Tracking down receipts and remembering what that $192.11 charge at Home Depot was for can be a real headache. The thought has probably crossed your mind—Was this the trip for the Pex pipe and expansion tank or the one for PVC and a backflow? Expense management shouldn’t require retracing your steps and a bottle of pain medicine. These best practices for expense management will help you stay profitable and productive.

We’ll help you:

- Become familiar with your business expenses

- Create expense policies and communicate them to your team

- Plan ahead with your major and minor expenses

Be familiar with your business expenses

More visibility into your day-to-day business expenses means you’ll be able to spot the common charges earlier to keep your business running smoothly.

Start a list of what recurring, fixed expenses you have month-to-month. Marking both what the charges are and the amounts will keep you informed about expected (or unexpected) changes that affect your bottom line.

For the cards your team uses to stock the office, buy lunch, or grab supplies, set limits on spending and ensure access is limited to those you know will bring the receipt back. Consider also setting up spending alerts for all transactions to understand where, when, and how much your team is spending. Then, once or twice a week, look through all your transactions to check for anything that is out of the ordinary or requires clarification.

Simple changes like these can improve the visibility of your expenses. You can even go a step further to manage expectations with your team by setting up expense policies.

Create expense policies and communicate them

We don’t mean creating some 15-page policies and procedures manual that might never get read. Creating expense policies for your business is all about setting up consistent processes and structures that are clear and straightforward. This could be a simple one-page document reviewed each quarter. It could even be a reminder email with highlighted points that goes out to the team once per month.

The most important part of expense policies is that they remain balanced and easy to understand.

You’ll want to include:

- Dos and don’ts for expenses

- Example: Do bring your receipts back to the office. Don’t make purchases over $500 without approval.

- Consequences of not following the policy

- Example: After a third strike for unapproved purchases your card must be will be deactivated.

- Morale building policies

- Example: Lunch is on the company every Thursday up to $20, or stock your truck with bottled water and snack bars every month.

However you decide to structure your policies, they’ll only work if you communicate them clearly and effectively with your team.

Tell them that these policies help them have ownership over the business’s profit margins; following the guidelines benefits the company, which benefits them.

One of the most important steps is getting a formal sign-off on their understanding of the policies; consider quarterly reviews and get signatures from your whole team. Be transparent with the results of the policies; meet with your team regularly to go over expenses and show them how their day-to-day purchases stack up over time.

Plan ahead with your expenses

After all, you can’t control the weather, but you can be prepared for it. Your business expenses can make or break your profit margins. Small leaks like untracked expenses can sink even the sturdiest of ships. It’s critical that you plan for what you can and can’t expect.

Now that you’ve got an awareness of your expenses and policies in place—keep track of them. Budget those expenses for busy and slow seasons. Get generous with those morale-building policies in the busy time. Tighten up with in-office lunches in the slow times.

You can begin to scale your business from the insights you learn from your expenses. By cutting down on unnecessary purchases, you can make room in the budget for that apprentice or new truck. Knowing what you keep purchasing every month or quarter can help you take advantage of seasonal discounts and stock up on supplies.

It’s not just the knowledge that makes this possible, but the systems and tools you set up to support your expense management.

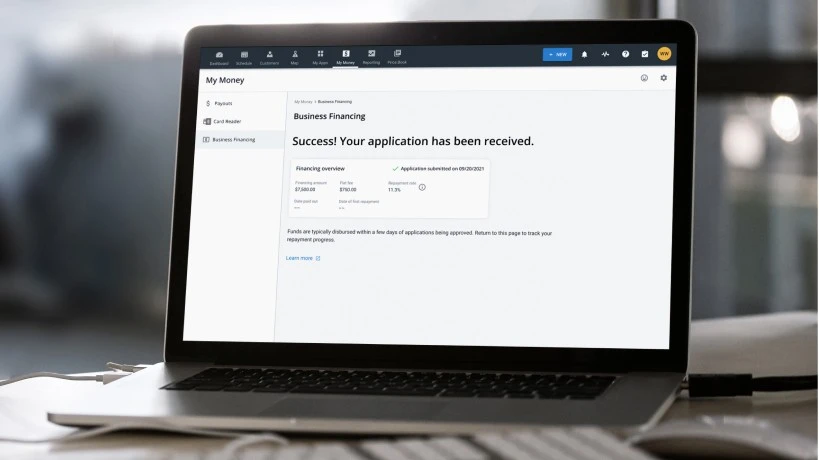

Did you know? We’ve made expense management a whole lot easier for our Pros with Expense Cards*. Signing up only takes a few minutes, but the benefits make up for the hours you used to spend collecting receipts and cutting checks to your team for reimbursements.

See for yourself how Expense Cards can change the way you do business. Learn more

*This product is available to any US-based Pros on MAX and Essentials subscriptions that are using Payments through Housecall Pro