HVAC business loan requirements

As an HVAC business owner, it’s important that your company can handle change. HVAC businesses need to be able to weather both periods of growth that requires more business funding, battle slow season, as well as cash flow instability. For example, maybe you’ve had an unexpected uptick in unpaid invoices; meanwhile, you still have to pay your technicians, pay rent for your HVAC company, and keep the lights on. A line of credit may be the right solution for you and your business since it can supply you with the money you need to keep your business afloat. In addition, it’s a more flexible financing option than traditional business loans, which might be a better option for small businesses that are just finding their footing.

Although you will need to qualify for a business line of credit, it’s a legitimate loan option for some independent business owners who need to get through periods of uneven cash flow. Keep reading to learn more about a business line of credit or skip to the section you’d like to know more about.

Watch Housecall Pro’s interview with Kevin Barlow as he discusses financial planning tips, eligibility, and what the application process looks like for home service businesses:

What is a business line of credit and how does it function?

A business line of credit is a type of small business loan that gives you funds that you can access as needed, up to the credit limit. The benefit of this financing option is that you only pay interest on the amount you withdraw rather than the entire amount you’ve been approved to withdraw. For example, if you get a business line of credit for $25,000, but you withdraw $5,000 to bridge the gap during a funding shortfall, you will only pay interest on the portion you took out (the $5,000).

Credit lines are considered a revolving form of credit because you have flexibility when it comes to repaying the loan, leaving your credit line account open, and borrowing again in the future. In many ways, a credit line is similar to a credit card. Revolving forms of credit are different from an installment or term loan, which requires that you follow a regimented payment structure over a particular period of time.

While lines of credit don’t expire, they can be closed or the credit limit reduced at any time by the lender. This may not be a problem unless you’re relying on using a certain amount of your credit line that is suddenly diminished when you need it.

Factors like large unpaid balances are factored into whether a business line of credit is either reduced or canceled altogether. Typically, lenders will review credit reports to monitor the account holder’s credit and financial health. This underlines the importance of practicing good financial habits and working with a professional financial advisor to make sure you’re in good shape.

Before you apply to receive a business line of credit, you’ll want to research your funding options and do your due diligence of making sure you’re choosing the right option for you and your business. The Simple Dollar recommends considering relevant features of different lines of credit offered by various lenders such as:

- Lender reviews: If the lender you choose has an excellent track record, that’s a sign they’re a trustworthy company. Don’t forget to check the Better Business Bureau to objectively evaluate whether or not a lender is up to snuff.

- Approval requirements: Lenders require either a particular credit score or a revenue amount (likely both) before your business is approved for a credit line. Typically, lenders offering business lines of credit are more forgiving with the requirements to get approved compared to a traditional business loan. This is because a credit score isn’t necessarily the only part of a business that shows your ability to pay back a loan. For example, your assets and inventory may prove to be a factor in the approval process as well.

- Annual review processes: Find out the reporting process you’ll need to know as the account holder so you know what to expect each year.

- Repayment periods: It’s a good idea to learn about the repayment terms so you understand how the payment structure works and if it fits within your business model.

- Interest rates and fees: Obviously, you’re going to want to look for lenders who offer the best loan terms. Low APRs and low fees are ideal.

- Credit limits: This is important, especially because lines of credit are typically less than what you can get with a traditional business loan. There are plenty of lines of credit that go up to the six-figure range, however.

Pro Tip: It’s a better idea to apply for a business line of credit before you need it when your business has great financial health. By applying for a credit line when business is booming, you’ll have access to cash when you need it, and your lender may be more likely to negotiate rates and terms.

What are the different kinds of business lines of credit?

There arehttps://smallbusiness.chron.com/secured-vs-unsecured-line-credit-18087.html two kinds of business lines of credit. The first is called a secured business line of credit where a business puts up collateral to qualify for the loan. In most cases, acceptable collateral may be inventory or even accounts receivable because it’s only a temporary liability. The only time those assets come into play is if you fail to pay off your credit line. At that point, the lender can claim your assets.

The other type of business line of credit is an unsecured credit line. This is simply defined as a credit line that doesn’t require the business to put up any type of collateral to secure the loan. Because you’re not putting up any assets against the loan, it’s a riskier loan in the eyes of the lender. For businesses, this means that the standards for getting approved are typically much stricter. Additionally, unsecured credit lines have higher interest charges and are approved for lower amounts.

Pro tip: read more about SBA loans during the pandemic

What will I need to get approved for a business line of credit?

- Collateral: This depends on the lender, but typically, you’ll want to put up some or all of your assets and will likely be required to do so. As mentioned above, these assets may include real estate, inventory, vehicles, etc.

- Time in Business: If you’re a brand new startup HVAC business opening its doors on day one, don’t expect to be able to qualify for a business line of credit immediately. The minimum for most credit lines is two years in operation as a business.

- Financial Evidence: Because so many businesses fail within the first year, it’s important to show a strong financial standing when you’re trying to get approved for a credit line.

- Profits and Losses: The amount of revenue your business brings in has to be enough to impress a lender. It will also show your general business health.

- Personal Guarantee: If you’re a small business owner with an independent business, you’ll have to make a personal guarantee that you will pay back the loan.

- Economic Ratios: These ratios help lenders decide whether or not your business is eligible for a credit line. Debt to equity and current ratio are just two figures a lender might evaluate to determine your creditworthiness.

Pro tip: before you get started, make sure to go over this https://housecallpro1.wpengine.com/learn/credit-planning/checklist of steps to take before applying for credit during the pandemic

What are some business line of credit options that work better for HVAC business financing?

Emergency repairs, equipment financing, late payments from customers, and other business needs are all possible reasons why you might suddenly find yourself strapped for cash. If you need tips for handling a delinquent customer, head over to our article covering that subject.

So, it’s in your best interest to avoid those worst-case-scenarios and consider a business credit line from lenders such as the ones below. Remember, lenders typically review businesses on a case-by-case basis, and terms may vary based on the size of your business, business history, and your general financial health.

Fundbox

- Credit Limit: $100,000

- APR: 4.66% of the amount you withdraw

- Minimum Credit Score: Varies

With Fundbox, you’ll enjoy perks like instant setup that allows you to easily connect to your bank account so you can get your approval for financing in as few as a couple of minutes. Plus, once you’re approved, your funds will be accessible in as little as one business day. Ready to pay your line of credit early? Do so, and you can get your remaining fees waived. Speaking of fees, you won’t be faced with any surprises with Fundbox. Just pay a simple flat fee for the weeks you need a line of credit.

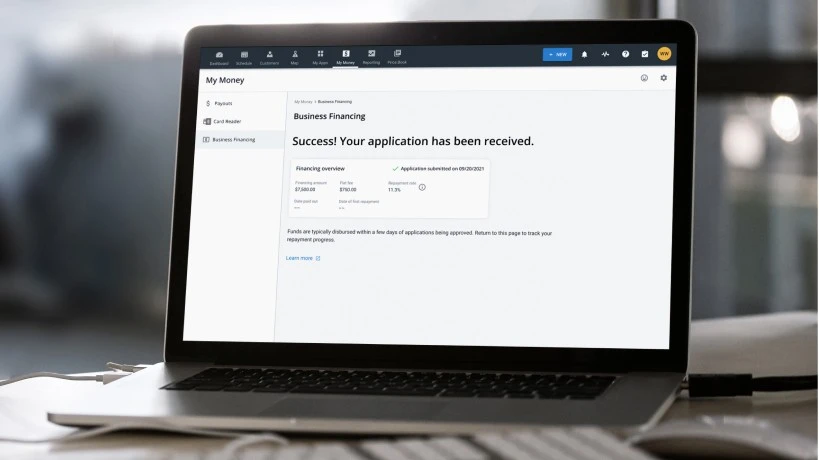

If you already have the Housecall Pro app, you’re one step ahead. Simply navigate to the My Money tab in your Housecall Pro account and go to Fundbox under Business Lending. Click “Get Business Credit” to get started.

Kabbage

- Credit Limit: $2,000 to $250,000

- APR Range: 24% to 99%

- Minimum Credit Score: 560

This business line of credit option works best if you need a lot of money fast and if your credit isn’t great. Kabbage only requires a minimum score of 560 and just $50,000 in annual revenue. Plus, your business only needs to be in business for a year total. To qualify for this line of credit, you will need a business checking account or an online payment platform. One of the biggest benefits of Kabbage is that you can qualify in as little as ten minutes and choose between 6, 12, or 18-month terms.

This simple alternative lending option is an excellent choice for small businesses looking for short term funding with transparent terms.

On Deck

- Credit Limit: Up to $100,000

- APR: 13.99% to 39.90% APR

- Credit Score: 600

Need fast funding? OnDeck provides you with financing as quickly as 24 hours after your approval. To qualify, you’re going to need a minimum of 600 credit score, be in business for a year, and at least $100,000 in revenue.

One of the most significant benefits of using OnDeck is that this lender offers discounts for borrowers who renew their credit line. Typically, rates range from 13.99% to 39.90% but repeat borrowers may enjoy discounted rates, depending on their overall credit line health.

Although it’s not as fast as some other lenders, you can still expect a reasonably quick turnaround. The drawbacks include stricter standards compared to some of the other lenders on this list. For companies that don’t have very high revenues or high credit scores, this may not be the right option. However, it may be the right fit for companies who present a low risk to lenders and can qualify for a rate at the lower spectrum. It’s also ideal for those businesses looking to create a relationship with a lender and stay with them for an extended period, so that you can enjoy loyalty discounts in the future.

Bank of America

Unsecured credit line terms:

- Credit Limit: $10,000 to $100,000

- APR: As low as 7.00%

- Credit Score: 670

Secured credit line terms:

- Credit Limit: Starts at $25,000

- APR: As low as 6.00%

- Credit Score: Varies

If you’re looking for a traditional lender, Bank of America offers both unsecured and secured lines of credit. Unsecured lines of credit range between $10,000 up to $100,000. If you want a limit of more than $100,000, you’ll typically need collateral and therefore, a secured credit line.

Both types are subject to a yearly review process. To qualify, you’ll need to be in business under the same ownership and have an annual revenue of at least $100,000 for an unsecured line of credit or $250,000 for a secured line.

This is a great option if you’re looking for rewards and want interest rate discounts that you can typically only receive after using one lender.

Wells Fargo Small Business Advantage

- Credit Limit: $5,000 to $100,000

- APR: Base rate 4.5% + 1.75% interest rate on amount used

- Credit Score: Varies

The Wells Fargo Small Business Advantage is a credit line designed specifically for small businesses – in case the name didn’t tip you off. If you qualify, it’s important to know you will be subject to a five-year term, after which, your credit line standing will be reviewed.

Unsecured lines range from $5,000 to $50,000. There may be an annual fee applied to your account, which depends on your credit limit. Examples of the fees you can expect are listed below:

- For credit lines ranging from $5,000 to $9,999, there is no annual fee.

- For credit lines from $10,000 to $25,000, there is a $95 fee assessed annually.

- For credit line between $25,001 to $50,000, there is a $175 fee assessed annually.

What fees do you pay for a business line of credit?

The answer to this question ultimately depends on the lender you choose. Each lender has their own set of terms and conditions you’ll need to find out during your research process. Many lenders will charge you an annual fee based on the total amount of your credit line. These may be around $100 to $200. You may also be able to find a lender who doesn’t charge an annual fee for the first year as an introductory offer.

You may also be paying for an origination fee if your loan when your loan is initially approved.

What is the difference between a business loan and a business line of credit?

Here are some of the major differences between traditional business loans and a business credit line:

- Fixed vs. Flexible: Business loans are based around a fixed structure of monthly payments while you only make payments on the amount you owe. If you haven’t used any credit that month, you won’t have a payment. Traditional business loans also carry fixed terms and tend to have higher rates than credit lines.

- One-Time Use vs. Multiple Use: A business is used once, usually for a singular reason such as building out a new headquarters. A credit line gets used multiple times since it’s a revolving form of credit, and it’s necessary for one purpose. For example, a credit line can be used for short-term issues like making payroll.

- Long Term View vs. Short Term View: Business loans typically have longer terms, while lines of credit are used for short term cash flow gaps.

- Closing Costs: This depends on the specific credit line or business loan you’re using, but typically, the closing costs for a traditional business loan will be higher.

- Rates: A business loan usually has higher rates than a business line of credit which can be more variable.

What are some other options besides a business line of credit?

If you’re not sure about using a business line of credit, you do have other options available for your small business financing needs. One option is to use a business credit card to pay for both small and large business expenses. And, if you choose the right card, you can get benefits like rewards.

If you do go this route, it’s a good idea to pick a card that gives you a good amount of cashback on your purchases. Additionally, it’s smart to look for a card that has an introductory 0% APR offer so you won’t have to pay interest immediately. This is a great strategy if you’re looking to buy something for your business and can pay it off within the introductory period where the 0% interest rate still applies. One drawback of these cards is that you are required to have good credit, which means some HVAC businesses won’t qualify.

You can also apply for a traditional business loan or even a microloan (typically between $5,000 to $10,000) if your business has a good financial standing and you’re going to use the money for a singular purpose.

Don’t forget: besides financing, you’re also going to want an easy payment platform for customers to utilize as well. One of the keys to getting paid on time is making it easy for customers to pay you on time. For example, Housecall Pro offers one of the best card processing services for small businesses that includes features like Instapay, where you can get payments sent directly to your bank account.

Pros and cons of using a business line of credit

A business line of credit has some serious benefits for businesses who are just starting out and looking to even out cash flow issues. Here’s a summary of the pros and cons of this type of financing at a glance:

Pros

- You only take out the amount of money you need

- You can have a zero loan balance to keep your interest rate fees under control

- You can keep your account open and borrow as needed into the future

- Great for short-term cash flow problems

- Helps build your business credit

Cons

- Lender can lower credit limit at any time

- Lender can close or cancel your line of credit

- Subject to annual fees

- Subject to origination fees

- Lower borrowing limits

Takeaways: Business line of credit

A business line of credit is a flexible form of financing that HVAC businesses may be able to leverage during periods of unstable cash flow. This is important for small businesses who may be faced with smaller margins for profits and losses. If there are weeks or months of late payments from customers, it could mean you end up short on money. Unfortunately, bills don’t wait, and neither do your hard-working employees. By getting a business line of credit, you can enjoy some stability in your cash flow levels.