The end of the year is a perfect time for home service businesses to make sure their payroll is set up for success. Get ahead of things before the new year (and busy season) starts using our Year-End Payroll Checklist.

Our simple checklist makes it easy to stay on top of essential payroll details like compliance, benefits, and next-year prep. Take the stress out of the process. Housecall Pro’s Year-End Payroll Checklist will help you wrap up this year successfully and set the foundation for a productive payroll system. Download our free step-by-step guide!

Get in touch: 858-251-9751

Download a free Year-end Payroll Checklist

16 steps to make sure your payroll is compliant

Keeping your payroll accurate and compliant is a top priority for running a home service business (or at least it should be). Still, it’s easy to get lost in all the regulations to follow. Here are 16 simple steps you can take throughout the year to make sure you stay compliant with your payroll.

1. Review your payroll processes from last year

Take a look at what worked well and spot any areas of improvement from last year’s payroll processes. Where can you improve things? Take note of any errors or compliance issues you had to deal with. Now, think through how you can avoid those issues in the future.

2. Stay updated with payroll regulations

Tax laws and labor regulations can change as the years go on. So be sure to stay in the loop about changes to tax and labor laws and any other compliance-related requirements that can impact your payroll. Don’t be afraid to ask for help either! Sit down with legal and tax experts to make sure your payroll practices are on track with the latest regulations.

3. Audit employee data

Review the employee information you have on file and verify that everything is correct. Make sure you have all the important employee details up-to-date, including names, addresses, Social Security numbers, tax withholding allowances, and benefit elections.

4. Use reliable payroll software

If you’re not already using cutting-edge payroll software, it’s time to start. Using automated payroll software cuts back on errors and simplifies the entire payroll process. There are a lot of options on the market, so make sure you pick a payroll software that’s reliable and can handle the specific needs of your business. The best option out there? Payroll by Housecall Pro. Our payroll solution is simple to use and runs seamlessly right in the Housecall Pro app.

5. Create a payroll calendar

Never miss an important date again. Create a payroll calendar outlining all the key dates you need for payroll processing, tax filing deadlines, and reporting requirements. And then stick to the schedule!

6. Calculate gross and net pay

Time to crunch some numbers! You can calculate gross pay for each employee based on their hourly rate or salary. To figure out net pay, subtract taxes, social security contributions, and other deductions. Be sure to double-check all the numbers to make sure everything is accurate.

7. Manage overtime and leave accruals

Make sure overtime, vacation, sick days, and other leave types are accurately tracked and reflected in the employee’s paycheck.

8. Review tax withholdings

Look over your employee tax withholdings and check that W-4 forms are accurate. Tax forms can get confusing, and sometimes employees make mistakes on the paperwork. Double-check that the tax withholdings match the employee’s preferences and current tax regulations.

9. Reconcile payroll and do internal audits

Keeping the books straight is essential for accurate and compliant payroll. So, regularly reconcile your payroll accounts, looking for anything that doesn’t match up. Reconcile tax deposits, employee benefits contributions, and other payroll-related accounts.

And don’t forget to do an internal audit of everything from time to time. That way, you can catch any issues right away to prevent them from snowballing.

10. Give employees clear payslips

Don’t keep your employees in the dark with confusing payslips. You want them to be able to see the breakdown in pay clearly. Make sure every payslip covers their earnings, deductions, taxes, and net pay. This transparency builds trust and helps employees understand their compensation.

11. Prepare for year-end reporting

Before you can welcome in a new year, you have to close the books on the old one. As the year comes to a close, prepare for year-end reporting requirements. This way, you can provide W-2 forms to employees quickly and file all the required tax forms on your end.

12. Communicate changes to employees

Nobody likes change. If you know there are changes in payroll processes, tax regulations, or benefit offerings for the new year, give your employees a heads-up beforehand. Communicate these changes clearly to your employees well in advance so they have time to take it all in.

13. Set goals and objectives

The beginning of a new year is the perfect time to set some goals. Set aside time to really think through your goals for payroll in the coming year. Your goals can include reducing errors, improving efficiency, enhancing compliance, and even researching the best payroll provider for your business.

14. Training and professional development

Pour into your people. Invest in training your payroll team to keep them updated on best practices, regulations, and software updates. This will enhance their skills and knowledge while keeping your business in line with the latest industry standards.

15. Talk to the experts

You don’t have to go through confusing financial and legal jargon all alone. Schedule some time to talk with tax professionals, legal advisors, or HR consultants to make sure your payroll processes align with the law and industry standards.

16. Get feedback

Continuous improvement is the name of the game here. Get feedback from your team to identify areas for improvement in your payroll processes. The more often you refine your system, the better accuracy and compliance your payroll system will be.

Maintaining an accurate and compliant payroll can feel overwhelming, but it doesn’t have to. Follow these steps to help keep your payroll top-notch and ready to take on the new year.

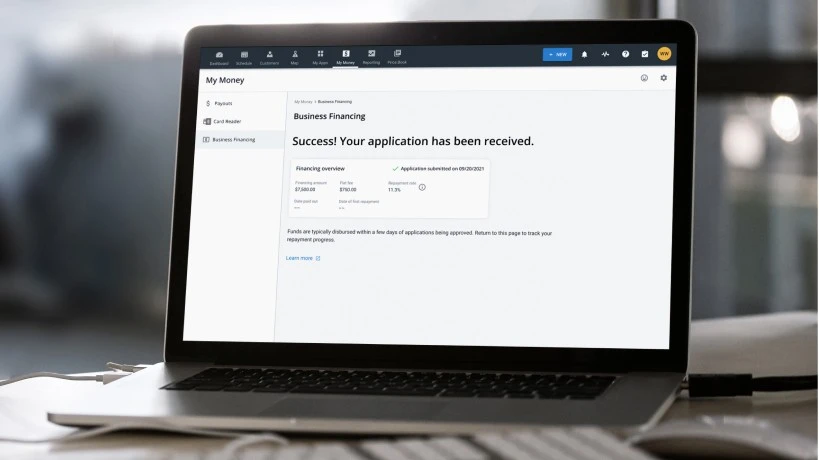

Take your business to the next level with easy payroll software

Don’t have a payroll provider yet, or ready to make a switch? Try Housecall Pro’s easy Payroll solution. Pay your team and manage your business—all in one spot. Book a demo and get started today!