee applies to overdue invoices.” That sets expectations without sounding harsh.

Always include this information from the start so customers aren’t caught off guard. Consistency is super important. What’s on your invoice should match what’s in your agreement. Being clear (and kind) helps avoid disputes later while showing you take timely payment seriously.

4. Offer Discounts and Incentives for Early Payments

Want to motivate your customers to pay sooner? Offer a small discount for early payment. For example: “Take 2% off if paid within 10 days.” That minor discount can help smooth out your cash flow over time, especially for larger invoices or ongoing contracts.

This tactic works best for repeat clients or commercial customers who may have internal approval processes. Here’s a sample line to include on your invoice: “2% discount available if full payment is received within 10 days of invoice date.” It’s a small incentive with a big impact on steady income.

5. Keep It Professional, Polite, and Unmistakable

The way you write your invoice matters. Keep the tone firm but respectful. Avoid jargon that might confuse customers and instead use clear language. A simple, effective example: “Thank you for your business. Payment is due by July 10, 2025.” That line sets a clear expectation while maintaining a courteous tone.

Professional language reflects well on your business and can reduce the chance of disputes. The goal is to set expectations without sounding rigid. When your invoices are clear and polite, customers are more likely to respond in kind and pay on time.

6. Add Important Info Every Invoice Needs

Missing details can lead to confusion, questions, and late payments. To keep things running smoothly, every invoice should include the following basics:

- Invoice number

- Customer name

- Service date

- Total amount due

- Payment due date

- Accepted payment methods or instructions

- Contact email or phone number for billing questions

When even one of these items is missing, it can delay the payment process or prompt unnecessary follow-ups. Using invoice templates helps prevent these mistakes, especially when juggling a busy schedule. A good template keeps your process consistent, saves time, and gives your customers everything they need to pay you on time. No extra back-and-forth required.

7. Use Invoice Payment Terms Templates That Save Time

Templates take the guesswork out of writing invoice terms. Here are three ready-to-use options:

- Immediate payment: “Payment due upon receipt of invoice.”

- Net 90 with late fee: “Payment due within 90 days. A 1.5% monthly late fee applies to past due balances.”

- Deposit split: “50% deposit required to begin. Remaining balance due upon completion.”

Bonus tip: When sending reminder emails, use a clear subject line like “Friendly Reminder: Invoice #1234 Due Soon” to help cut through the inbox clutter and keep your cash flow moving.

What to Do If There Are No Payment Terms on the Invoice

Sending an invoice without payment terms creates confusion and opens you up to delayed payments or legal disputes. Without clear terms, customers might assume they can pay whenever they want.

If you’ve already sent an invoice with no terms, follow up right away. You can amend the invoice to include due dates and fees, or send a written agreement outlining expectations. Clear communication now helps protect your business and avoid issues down the road.

Automate Your Invoicing Process to Get Paid Faster

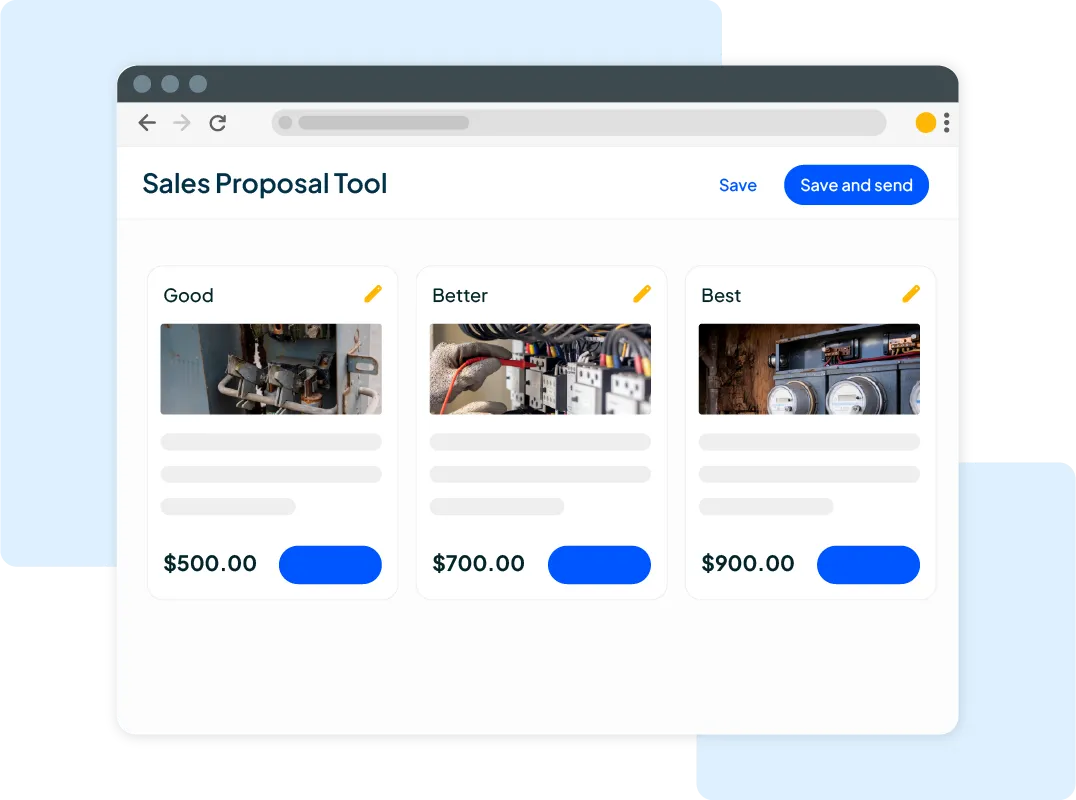

If you are just getting started with your business or you know that you need a better invoicing process, we can help. With Housecall Pro, you can automate your entire workflow, from writing invoices to collecting unpaid invoices, without the constant follow-up.

Use the platform to automatically send invoices with clear commercial invoice payment terms, schedule reminders, and apply late fee triggers when needed. You can even offer consumer financing options right through the system to make larger jobs more accessible for your clients.

Housecall Pro makes payment easy by accepting all major methods directly from the invoice, so there’s no need for back-and-forth. You’ll also have complete visibility into which customers have paid, when, and how, all from your phone. It’s the simplest way to get organized, look professional, and get paid faster.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

Set Clear Payment Terms, Get Paid Like a Pro

Writing clear invoice payment terms isn’t about sounding official. It’s about getting paid on time, every time. Use these best practices to cut out confusion, avoid awkward reminders, and keep a streamlined cash flow management system. Don’t let vague terms hold your business back. Set expectations early, automate where possible, and take charge of your invoicing.

With Housecall Pro, collecting payments is simple. No chasing, just results.