Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Slow or missing payments choke the cash flow of any pest control business. When payments lag, so does your ability to cover operational costs and employee wages. It becomes harder to take on new projects and expand your business.

Many pest control professionals complain about the hassles of billing. These include chasing down late payments and finding lost invoices. These situations can lead to awkward payment conversations between you and your clients. You’re also left wondering how to collect unpaid invoices without damaging customer relationships.

But getting paid for your pest control services doesn’t have to be this hard. With easy invoicing and scheduling software from Housecall Pro, you can automate billing and avoid cash flow problems.

The goal is simple: get paid faster, easier, and without those awkward payment reminders. In this post, we’ll show you how to collect payments from pest control customers with ease.

- 1. Start With a Clear Payment Policy from Day 1

- 2. Choose Payment Options That Fit Your Customers’ Needs

- 3. Set Up a 24/7 Customer Portal for Online Payments

- 4. Go Mobile With On-Site Payment Collection

- 5. Automate Recurring Billing for Regular Service Plans

- 6. Send Clean, Easy-to-Understand Invoices

- 7. Embed One-Click Payment Links

- 8. Set Up Smart, Automated Reminders

- 9. Offer Payment Plans for Bigger Jobs

- 10. Have a Clear and Fair Late Payment Policy

- Streamline Billing & Payments With Pest Control Software

- Don’t Let Payments Be the Pests in Your Business

1. Start With a Clear Payment Policy from Day 1

Many business owners fail to set a clear payment policy, especially those who have just started a pest control business. But without setting clear guidelines, you may find yourself waiting on payments. Also, you’ll spend a chunk of your time clearing up misunderstandings about payments.

Here’s how to craft a clear payment policy for your pest control business:

- Set Payment Thresholds: If you want to receive payment within a specific time frame, let customers know upfront. State the specific date during the customer’s booking or initial consultation. This makes for a much smoother transaction between both parties.

- Reinforce Your Policy: Send out a confirmation email after a booking has been made. You can speed things up by using automated tools to send service agreements outlining your policy. This protects your pest control business from conflicts over payments.

- Spell Out Important Details: Besides stating your service fee and due date, outline other important details. These include:

- Accepted payment methods

- Whether you require a card on file for recurring services

- Late fees for overdue invoices

- Refund or cancellation policies

By defining your invoice payment terms early on, you will avoid uncomfortable talks with your customers about payments and refunds. Plus, you’ll position yourself as a reliable, professional service provider from day one.

2. Choose Payment Options That Fit Your Customers’ Needs

According to a recent study by software solution provider Weave, 38% of customers couldn’t buy from small businesses because their preferred payment method wasn’t accepted. Don’t let that happen to your pest control business.

Follow these steps to make payments convenient for your customers:

- Offer a Range of Payment Methods: Include popular payment methods like credit and debit cards, ACH transfers, and PayPal. You can also accept mobile payments through Apple Pay or Google Pay.

- Add Modern Solutions: Simplify payments with one-click links and mobile card readers. Also, make invoicing easy with click-to-pay options.

- Simplify Recurring Billing: Consider ACH or card-on-file transactions for recurring services. This makes payments easier and keeps customers from missing deadlines.

To maintain a healthy cash flow, show customers you prioritize their comfort. This means offering the pest control payment methods they prefer. Such flexibility removes friction in the payment collection process and helps you get paid faster.

3. Set Up a 24/7 Customer Portal for Online Payments

Figures from 2025 research by global news platform PYMNTS.com, reveal that 51% of customers prioritize convenience when choosing payment methods. And nothing is more convenient than being able to settle a bill on their own time.

An online customer portal allows them to make payments from the comfort of their home. Without this channel, customers would need to reach out to you when they’re ready to make payment.

Here are some best practices to implement when creating an online payment portal:

- Give customers 24/7 access to invoices securely from anywhere.

- Make the portal mobile-friendly so that customers can pay by phone.

- Tie each payment directly to the job details so customers don’t need to ask, “What was this charge for?”

- Cut down on back-and-forth calls and emails by letting customers access and pay invoices at their convenience.

You’ll reduce time spent on administrative tasks by creating a customer portal. Plus, customers can make payments in a breeze. This means lower overheads and a better customer experience.

4. Go Mobile With On-Site Payment Collection

Show up professionally; leave paid. That’s the idea behind on-site payment collection. Instead of chasing down late payments, you collect money on-site right after completing a job.

Let’s go over some tips to help you go mobile when collecting payments from customers:

- Equip your technicians with mobile payment tools. Examples include card readers, pest control credit card processing apps, and tap-to-pay devices.

- Use mobile payment apps like QuickBooks to collect payments before leaving the job site.

- To keep the payment process professional, provide receipts or confirmation messages immediately after receiving the payment.

On-site payment collection is perfect for one-time services or urgent pest control jobs where you need to get paid quickly. The faster you receive payments, the healthier your cash flow will be.

5. Automate Recurring Billing for Regular Service Plans

If you offer monthly, bi-monthly, or seasonal pest control services, you don’t have to manually keep billing the same clients. Automating recurring bills saves you time and reduces late payments.

Follow these tips to automate the billing of recurring services properly:

- Align billing dates with your service schedule so customers are charged right after you complete a job.

- Use auto-pay options to secure pest control monthly payments without sending follow-up emails.

- Choose a payment system that allows for both fixed recurring charges and variable billing. This keeps you on track even if your customer’s service order needs changes.

Billing automation takes care of invoicing and payment collections for you. It also keeps your revenue consistent without you having to chase repeat customers.

6. Send Clean, Easy-to-Understand Invoices

Create an invoice that is easy to understand and only contains information that directly relates to the transaction. The clearer your invoice looks, the faster you’ll get paid.

Here’s how to create a clean, uncluttered invoice for your pest control business:

- Use a Customer Invoicing Tool: Save yourself hours by not having to create an invoice from scratch. Invoicing software from Housecall Pro lets you build out a branded invoice that reflects your business.

- Keep It Simple: Stick to pertinent information such as your service description, rates, date of job, tax, payment due dates, and invoice number.

- Add Notes and Images: Notes add value to your work and build transparency. You can also include before and after photos to provide visual proof of your work.

- Make Your Invoice Clear: Your invoice should tell the customer the services you provided. It should preempt any questions, so customers don’t need to call or email you after getting it.

Pro Tip: Send an invoice immediately after completing a scheduled service. Because the work is still fresh in the customer’s mind, there’s a high chance you’ll be paid early.

7. Embed One-Click Payment Links

Every invoice you create should have a one-click link for direct online payment. This speeds up payment collections and removes barriers to getting paid. Customers can conveniently pay for your service wherever they are.

Mobile phones account for over 64% of global website traffic. So, it’s important to optimize your invoice for mobile devices by following these steps:

- Use mobile-friendly payment forms that adjust to different phone screens.

- Include only the fields that are most relevant to your pest control business.

- Enable digital wallets for instant payments.

- Test your payment link on multiple devices to confirm the page loads smoothly.

Modern payment platforms use encryption tools to protect customers’ sensitive data. They’re also fast, allowing customers to settle their bills in 30 seconds or less. Plus, they’re painless, requiring no complicated logins or signups.

8. Set Up Smart, Automated Reminders

Sometimes, even your best customers can delay payments. They may even lose track of pending transactions. With smart, automated reminders, you don’t have to reach out to them. Automated systems do the job for you.

Here are some guidelines to follow when setting up automated reminders:

- Send Timely Nudges: Automated alerts are usually sent via text or email. Set these up to trigger at key moments, like a day before the due date, on the due date, and a few days after.

- Include Service Summaries and Payment Links: In every payment reminder, briefly describe the delivered service. Then, embed a one-click, secure payment link to simplify the payment process.

- Don’t Rely on Memory: When you rely on your memory, it’s easy for an invoice to slip through the cracks. With automation, every customer gets a gentle nudge to send payment as soon as it’s due.

- Set the Right Tone: Use a warm tone that matches your brand’s personality. A friendly approach protects your relationships with customers while keeping your cash flow on track.

9. Offer Payment Plans for Bigger Jobs

Do Pest Control Companies Have Payment Plans?

Yes, pest control companies have payment plans. These come in handy when dealing with large jobs, such as termite treatments or recurring maintenance services.

Check out three common payment plans for a pest control business:

- Payment Milestones: Breaking down large jobs into milestones makes it easier for customers to book you. They won’t have to drain their finances by paying a lump sum at once. Less financial burden on customers means more deals for you.

- Book Now, Pay Later: This payment plan for pest control services allows customers to schedule work as needed. Then, they can spread the payment across several days or weeks.

- Automated Billing: Always provide a clear, written agreement outlining your payment schedules and policies. Then, tie these terms to automated billing and reminders to reduce late payments.

Use In-App Financing for High-Ticket Services

Providing a consumer financing option is a game-changer for premium pest control jobs. A field service platform like that offered by Housecall Pro provides built-in financing tools that are easy to use.

Here’s the deal: A customer applies for financing right through your field service app. Once a third-party lender approves their request, you get paid upfront. Then, the customer pays in installments over a set period.

Built-in financing is perfect for those big jobs where costs can quickly add up. Think termite treatments, attic cleanouts, and year-round pest prevention packages. Customer financing options mean higher conversion rates, happier customers, and fewer abandoned estimates.

10. Have a Clear and Fair Late Payment Policy

If you don’t set due dates, your customers will assume they can pay for your services anytime. And that’s not good for business. Take the initiative by setting clear expectations for when payment is due, when it’s late, and what happens if a customer does not pay on time.

To develop a fair late payment policy, do the following:

- Clearly Explain Your Terms: Specify when you expect payment. You can simply indicate that payment is due upon invoice receipt or within seven days. Also, state what date an unpaid invoice is considered late.

- Automate Reminders: If an invoice is due in the next couple of days, send a reminder. Once it’s overdue, send a late payment fee notice for pest control. Keep your tone firm yet friendly and on brand.

- Offer a Short Payment Plan: Break payments into installments so customers can gradually pay off their debt. This encourages cooperation while preserving your business relationship.

Be sure to include your late payment terms in all job agreements so your customers know what they’re getting into before committing. Then, repeat these terms on each invoice as a reminder.

Streamline Billing & Payments With Pest Control Software

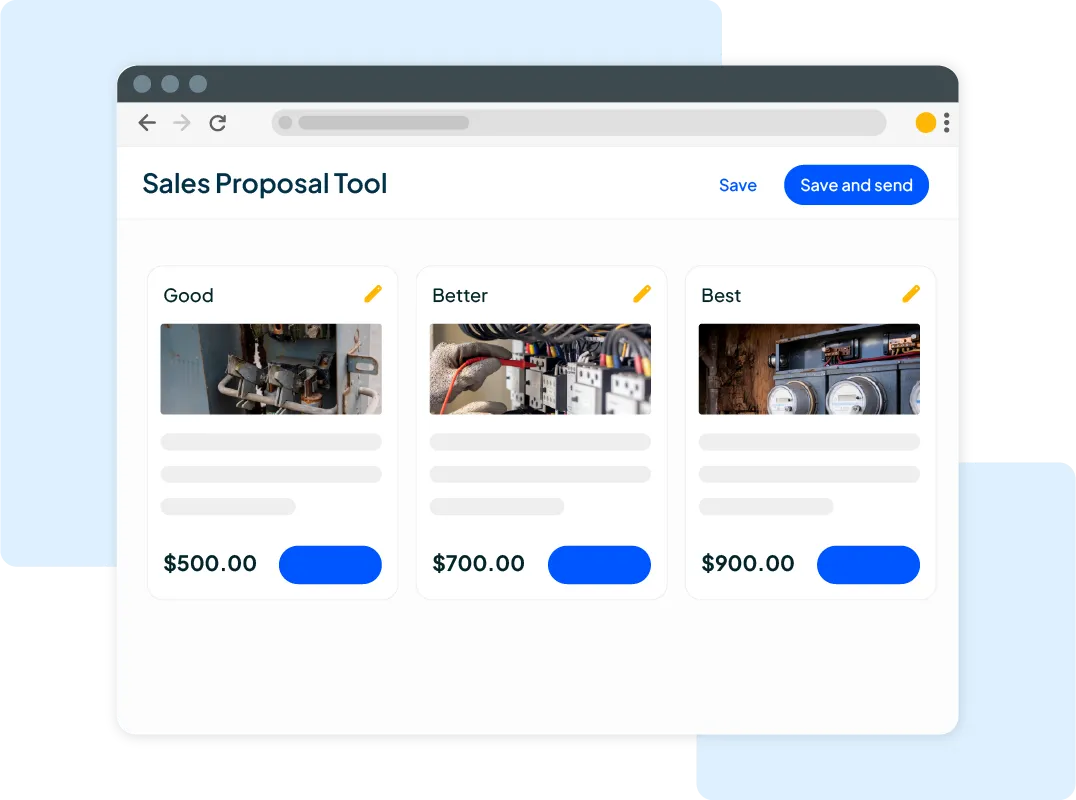

Ditch the paperwork and simplify billing with pest control software from Housecall Pro. This user-friendly tool ranks among the best pest control apps to streamline payment processing. It scales with your business and helps you take control of your finances.

Check out Housecall Pro’s key features:

- Support for all ACH transfers, as well as all major debit and credit card

- Simplified scheduling, invoicing, and payment management from one dashboard

- Flexible financing options to help customers afford premium pest control services

- Seamless integration with other software in your tech stack, including QuickBooks and Wisetack

When setting up to collect payments in the pest control industry, prioritize speed, efficiency, and organization. With Housecall Pro, everything is handled in one place, so you can save hours of manual work and scale your business with ease.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

Don’t Let Payments Be the Pests in Your Business

Collecting payments from pest control customers can feel like a nightmare when you’re stuck with paperwork and manual processes. But with pest control business software from Housecall Pro, you can clean up your accounts receivable and simplify billing.

Housecall Pro lets you manage invoicing, scheduling, and billing from a unified dashboard. Once you set up your workflow, automation does the rest of the work for you. This frees up time for you to focus on more important things, like business growth and customer satisfaction. Ready to streamline billing and payments for your pest control business? Try Housecall Pro on a free 14 day trial and say goodbye to cash flow chaos.